By tracking your income and expenses, you will know where your money goes and be better prepared to set up a realistic budget for future spending. Knowing how much you have to spend and spending no more than is allotted in each spending category puts you in control of your finances. Keep household and business records separate Most small business owners (including self-employed farmers, ranchers and entrepreneurs) are required to report the status of their business and business expenses prior to being approved for a loan and for income tax purposes. It is much easier to do if you keep separate books for household and business.

There are additional benefits to keeping separate books. When net farm income is down, knowing where to adjust household spending will help offset a drop in income. Financial stress encountered by farm households will be more likely due to debt service difficulties with non-farm debts than with farm-related borrowings.

Selection of a tracking method

There are a number of different methods – some detailed and time- consuming and some simple and quick – to use to track current income and expenses.

Each has its advantages and disadvantages. The following information can help you decide which method or combination of methods will work best for you.

Envelope (cash) method

One of the easiest ways to track money is by working with cash only. If you learn best by handling or touching things, this might be a good method for you.

Collect some envelopes and write a spending category on the outside of each. For household expenditures these might be rent or mortgage, utilities (unless included in the rent), food, clothing, transportation, personal care, children’s activities, entertainment, and debts. For business expenses you might have rent, repairs, fuel, feed purchases, etc. Then write the amount of money you anticipate you will spend for the next month or quarter for each category. Note that the total amount listed on all envelopes cannot exceed total income. Put the cash equivalent to the amount listed inside each envelope.

Many people find the envelope system a convenient and tangible way of handling their money. When they see the envelope for a particular category is empty, they know they cannot buy more items in that category. As you get used to the system, you will increase your accuracy in determining the cash amount for each category.

Don’t forget to keep occasional expenses in mind – insurance premiums, birthdays and holidays, vacations, repairs, etc. Have the envelopes ready for use so that you can put the cash in them before payments are due.

You can know how much is left in the envelope if, as you withdraw money, you subtract the amount from the original balance and write it on the front of the envelope.

There are a few drawbacks to using this system. Of major concern is the danger of keeping cash around the house – it could be lost to fire or theft. Also, because it is so accessible, you may be tempted to spend it.

Often, it is best that the envelope system be combined with other tracking systems for convenience and safety.

Companies that expect payments to be sent in the mail usually specify that cash not be used. If you use a checking account, you will need to deposit the money in your account to pay your major bills. Without a checking account, you may need to purchase a money order that will incur a service charge.

Even if you decide against the envelope system, change a month’s income into cash and bring the family members together to show them where the money goes. Show how expenses are fixed (they don’t change), flexible (they vary a bit each month), and discretionary (they are unplanned). Talk about the amount you can set aside each pay period for emergency savings. Somebody may have a suggestion for saving that is worth trying.

Receipt method

Another convenient, easy method of tracking where your money goes is to keep all sales slips, cash register receipts, and other receipts in a drawer, a calendar with pockets, or other container.

What works well are cans or jars labeled “household” and “business.” Put them in convenient locations – the household container perhaps in the kitchen, the business container in the home office or near an entrance.

For this method to work, all family members need to collect receipts for all their expenditures and place the receipts in the containers on a regular basis. If you do not receive a receipt, make your own on a slip of paper.

Empty the container at the end of each week or each month, total the amount in each category, and save those receipts needed for tax purposes and warranties. Discard the others if you wish.

The receipt method is easy to do, and all family members can participate. Indeed, for it to be successful, all household members must cooperate. Family members must make it a habit to bring home receipts for all purchases. Since not all sellers provide a receipt, the family also will have to get used to making and labeling their own receipts so there are no gaps in the record of expenditures.

Totaling expenses for each category is simple, and receipts are then available for other purposes, such as income tax deductions.

The receipt method organizes tax-deductible items and can provide great satisfaction if you enjoy simple math. But if you are intimidated by numbers, use a computer program or make a spreadsheet that will accurately add and subtract for you automatically.

Checkbook method

Many people prefer to write a check. It automatically becomes a receipt of the transaction. This requires that you carefully record each check written – to whom it was written, the amount spent, and, if possible, the item or service purchased. If you have trouble remembering to record each check, you may want to pay a little more to get duplicate checks (the second is a carbon copy of the check you wrote).

Since it is not always convenient nor appropriate to write a check for all small items, you may want to have a pre-determined petty cash fund to cover such expenses, but plan this in your budget. Write a check for the cash to cover the amount and use the envelope method for its allocation.

