In recent years, higher and more volatile feed prices have made it difficult for producers to predict their profitability by looking at milk price alone. While the milk price trading on the Chicago Mercantile Exchange (CME) has historically been a good indicator, it only shows part of the picture.

In order to get a better idea of producer profitability, we can look at a milk-feed margin. This margin is calculated using the current futures trading prices on the CME for Class III milk, corn and soybean meal.

While this margin isn’t accurate for all dairy farms across the country, it is a fairly good representation of the industry and is consistent over the years.

In order to get a frame of reference for current 2013 prices, let’s review what the milk-feed margin is and what it has done for the past five years. First, the milk-feed margin that I use is simply the Class III milk price minus the price of corn and soybean meal required to produce that hundredweight of milk.

In order to calculate that margin, I reviewed multiple feed rations from producers across the country and came up with corn and soybean meal equivalents that were fairly well matched with the energy and protein fed on the dairies.Therefore, this margin is designed to cover the bulk of the producer’s feed requirements using corn and

soybean meal equivalents.

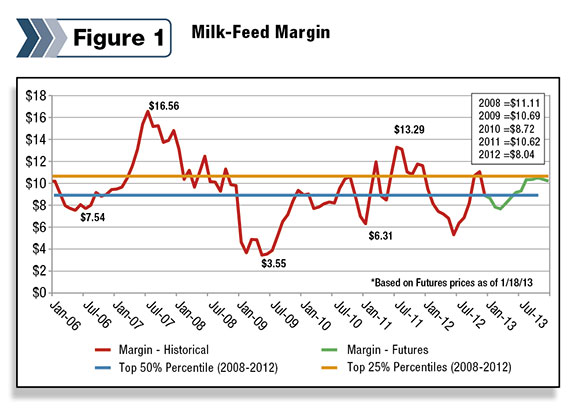

The milk-feed margin that is depicted in Figure 1 has a five-year average of $8.71 for the years 2008-2012.

Along with the average, I like to look at the percentiles – the 50th percentile for the same five years is $8.92 (similar to the average), and the top 25th percentile is $10.68.

This tells me when the margin is trading at a price of around $9 or better that most producers are probably breaking even or profitable.

If the margin should get up to $10.68 (top 25th percentile), on a broad scale, dairy producers are most likely profitable.

Based on CME futures prices on January 18, 2013, the current milk-feed margin for all of 2013 is trading around $9.27 (that compares to the five-year 50th percentile of $8.92 and the top 25th percentile of $10.68).

The first half of 2013 is averaging $8.35, and the back half is averaging $10.19. When I see the average for the back half of 2013, it makes me take notice.

That average is approaching the 25th percentile mark which, on a broad scale, means there are some good hedging opportunities currently available to dairy producers.

In my opinion, if these current futures prices maintain until settlement, it will most likely be a profitable year for dairy producers.

So if current margins hold, what will that mean for the dairy industry? Again, from my point of view, and as it looks today, the higher milk prices and lower feed prices projected for the back half of the year will mean that the majority of dairy producers will have a profitable year but not a record year.

The current 2013 margin is less than $1.50 below the 2009 and 2011 averages, but about $1.20 higher than 2012.

I would suspect that the moderately higher margins will result in an increase in milk production, especially when you consider that the margin for the end of 2012 was considerably higher than the recent averages (over $11 for October and November).

Once producers have a couple profitable quarters under their belts, they will keep cows producing longer, increase their herd size within their facility limits – and some will even expand or purchase facilities to fill with producing animals.

So what can producers do? I suggest producers take some time to review the milk-feed margin to determine the profitability level for their operation and then review available risk management strategies to set up a plan that meets their needs.

Along with risk management for milk price, they also want to review their strategies for feed price risk management.

Feed price risk management can be very diverse as producers’ ability to grow and contract feed locally, and weather conditions, all play a role. I suggest working with an expert who will help with milk and feed price protection so that you are better protecting your milk-feed margin and your profitability.

Some important things to consider are that this default margin does not account for regional differences such as weather, feed problems or higher prices that may exist in certain areas (such as the higher feed prices in the Southwest).

So as we run into regional weather occurrences, we can see a big shift in profitability for specific areas of the country. We also need to keep in mind that dairy producers’ profitability may be impacted by volatility in their operating costs, which is not accounted for in this calculation.

What can change these margins? Simply put – lots of things. If the margins are good and producers are profitable, milk production can start to increase sooner than expected.

And although the international demand has been good, and domestic demand has held steady, the demand side is certainly vulnerable and can change quickly.

But conversely, these margins could move even higher. For example, demand could be strong, pushing milk prices higher, but feed prices could continue to decline once we enter next year’s planting and then harvest.

The only things that exist now are speculation and opportunity for those who are willing to hedge their risk. The current hedging prices that are available have not always been there, and now is the highest this milk-feed margin has traded for the second half of 2013.

I am urging my clients to take advantage of these higher prices and protect their profitability if possible for the upcoming year. As of now, 2013 looks to be a good year for dairy producers, but we all know things can, and usually do, change quickly. PD

Katie Krupa is the director of producer services with Chicago-based Rice Dairy, a boutique brokerage firm offering guidance, analysis and execution services on futures, options, spot and forward markets. Click here to reach Katie by email . Click here to visit Rice Dairy's website . There is risk of loss trading commodity futures and options. Past results are not indicative of future results.

Katie Krupa

Director of Producer Services

Rice Dairy