Since dairies come in all shapes, sizes and profit levels, it is nearly impossible to predict what profitability “looks like” at a glance. Is the most profitable business the one with the highest production? Nicest cows? Best reproductive numbers? Most land base? Healthiest heifers? What profits “look like” can vary somewhat from dairy farm to dairy farm – but studying a variety of dairy farm businesses over time can help to distinguish patterns for higher profits on dairies. This area of “profit patterns” has been the focus of recent Penn State research.

While it is easier to understand the “patterns’ of unprofitable businesses, the differences among dairy farms in terms of business strategy and capital investment, as well as the natural biological variations associated with growing crops and cows, make predicting positive profit patterns more challenging.

So, let’s start with the unprofitable patterns first. Some characteristics of unprofitable businesses, not just dairies, are high cost of production, investment in unproductive or marginally productive assets, insufficient revenue generation and/or underuse of resources.

High cost of production

Lack of profits may result from high cost of production relative to price of goods sold. For example, if the raw materials, labor and overhead costs to make a wooden bench are $100 but the benches sell at the local marketplace for $99, then the business is losing $1 for every bench sold. It is not hard to understand that selling product below cost leads to an unprofitable business. How do we make our venture more profitable?

• Discount our own labor?

• Shop for raw materials in bulk and reduce costs?

• Share equipment to lessen overhead costs?

• Invest only in needed resources and lease, rent or other to reduce overhead?

• Increase the sale price of the bench? (What if the market buys fewer?)

The bench example has some parallels to dairy businesses. Certainly we can note some changes in profit levels with the “sale price” of milk and volatility in the market – but more important may be the unrecognized potential in understanding and developing strategies to manage cost of production.

Dairies with high cost of production per hundredweight of milk struggle to achieve high levels of profit, even with higher milk price cycles. In low milk price cycles, those high-cost businesses lose not only profit but also may lose equity in the business as well.

Like the bench example, we look to large expenditures like feed, labor and interest to analyze whether or not cost of production is competitive. If our bench maker decides to lease rather than buy some lesser-used equipment and shops differently for raw materials, then cost per bench might be reduced to $90 – resulting in a change in margin from -$1 to +$9.

The first step in changing this piece of the profit puzzle was knowing exactly what the cost of production was and where reductions in cost could be made without hurting production. Likewise, knowing cost of production for 100 pounds of milk can help your profit puzzle by targeting areas to reduce cost without reducing production to improve profits.

Unproductive assets

Lack of profits may result in investing in unproductive or marginally productive assets. In the case of our bench maker, purchasing wood from a different supplier may increase cost per board foot, but reduce the need for an expensive piece of lesser-used equipment – resulting in lower input costs.

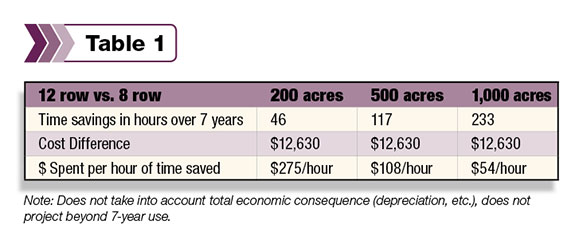

How and when a dairy business purchases inputs can greatly impact the cost of those inputs. Our bench maker changed strategy for purchasing inputs and was able to eliminate the need for equipment that was an underutilized asset. Profitable dairies are those that make the most productive use of all assets. Equipment that is used over few acres or few cows infrequently or inefficiently will drain profit from the operation. Consider the following investment example (see Table 1 ).

An eight-row corn planter costs $31,000 and plants 10 acres per hour while a 12-row corn planter costs $42,000 and plants 15 acres per hour. Financing the investments at 4 percent interest for seven years results in $12,630 more investment for the 12-row planter.

Is investing $42,000 in the larger planter improving profits or draining dollars away from the operation? Where else might the dairy business utilize the $42,000 that would increase profits by investing in more productive assets?

Low revenue generation

Lack of profits may result from low revenue generation or underuse of resources. A majority of the income from most dairies is from milk and, since feed cost is most likely the largest expense, calculating income over feed cost on a monthly basis is a good strategy for evaluating that piece of the profit puzzle.

Lower levels of milk revenue coupled with higher feed costs can signal the need for changes in feeding or management in order to boost income over feed costs. Lower revenue from milk may be the result of either a need for change at the farm level or a drop in milk prices in the marketplace. Either situation requires a closer look in order to make improvements to revenues.

Underutilized assets, like the bench maker’s equipment or our corn planter example above, result in dollars being spent without a resulting increase in income. More importantly, dollars spent on marginally productive assets are taken away from cash available for productive assets – and an opportunity to improve profit is lost.

While the dairy business is certainly capital-intensive in comparison to other businesses, investing in assets that are only marginally productive in order to save minimal time or as a matter or preference may not contribute favorably to the profit puzzle. Data from research looking at Pennsylvania dairy farms in 2008 to 2011 showed that all herds in the dataset with an overall return on assets of 8 percent or above had a total investment per cow of $8,000 or less. Where does your dairy invest its dollars? Which of your assets are most productive versus marginally productive?

Improve profits in your business by examining cost of production and determine if it is competitive in the marketplace. Make changes if necessary. Next, examine income over feed costs and overall revenue generation in your dairy business. Make changes as needed.

Last, evaluate investments and determine which assets are unproductive or marginally productive in your operation. Can these be reduced or eliminated? The pieces of the puzzle are all within the grasp of dairy farm managers. It is taking time to study and assemble those pieces the right way for each business that creates an unmistakable pattern for profitability. PD

—Excerpts from Penn State Dairy Digest, April 2012

Lisa Holden

Lisa Holden

Associate Professor Department of Dairy and Animal Science

Penn State University