The cost of financial statements and tax returns is often seen as an annoying expense to meet an outside party’s requirements. However, the information contained in these documents can easily be used to calculate key ratios that can be valuable management tools when understood and used to make operating decisions. Ratios allow a dairy owner to quickly understand whether the dairy is making money and where it stands compared to prior years and industry benchmarks.

While industry benchmarks can be a useful consideration, the true benefit of understanding financial ratios comes from gaining a real-time snapshot of financial position and making improved management decisions.

While there are many ratios that can be calculated, it is important to choose a few meaningful ratios that can be calculated easily and consistently. This article focuses on four ratios that give quick measures of balance sheet health and ability to pay bills (ability to survive and grow) and ability to generate income (ability to benefit owner lifestyle).

1. Debt to net worth

2. Debt to market value

3. Ag working capital

4. Breakeven

Debt to net worth

The debt to net worth ratio is a measure of how much owner equity is supporting the assets of the business compared to outside debt. It is a measure of the health of a dairy’s balance sheet.

The more debt there is to every dollar of net worth, the less likely a dairy will be able to survive downturns in milk prices or increases in operating costs and interest rates.

This ratio is calculated by dividing total liabilities (including accounts payable, payroll liabilities, all long-term and short-term borrowing) by total owners’ equity (including stock or member capital, retained earnings, current year earnings).

These amounts are found on the financial statement balance sheet or the balance sheet on page five of federal corporate and partnership income tax returns.

While there is no specific ratio that debt to net worth should be, generally when a debt to net worth ratio exceeds 100 percent, further analysis of operations, debts and ability to service those debts should be undertaken. Debt to net worth ratio is calculated as follows:

Total debt ÷ total equity = debt to net worth ratio

Debt to market value

(loan to value)

Debt to market value is a measure of a dairy’s borrowing capacity. This ratio is also referred to as loan to value. It is calculated by dividing the total debt (determined the same as discussed above) by the amount the dairy herd and equipment would sell for.

Fair market value is the total of the value of individual heifers, cows and significant pieces of equipment.

Total debt ÷ fair market value of herd and equipment = debt to market value

Most loans are limited to a percentage of market value. Therefore the higher this ratio, the less borrowing capacity a dairy has and the more likely it is to be in default if cattle or equipment values decline.

Ag working capital

A measure of a dairy’s ability to pay its bills, ag working capital is calculated by dividing assets that are cash or will be converted to cash within 12 months (current assets) by liabilities that need to be paid within 12 months (current liabilities). Payments on debts that will take more than one year to pay off are excluded from this calculation.

Ag working capital focuses on a dairy’s liquidity. Another way of using ag working capital is to compare the excess of current assets over current liabilities to the annual budget of operating expenses plus interest. A healthy operation will have net ag working capital equal to several months’ budgeted operating expenses.

Amounts to calculate this ratio are also found on the financial statement balance sheet or the balance sheet on page five of federal corporate and partnership income tax returns. Current assets include cash, accounts receivable and feed and supply inventories. Current liabilities include accounts payable, payroll liabilities and debts required to be repaid in less than 12 months.

Current assets ÷ current liabilities = ag working capital (as a ratio)

Current assets – current liabilities = ag working capital (as a dollar amount)

Breakeven

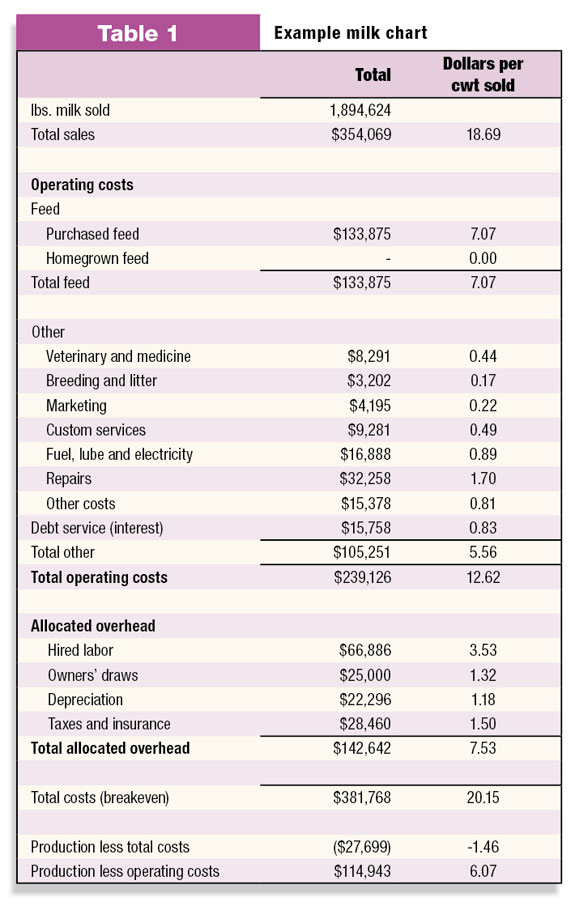

The breakeven concept is probably the most important of these ratios to understand. Breakeven is the point where the income generated equals the costs. When determining breakeven, all costs need to be considered (i.e., both operating costs and allocated overhead).

Breakeven should be calculated on a per-hundredweight basis. This allows a quick assessment of whether the price per hundredweight being received is adequate to cover all costs. Determining costs on a per-hundredweight basis is done as follows:

Item of cost (i.e., interest expense) ÷ (pounds of milk sold) ×100

Determining breakeven on a consistent basis will allow trends and anomalies to be quickly identified. When current breakeven amounts are in excess of current milk prices, costs need to be reduced to assure the ongoing viability of an operation.

There may be some costs which can be managed on a short-term basis (i.e., hired labor and owner draws); however, for many costs a short-term cost reduction plan is not available.

These costs must be managed with a long-term plan. A historical breakeven analysis like Table 1 can help in developing that plan. The example is for one year, but the real benefit comes from putting a number of years side by side for analysis.

Successful business management requires that owners and operators have a constant flow of reliable, understandable information. Ratio comparisons are one way to simplify and make financial information meaningful so that decisions can be made in a timely manner. PD

Co-author Brent Sandberg is a partner in the Logan, Utah-based accounting firm Jones-Simkins.

Paul Campbell

Tax Officer

Jones Simkins, PC

pcampbell@jones-simkins.com