When the monthly bank statement arrives, take the time to justify the check ledger and/or duplicate checks with the bank statement. Group expenditures into the appropriate spending category or categories, remembering that sometimes checks are written for items listed in more than one category. Total the amounts in each category.

Keep a record of the totals in a notebook or budget register for an overview of your financial status. Set aside those checks needed for tax and/or loan purposes.

Should you set up more than one checking account in your family? Some couples have different checking accounts for convenience in tracking expenditures and keeping accounts separate. In your family meeting, you should establish which expenses will be covered by which account and who will be primarily responsible for accurately keeping those records.

Some of the benefits of the checkbook method:

• If you are already accustomed to paying for most purchases by check, it may be the logical way for you to track your income and expenses.

• Checks serve as proof of payment for products or services and provide receipts for tax purposes.

• You can preauthorize payments for regular bills and have income automatically deposited.

• Some checking accounts pay you interest but usually require larger minimum balances than non-interest-bearing accounts.

• Separate checking accounts allow you to keep better track of cash flow for individual purposes or goals such as the farm or ranch income and expenses, household maintenance, personal needs and wants, and saving money for a future vacation trip.

Some of the costs/risks of the checkbook method:

• You may have to pay a service charge and/or a per-check charge if the balance in your account goes below a required minimum. Overdraft protection can help prevent bounced checks.

• A regular checking account usually does not earn interest.

• Inaccurate records may result if checks are not recorded at the time of payment or if duplicate checks are not used.

Account book method

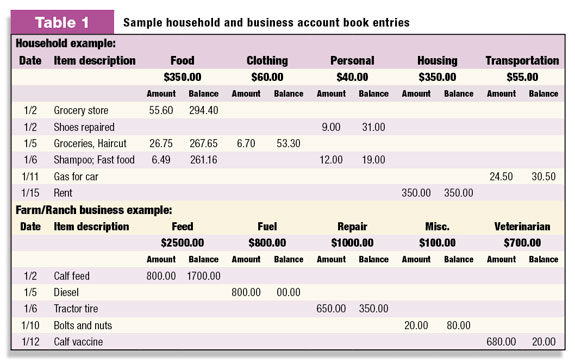

Keeping a daily record of income and expenditures for household and business accounts is chosen by some money managers.

Many commercially available account books provide forms on which to keep records. An account book for farmers and ranchers, with agricultural business and household accounts kept separately in one book, is the Ag Business Management Account Book available from Adele Publishing Company, Box 25, Seward, NE 68434, phone 402-643-4340, for $12 plus postage.

You can also develop your own account book by purchasing blank ledger sheets at any stationery or discount store, by drawing your own columns in a regular notebook, or by using your computer with or without a program such as Quicken by Intuit or Microsoft Money (two of the most widely used programs).

One family member usually assumes responsibility for keeping records. Other family members have the responsibility to report expenditures to the recordkeeper. It would be wise to use the receipt system to gather accurate information for the recordkeeper to enter into a daily ledger under major expense categories as suggested under the envelope system. Record bills as they are paid and as money is spent.

On a weekly or monthly basis, add the expenditures and record the totals on a summary sheet. The summary sheet allows you to see where the money is going; it becomes the basis for developing a family spending plan.

When you want to know the remaining balance at any point in time, simply subtract from the budgeted amount as it is spent.

Approximate amounts will do unless you prefer totally accurate accounts. If you happen to underestimate the amount needed to cover expenses in any one or more categories, you will need to cut back your spending in one or more categories by that same amount.

The account book method takes time to make daily or weekly entries. The accuracy of the account book method is dependent upon family members conscientiously and regularly reporting expenditures.

Summary

Whatever primary method of tracking income and expenses you choose, you need to record the totals spent in the various categories either weekly or monthly in some type of notebook, account book, or computer program so that you will have an overall picture of your financial situation.

Tracking income and expenses provides valuable insight into your spending habits. Only with this knowledge can you intelligently make decisions for cutting back your spending and still keep sight of your family financial goals.

If you have overspent, employing one or more of these methods will help you get in control of your spending. If you want to make a major purchase in the future, setting up a budget can help you put aside funds to cover its cost. Keep accurate household and business accounts that will serve you well when guiding you to make important financial decisions. PD

Liz Gorham

Associate Professor

South Dakota State University Extension

Elizabeth.Gorham@sdstate.edu

References omitted due to space but are available upon request to editor@progressivedairy.com .

— Excerpts from South Dakota State University Cooperative Extension Service