“Opportunity is missed by most people because it is dressed in overalls and looks like work,” quipped Thomas Edison. Kudos to the dairy producers who have joined trading simulation groups to learn how to apply marketing strategies. Learning this stuff is a lot of work. “I wish I could just sit back and get the milk check at the end of the month without having to learn all this,” one producer said in a trading group conference call. “But I know that isn’t a good long-term solution,” he added. So they keep on keepin’ on. The five producers who make up the first Progressive Dairyman Trading Simulation Group are tracking their positions using the University of Florida’s Financial and Agricultural Commodity Trading Simulation – FACTSim for short. They’ve agreed to monthly conference calls to compare notes on their feed and milk pricing strategies and the impact of their decisions.

It was all too much for one participant – Wildcat – who traded for awhile and then dropped out. And then there were four, plus mentor and coach Mark Ludtke from Stewart-Peterson Inc.

The purpose of the group is to give dairy producers the opportunity to execute marketing decisions using a trading simulator, which provides a “safe” place to make mistakes. The simulator tracks standings in terms of profit in the hedge account, but other than a little friendly ribbing, the participants aren’t paying much attention to the red and green numbers in the profit column. They’re in it to learn.

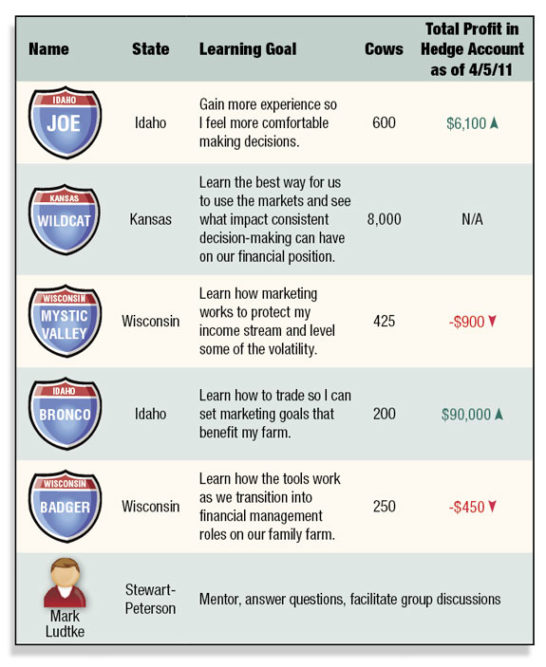

Figure at right : Members of the trading peer group have set up their trading accounts with FACTSim. The traders’ beginning account balance is $200,000, giving the participant with the largest number of cows an adequate marketing budget.

Here’s a report on Group 1’s learnings as of April 5:

Joe

After six weeks of trading: “I’m frustrated with myself! When prices ran up in early March, I was trying to be patient … I thought they would keep going up. I was too patient! Now I’m sitting here both in the game and in real life, having done nothing.”

Biggest challenge: “I really need to learn how to use a fence strategy. I think I would be comfortable and more disciplined with a floor and ceiling in place and a price range to work with for my milk.”

Time spent: “When I first started the simulation, I checked prices more. Then I got more cautious. I started treating it like my money. And I didn’t do anything for fear of losing it. I know it’s just a simulator and I need to make some moves to learn.”

Coaching from Mark: See sidebar , “How a Fence Works.”

Bronco

After six weeks of trading: Bronco is making use of spreads to take advantage of seasonal milk prices. He has been selling the nearby month and buying the far. Typically, late spring is weaker milk price and late summer is stronger.

Milk prices were strong this spring, and he thought they were a pretty good deal, so he sold milk. Lots of it. Even more than he had to sell physically, which is a speculative move. Bronco’s speculative trades are paying off in his hedge account. He acknowledges that he’s doing it to learn, not to replicate what he would actually do on his dairy.

Biggest challenge: Learning how to manage the positions he puts on. “When it goes up I want to sell and if it goes down I want to sell. I get nervous having money on the table.”

Time spent: “When I have a position on, I am way more emotional and check it more.”

Coaching from Mark: Have an exit strategy in mind for each position, and develop the discipline to stick with it.

Badger

After six weeks of trading: “I have only used futures. I’ve found that options are more expensive than I initially thought they would be. I just pick what I think is a comfortable price to protect our breakeven. I have been aiming for futures contracts at $17.50 or above.”

Biggest challenge: “Fear to do more than what I’ve been doing, with all the volatility. I have about a quarter of our 2011 milk locked in at this point, all with futures contracts.”

Time spent: “Not as much time as I thought I would. With all the volatility, I decided to pick a price and call it good rather than involve my emotions in watching it go up and down.”

