Milk price volatility continues to be a major concern for U.S. dairy producers. That volatility – along with the recent experience of large negative producer price differentials (PPDs) – can have a significant impact on net milk prices.

Editor's note: There are several risk management tools available to dairy farmers (see Learn to use milk price risk management). One may be a better option than another based on your dairy.

The magnitude of volatility

To get some perspective of the magnitude of the volatility impacting dairy producers, I have tracked Class III milk and corn prices between January 2006 and July 2020, analyzing the range and frequency for when the final price was greater or less than futures contract prices three months and six months prior. For example, the final July 2020 Class III milk price was compared to the closing Chicago Mercantile Exchange (CME) futures prices three months (April 2020) and six months (January 2020) earlier.

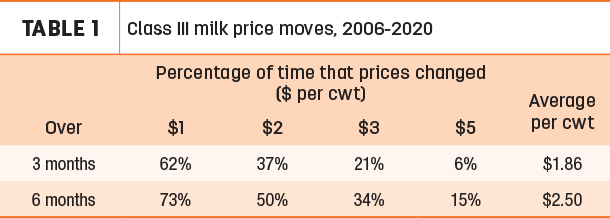

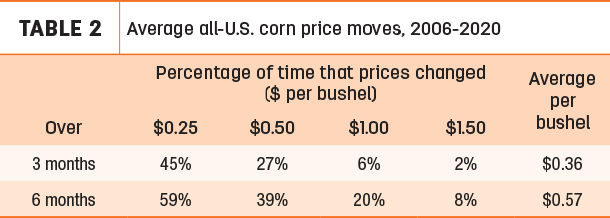

Tables 1 and 2 help identify how much and how fast prices can change.

The analysis indicates that 50% of the time, the Class III price (Table 1) changed (up or down) more than $2 per hundredweight (cwt) within a six-month period.

Further, the average Class III price closed up or down by $1.86 per cwt over three months and $2.50 over six months. About 15% of the time – that’s once every seven months on average – the prices changed by more than $5 per cwt, although those changes tend to happen in groups during major price moves.

Similarly, Table 2 shows that the average price for corn sold each month increased or decreased 36 cents per bushel over three months and 57 cents per bushel over six months.

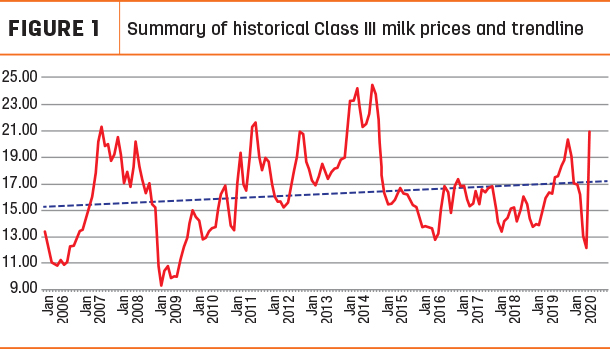

Figure 1 shows the history of the final monthly Class III milk price over the past 14-plus years. It also helps illustrate month-to-month and year-to-year changes.

The purple line is a trendline, which indicates an approximate 1% annual increase in price over the whole period.

One relatively recent trend is that other than 2020, which is impacted by COVID-19, volatility had actually settled down from 2015-19. I believe one of the reasons for this is the implementation of additional governmental programs geared toward assisting with price risk. While the Livestock Gross Margin for Dairy (LGM-Dairy) program has been in place since 2008, the 2014 Farm Bill created the initial Margin Protection Program (MPP). The Dairy Revenue Protection (Dairy-RP) program was rolled out in late 2017. After that, MPP-Dairy was converted to the Dairy Margin Coverage (DMC) program for 2019.

Consider alternatives

Dairy producers have a number of alternatives to assist them in price risk protection strategies. However, there are some important things to keep in mind.

- Milk basis (the difference between the Class III or Class IV price and the actual pay price received by the producer) cannot be managed or locked in via any of the mechanisms that use CME futures as the base (regular CME futures and options, Dairy-RP and LGM-Dairy). Since DMC is based on actual milk pay prices, it does factor in milk basis, albeit essentially a national average including component differences.

- PPD levels, which are part of milk basis, can be erratic at times due to the federal milk marketing order (FMMO) process. This was most recently evident in June and July 2020, when PPDs ranged between -$4.00 to -$9.00 per cwt across applicable FMMOs.

- The overall market prices on the CME and Chicago Board of Trade (CBOT) ultimately dictate what price ranges can be protected through risk management tools. This is primarily a function of supply and demand. However, as we have seen in 2020, there are repercussions based on export markets, economic or political issues, and contagious human diseases. There are also non-industry participants who trade both futures and options for agricultural commodities for their own financial gain and/or loss.

No ‘one size fits all’ strategy

With the wide range of government programs and other tools available, what should a marketing plan reasonably look like? There is no “one size fits all” approach. Strategies vary based on herd size, financial position and individual risk appetite. Following are a few key things to consider:

General suggestions

- It is crucial for dairies to have reasonable knowledge of their cost of production, expected breakeven price and milk basis. Without these numbers, risk management decisions are less effective.

