If you like old Westerns, then you are familiar with the popular scene where the heroine of the story is tied to the railroad tracks as a speeding locomotive races towards her peril. That scene aptly describes the scenario lingering in the dairy community.

Many producers can identify with that seemingly helpless woman: No matter how hard they try, they are tied to a market that seems to leave them bound to the very same spot. Feed prices have been stagnant throughout the year and 2017 Class III milk prices have posted the narrowest range from top to bottom witnessed since 2005.

Like the old saying, something has got to give. Quiet markets only last for so long before being interrupted from their sleep to go on a run. The question everyone is currently wrestling with is whether that run takes us higher – or causes a deeper dive.

There are some interesting things to factor in when considering an answer to that question. What will the world economy look like in the coming year? Will importing nations work to raise internal production or become more dependent on foreign suppliers? What political negotiations or happenings will unfold in the months ahead? How will weather impact milk production in the top-producing regions? How will producer profitability affect decisions in a new calendar year?

This list can go on. As we work through answers, the governing rules of supply and demand will play out. When considering the demand side of the equation, we continue to observe ongoing strength in domestic consumption. While fluid milk continues its 25-year decline, product categories (especially those featuring milk fat) are on the rise. Monthly disappearance of butter has been relatively flat relative to last year, but whole milk and full-fat ice cream have witnessed dramatic improvements.

On a milkfat basis, total disappearance across all product categories is up 1.5 percent year-over-year through September. In the first three quarters of 2017, domestic commercial disappearance of American cheese averaged 391 million pounds per month. This represents a 1 percent improvement over the same period last year and continues a long-standing growth trend.

But can strong domestic consumption alone continue to soak up growing milk production volumes year after year? It doesn’t appear so. Monthly milk production in the U.S. has grown by 1.9 percent on average when compared to the same months in 2016. At their best, U.S. consumers still fall nearly 1 percent short of keeping up with domestic milk production. We are becoming increasingly dependent on exports. However, exports to date have not grown enough to cover that gap. It is exactly why product inventories continue to approach or establish new record levels.

Cheese inventories have risen nearly 6 percent from September of last year and 13 percent from 2015. The good news is that butter inventories have fallen 4.5 percent from 2016 levels, but still remain 37 percent higher than two years ago. Dry whey inventories have rocketed 105 percent higher from the year prior and 54 percent from 2015. Nonfat dried milk supplies have also ballooned by rising 49 percent over 2016 levels and 52 percent over September 2015.

Rising inventories wouldn’t be such an issue if world milk production was on the decline. Such an occurrence took place last year as the European Commission worked to reduce production among the European Union (EU) member states. The program worked temporarily and prolonged the negative growth rates that began in mid-2016. However, as government payments ended and rising product prices came calling, milk production responded.

Of late, September production in the EU rose 3.5 percent over the same month in 2016. With still-strong markets and the momentum of growth behind it, further increases are forecast well in to 2018. Oceania shares some of this same fate. Early forecasts for the 2017-18 production year suggested a 3 percent growth rate. Poor pasture conditions in New Zealand are hampering those early forecasts, but positive growth rates are still achievable.

How can such an environment exist? Why do the EU and Oceania markets command a higher price for their product while we struggle to catch up? The answer lies in the cycle of markets. For two years, New Zealand milk production fell as poor profitability and uncooperative weather conditions weighed on their producers.

In the end, the cow herd declined. The European situation was not that different. For nine months, producers curtailed production growth. In the wake of tighter production, prices responded. As of September, farm-gate prices are 15 percent higher in Europe than in the U.S.

Back to the tracks

So where do we go with all of this? We go back to the railroad tracks. The supply train has been rolling down the line as 54 consecutive months of year-over-year production growth has led to massive inventory builds that even a hungry U.S. consumer has been unable to stall. Many still hold the hope for higher prices.

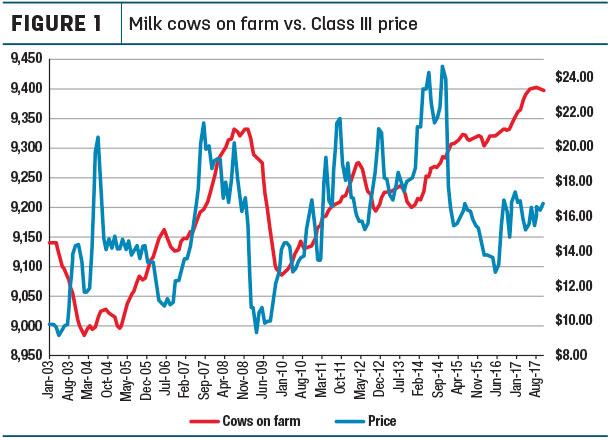

While not out of the question, the track to get there likely leads us through the same kind of territory witnessed by our friends elsewhere. A quick review of cow numbers (see Figure 1) shows a herd that is the largest since 1996.

While herd growth has stalled in recent months, it has grown by 200,000 head since the 38,000-head reduction that took place in summer 2013. Since that time, it has been nothing but growth, aside from a few minor setbacks.

With exception to 2014’s stellar export experience and the record-setting prices that followed it, every major price hike in this millennia that has taken us to the land flowing with milk and honey (we call that $20 milk) was always preceded by a sizeable herd reduction. In the last three, the average herd reduction was 160,000 head.

By cause and effect, $20-per-hundredweight milk became possible. If you are still looking down the track hoping to see this beautiful country, recognize that it likely sits on the other side of treacherous mountain terrain known to shake a few cows out of the cars along the way.

Unfortunately, it takes much longer to get there than you would hope and causes a little motion sickness along the way. Be prepared for an interesting ride in 2018. ![]()

DISCLAIMER: The information contained herein is the opinion of the writer or was obtained from sources cited herein. It should be noted that the impact on market prices due to seasonal or market cycles and current news events may be reflected in market prices. Trading in futures products entails risks of loss which must be understood prior to trading and may not be appropriate for all investors.

-

Mike North

- President

- Commodity Risk Management Group

- Email Mike North