Coaching from Mark: Think about your overall risk plan. If you put in an order for $17.50, what if milk goes to $22? What have you done to manage that risk? Or if it goes to $12.50? Consider selling in increments to manage risk.

For example, sell one-half of your milk at $17.50, and leave some open. Then run calculations that show what impact various price scenarios will have on all of your milk.

Mystic Valley

After six weeks of trading: “I have been watching the markets and trying to decide if I should take a position. There is so much volatility, it is hard to decide if now is the time.

I know that in being patient I have missed some opportunities. I have taken some bad positions, but have learned to get out of them before I lose more money. I am trying to have an exit strategy from the beginning.”

Biggest challenge: “Not doing something because I am afraid to make a mistake. This is a bigger mistake, as I have probably left money on the table.”

Time spent: “I check the markets daily and dedicate some time every day to see how I did. This might be bad because one-day moves can really make a long-term plan look bad.”

Coaching from Mark: It is difficult to make decisions when market volatility is high. Having an exit strategy or a next step is crucial with the market as volatile as it is. Mystic Valley is learning to have an exit strategy, which is good, and he probably needs to go just a bit further.

A complete exit out of a position may be right in some cases and in others he may need an additional step in lieu of a complete exit. For example, the purchase of an option against the sale or purchase of a commodity might be a more appropriate step. An exit out of a position may be fine as long as a re-entry point is planned should the market turn around again.

It is good that Mystic Valley is keeping track of the markets daily. Over time, the big moves will not be as “shocking” and can be put into context relative to everything else going on in the market. This perspective simply requires experience to develop.

Simulation mirrors reality

Coach Mark Ludtke observes that this group is representative of most marketers in general.

“After the Japan earthquake, everything turned. Selling was everywhere, from commodities to the stock market, like a vacuum sucked the air right out of the markets. People either took gains or limited losses, and got out to wait it out,” he says.

“Then when the milk market dipped, everyone stepped away saying, ‘let’s just see what happens here.’ Uncertainty has a way of causing most people to stand back and watch. And that’s what happened in the group, too.”

Group 1 members committed to a six-month to 12-month simulation, and Ludtke intends to help each group member develop deeper strategies, in keeping with each one’s goals.

“I’d like to see each of them create ‘next steps’ for themselves, so that as they move in and out of positions, they know what their next move will be and can move more confidently.”

He adds, “I give these players a lot of credit. They’re out of their comfort zone, jumping in and learning something that many are afraid to try.”

Group 2 gets started …

Group 2 is off and running with four producers and one nutritionist participating. The producers are from all over the map – Ohio, Minnesota, Washington State and Wisconsin. When it comes to marketing, their needs are the same.

“I believe volatility is going to continue and I would like a better understanding of how to use marketing tools,” says the Ohio producer.

“It’s something we’re going to have to learn to protect ourselves,” adds the Washington State participant. “I’ve marketed before through my co-op, but only in fits and starts. It’s time to really learn.”

And so they roll up their sleeves, because finding opportunity takes work. PD

You can still join!

You can still join a team of Progressive Dairyman readers who want to learn how to make marketing decisions. For producers who join a group in 2011, all fees will be covered through a sponsorship from Stewart-Peterson. Mark Ludtke will serve as mentor for the group.

To join, email Ludtke at mludtke@stewart-peterson.com , or call him at (800) 334-9779 .

Benefits of participating:

• Learn the language, concepts and typical positions in commodity trading.

• Learn how to move in and out of positions.

• Experience the impact of decisions made.

• Develop the discipline to execute decisions.

• Share experiences and ask questions of those in your peer group. PD

How a fence strategy works

It’s March 15. June milk is trading at $16. You buy a put option for 70 cents to protect a $16 price for yourself for June. Then you sell a call option for $18 June milk, which gives a milk buyer the right to “call” your milk at the price of $18.

If the milk price goes over $18 in June, you do not get anything over the $18 price. However, you have effectively lowered the cost of establishing your floor, and have given yourself a comfortable price range for your milk.

By agreeing to establish the ceiling of $18, you were able to lower your cost of this protection strategy. How? Selling the call option in March nets you 34 cents. When you subtract that from the 70 cents you spent to put a $16 floor on your milk price, your net cost for that protection is 36 cents.

The call option brought down the cost of establishing your floor price, and it still gave you an opportunity to capture up to $18 if the price goes up (less your 36 cents per cwt cost).

Fences are helpful when option prices are very high. One of the downfalls of using options in this way is the ceiling that is imposed if the milk price explodes higher. You typically use a fence strategy when there is significant downside risk with limited upside potential.

Some milk plants will offer this pricing opportunity, typically called a Min-Max contract. PD