Dairy sector economics have been challenging. On one hand, the U.S. and world economies are growing with increasing demand for dairy products, particularly butter and cheese. On the other hand, since Europe removed its milk quotas a few years ago and Canada tweaked its pricing system, the additional milk supply worldwide is outstripping this growing demand.

The result? Milk prices are lower, which means margins are tight. And as Farmer Mac’s spring 2018 issue of The Feed points out, increased competition in global markets will put even more pressure on dairy prices in 2018. Ultimately, the report states, “The demand-side challenges producers will face in 2018 may put many producers firmly in the red for much of the year.” Furthermore, the excess milk in the market means local basis has eroded, and dairy producer milk checks are smaller than they were a year ago.

It’s a difficult environment, but there are steps you can take to help mitigate your risks while positioning your operation to take advantage of opportunities when the dairy sector improves.

Three steps for managing margins

When margins tighten, what can a dairy producer do?

1. Focus on liquidity or working capital. No one knows how long milk prices will be below the cost of production, and your liquidity – cash and available line of credit – may be the primary source to bridge the gap until prices move higher.

2. Focus on cost control. Examine your highest expenses – feed, labor, repairs, etc. Are there some costs savings to make without sacrificing milk or livestock sales?

3. Examine your price risk management plan. This includes not only contracting, hedging or options strategies for milk sales, but also the other half of the income statement: managing expenses. Matching price risk management for milk sales and feed costs as the largest variable expense can lead to a margin. Your price risk management strategy should also account for certain variables. Corn prices in February, for example, increased by about 30 cents a bushel, or just under 10 percent. Can you absorb a 10 percent increase in your feed cost? When you know this margin and whether it’s a surplus or deficit, you can better manage liquidity or working capital.

Improve your working capital

Even after you understand your liquidity position, start managing your costs tightly and execute a price risk management plan, you may find you’re still short of meeting cash flow obligations. Now what do you do? Time to pull out the balance sheet to see if there’s a way to improve working capital.

Start by examining all of your assets. Are there unutilized (or underutilized) assets you can sell? Is there equity in the real estate you could remortgage to replace some liquidity?

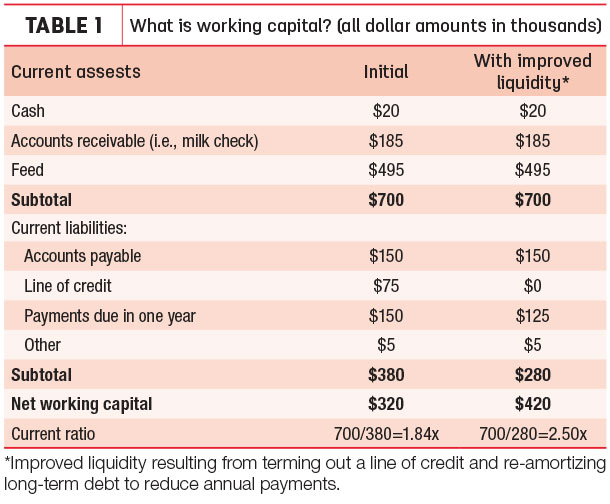

The accompanying chart (Table 1) illustrates a simple calculation for determining your working capital. But if you find yourself at an impasse when determining your financial position, don’t be afraid to seek out help from professional resources, whether it’s from a dairy business consultant, an extension agriculture agent, your tax preparer or your banker.

After reviewing your balance sheet, it’s time to discuss the plan with your banker. Show the work you’ve done to understand your financial position – cost of production, price risk management plan, liquidity and balance sheet structure – and work together to develop a plan to navigate the current low price environment.

In a tough margin environment, it’s understandable if your farm isn’t turning a profit. But you still need to be able to operate until profitability returns. It’s one thing to post losses; it’s another thing to run out of cash.

If you don’t know your financial position, you may find yourself unable to meet your payment obligations. Ultimately, the continuation of your business may be at risk. Getting a snapshot of your financial picture will go a long way toward devising a strategy to keep your operation afloat through these lean times. ![]()

For more agriculture industry insights, visit the BMO Harris Bank website.

-

Sam Miller

- Managing Director, Head of Agriculture Banking

- BMO Harris Bank

- Email Sam Miller