- Consider the impact of feed pricing on overall net margins and profitability. If you only address milk price risk, you are leaving a portion of your real net income at risk. Consider a strategy to also protect feed; whether it is at the same time as executing milk pricing or executing a strategy independently. Staying open to market risk on feed while protecting milk prices is also a strategy, especially if you grow your own forages, but keep in mind that does leave some risk to bottom line profitability.

- Price risk management does not have to be an all-or-none consideration. Many producers use a percentage model to lock in various strategies at a time, such that if projected profitability hits certain per-cwt benchmarks, they will execute the strategy. The key is to consistently apply that approach so you are not always on the “losing end” of locking in milk prices on the way up but failing to benefit when milk prices go down.

- Recent history shows producers who used this method locked in prices for June and July 2020 below the high as prices moved up, but they also had August 2020 contracted at over $23 per cwt and September 2020 contracted at over $20.50 per cwt, both well above the final August Class III price and the currently available September Class III futures price.

- Likewise, price risk management does not have to be based only on one type of strategy. Mixing DMC with Dairy-RP, LGM-Dairy and futures and options can make sense for a variety of reasons.

- If you use a brokerage account, make sure that you –and your lender – understand the possibility of having to cover margin calls.

Possible strategies

- The cost of DMC makes the Tier 1, 5-million-pound/$9.50-per-cwt coverage a very reasonable base level of protection, especially for any dairy where 5 million pounds makes up a significant portion of annual milk production. DMC Tier 2 is expensive at the top $8.00-per-cwt level but may have some merit for dairies with a lower cost of production.

- DMC does not result in margin calls, and producers enjoy the full upside. However, enrollment is once a year and does not offer the flexibility of market-based risk management tools. And since the same calculations are used for all dairy producers nationwide, it is more beneficial to regions that have a lower cost of production. As mentioned previously, DMC does have some consideration for milk basis.

- Dairy producers with significant debt who cannot afford to have loss years have a greater reason to use strategies that help them lock in expected breakeven results – even if the cost is 10 cents to 25 cents per cwt. The use of options or Dairy-RP will allow them to still enjoy the upside but protect the downside. The key consideration is whether the market or Dairy-RP offer prices that protect those breakeven levels. When those opportunities exist, it is prudent to consider such strategies, especially if breakeven can be obtained after the cost of the Dairy-RP or options strategy. These strategies are more advantageous when expectations are that milk prices will more likely increase than decline.

- Realize that Dairy-RP, LGM-Dairy and options are really like insurance. They carry a cost that you must be willing to absorb – and that you may not see any return on when the actual Class III price exceeds the price you paid the premium on. This should be viewed as a positive because it means the market price you will realize will be greater than the price you protected. You pay property insurance and are willing to “lose” the premium because your facilities did not burn down – this is the same concept.

- Any time Class III milk futures exceed $19 per cwt for a stretch of five-plus months, that is a signal to consider action. This is a rare situation and a sign production increases will likely occur. Each situation can be different. If it is believed that prices could continue to rise, then an option or Dairy-RP or LGM-Dairy strategy makes more sense. If the concern is that milk prices will drop, then straight milk futures or contracts with the processing plant make more sense. In either case, do something. For a shot of reality, simply keep a picture of Figure 1 posted in your office.

- Consider Class III and Class IV pricing mechanisms. While Class III influences the vast majority of pricing, the spread of pricing between Class III and Class IV should also be considered. When Class IV futures prices exceed Class III (especially if this is more than a $2 difference), you will want to consider utilizing a percentage of your price risk management via Class IV methods.

- Ever since COVID-19 hit, Class III and Class IV futures have had greater volatility, which has resulted in higher costs for Dairy-RP and options strategies. When things get back to normal, the following strategy has worked fairly well for my customers. If a) the fundaments indicate a high likelihood of milk price increases, b) it appears that cow numbers or milk production will be curtailed, or c) the industry has been through a prolonged period of low Class III prices, consider buying Class III calls six to nine months in advance at a strike price approximately $2 per cwt above the corresponding futures price for around 10 cents per cwt. In this scenario, after the calls are purchased, and if Class III futures do in fact rise to the level of the call strike price, the dairy producer can then lock that price in through the dairy plant or brokerage account. This acts to set a floor $2 per cwt higher than when the option was purchased. If prices retreat after this, the dairy producer has that new higher floor, or minimum price. If prices continue higher, the producer uses the call they purchased to participate fully all the way up.

- Currently, due to the higher cost of Dairy-RP, producers are looking at many other mechanisms to combine Dairy-RP with options via a commodity broker in a two- or three-step process. These can get very intricate to describe and could take a separate article to explain.

- Lastly, if you are new to considering price risk management strategies other than DMC, it is preferential to avoid starting when prices are at a low point. It is much more preferential to start when prices are average or above.