The dairy industry has evolved considerably over the last several decades. Major changes in genetics, nutrition, technology and management have reshaped dairy production. Producers have had to adapt to these new techniques and ideas in order to keep their farm competitive.

Dairy markets have also gone through major changes in the last several decades. Most noticeably, volatility has skyrocketed. Your father’s or grandfather’s risk management style is no longer a viable and profitable choice because the market’s highs are higher and the lows are lower. How has your operation adapted to address the needs in today’s markets?

The major components of dairy production are milk price, feed costs and other inputs. The other inputs are unique to every farm and include labor and infrastructure. While market volatility won’t affect those costs, it has affected the price of milk and the cost of feed.

We take those movable components of dairy production and distill them down to one number: revenue over feed. It’s a simple formula: revenue over feed = milk - corn - soymeal meal, and it allows us to track the three tradable commodities in one number.

We use an adjusted index, revenue over feed lite, for producers who grow their own forages. It takes the corn out of the formula and settles a little higher than revenue over feed but follows its movements closely. Essentially, revenue over feed is an easy way to track and manage your margins and profitability.

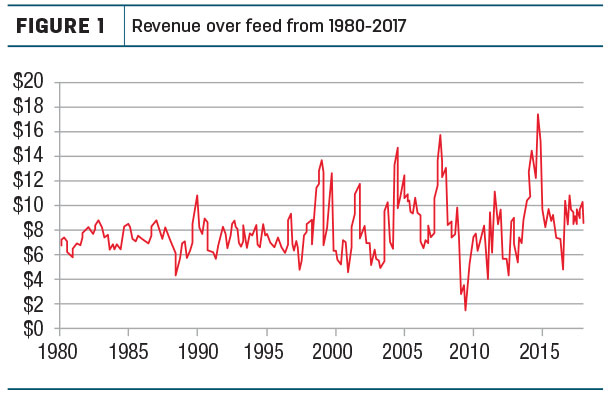

Figure 1 shows the historical revenue over feed settlements from 1980 to 2017.

Prices have always had some movement based on weather risk, animal or plant disease, and general supply and demand, but you can see how dramatically the volatility of margins have increased. Those impacts continue to affect the markets, but now changes to government policy and the increasing exposure to global markets have added to the volatility.

From 1980 until 2017, the average revenue over feed settlement has been $7.99. As you can see, in 1997, the volatility started to increase. Before 1997, prices stayed within $3.46 of the revenue over feed average. The lowest was $4.53, and the highest was $10.75.

Starting in 1998, prices have swung wildly to new highs and new lows. In 2009, it hit $1.60, more than $6.39 below the average. Five years later, it went up to $17.53, $9.54 above the average. While everyone would love margins to stay that high, it’s unsustainable. Within a couple of months, prices had dropped back down.

The unpredictability of these swings makes it hard for producers to create a reliable budget and ensure they have cash on hand when bills are due.

How do you budget for the $1.60 months when you don’t know when they are coming? If you can’t weather the lows, you won’t make it to the highs. What steps are you taking to manage your long-term profitability? If you could set your margins in advance, it would make planning your farm’s finances easier.

Take control of your pricing

We believe everyone should be taking proactive steps to protect themselves in today’s markets. There are many strategies to consider, but the overall consensus is: You should be doing something. Completely passive risk management is no longer a viable answer; you have to take control of your own margins by pricing in advance.

Instead of waiting until you receive your milk check, you can set your margins by pricing six months out with a revenue over feed program.

We promote three strategies commonly used with margin management: buying a floor, selling a ceiling or building a window. All of these are designed to let producers make decisions now about pricing for future months.

Buying a floor protects from a downturn in margins. If you buy an $8 floor, you’re ensuring you will make at least $8 per hundredweight. If margins drop below $8, you get paid the difference – but you are buying a floor. You have to pay an option premium, or the amount the market has determined the floor costs.

On the upside, floors allow full participation in improving markets, so if margins keep going up, there is no cap on how much you can make.

On the other hand, you can sell a ceiling. In this strategy, you are being paid the option premium. If revenue over feed settles below your chosen ceiling, you’ll be paid the option premium, though a ceiling does limit your upside potential and you are capped on how much you can make. It also allows for the full risk if markets go down.

The last strategy is to build a window. That means you are buying a floor and selling a ceiling. Oftentimes, this can be done at even cost, so you don’t have to pay an option premium for your protection while getting the benefits from both strategies. You can also create a window by selling a ceiling and pairing it with your existing Margin Protection Program floor. Regardless of the strategy you choose, they all offer the advantage of pricing your own margins and making your financial decisions in advance.

Stability through revenue over feed

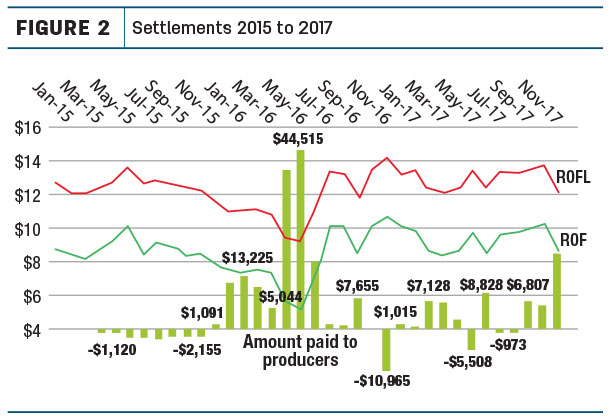

Figure 2 shows revenue over feed and revenue over feed lite settlements from 2015 through 2017.

Overlaid is a green bar graph showing the amount we paid out to producers using our program each month. Participating producers used a combination of the strategies we discussed above, and all have had success in stabilizing their margins.

This is a great visual explanation on how our program helps producers stabilize their profits. When revenue over feed settles low, we pay producers. When it settles high, producers pay us. In this way, producers avoid taking the hit of unexpected drops but give up some of the upside when markets are high.

For example, in June 2016, revenue over feed settled at $5.21, and we paid our producers $2.07 per hundredweight hedged. Effectively, they made $7.28 per hundredweight while everyone else’s margins were much lower. As you can see, it works in the inverse too. When margins are good, like in December 2016, producers had to pay in.

Even though they paid us -37 cents per hundredweight hedged, their margins for that month were still above average, coming in at $10.36. By using revenue over feed, producers were able to take control of their profits even when the market moved unpredictably.

In the landscape of today’s markets, active risk management has become a fundamental aspect in running a successful dairy. Don’t leave your profit up to chance; take proactive steps to diminish the effect of volatility on your production by pricing your margins yourself. ![]()

Tess Wilson is an analyst at CSC Arbitrage Group. Email Tess Wilson.