Joe Dairyman has a dilemma. Joe has to decide whether he will build another 200-cow freestall barn or purchase and install five large feed bins. He does not have enough money to make both investments.

Assuming that Joe’s goal is to pick the option that gives him the most economic benefit, how should he decide which investment to make?

Both of these investments are long-term investments, with cash invested and generated over a span of years. Two very important principles need to be considered when evaluating a long-term investment:

• Time is money. Would you rather have $1,000 now, or would you like $1,000 in 10 years? Hopefully, you would all say “Now!” with your hands out. Why? Money is worth more today than in the future primarily because you have an opportunity to put that money to work.

• Cash is king . We are talking about greenbacks, not the man in black. Keeping accrual profits in the black is important to the long-term success of a business, but if you “burn, burn, burn” through your cash faster than you can bring it in, then the business will not make it past the short term.

Putting these principles together, we can say that the value of any investment is determined by the amount and timing of cash the investment will generate.

How do we compare investment options to decide which would generate the greatest economic benefit? Two commonly used yet flawed measures are the rate of return and the payback period.

The rate of return is the average annual cash inflow divided by the total cash outflow. This is a good measure to evaluate investments in which the costs and benefits occur within a year or less. The problem with using rate of return to evaluate a multi-year investment is that it does not take into account the timing of cash flows.

The payback period is the time it takes to recoup the initial investment. This measure can be a rough indicator of the level of risk an investment represents in that the longer it takes to recoup an investment, the higher the risk. But this measure ignores the timing of cash flows that occur within the payback period, and it completely ignores the future cash flows beyond the payback period.

A calculation known as net present value (NPV) accounts for both the amount and timing of all cash generated by the investment. This is accomplished by discounting cash flows from future time periods to determine what that future cash is worth today.

The rate at which future cash flows are discounted is called the discount rate. If the sum of that future cash is worth more than the money spent on the investment, then the investment will create economic value.

The NPV calculation sums the present value of the future cash flows and subtracts the initial investment cost. Therefore, an investment with a NPV greater than $0 will be an investment that creates value.

Let’s get back to helping Joe make a decision.

Step 1 – Estimate relevant cash flows

The goal that we want to accomplish in this step is to estimate the cash flows we expect the investment to generate. We are only concerned with the cash inflows and outflows that would arise if Joe were to make the investment.

Do not include interest expense in the cash-flow estimates. Interest is a cash expenditure, but it is accounted for in the discount rate calculation (which is Step 2). We would be double-counting if we included interest expense in the cash-flow estimates.

Another key point to remember on this step is our “cash is king” principle. Depreciation is a special expense to watch for because it is an accrual expense, not a cash expense.

Depreciation actually increases cash flow by the amount of income tax that otherwise would have been paid. To calculate the depreciation “tax shield” of an investment, we will need to know the amount of depreciation expense and the effective tax rate.

Effective Tax Rate = (Income Tax Expense) / (Net Income + Income Tax Expense)

Depreciation Tax Shield = Depreciation Expense × Effective Tax Rate

Cash Flow = (Before Tax Cash Flow × (1 - Effective Tax Rate)) + Depreciation Tax Shield

Step 2 – Setting the discount rate

• Cost of capital – Joe’s cost of capital is his financing costs. If Joe is going to finance the investment with debt, the cost of capital is the adjusted annual interest rate.

The interest rate is adjusted to take into account the tax shield effect of interest expense. The cost of capital for equity financing would be the rate that Joe expects his money to return on an alternative investment.

If Joe were to finance the investment using a mix of debt and equity, then the cost of capital would be a weighted average of the adjusted annual interest rate and Joe’s required rate of return on equity.

• Investment risk – The more risk associated with an investment, the higher the return must be in order for an investor to make the investment.

In practical application, we can set the discount rate greater than the cost of capital if we think there is potential for the actual cash flows generated by the investment to be different than our projections. A good example would be the barn option.

Our expected cash flows are very sensitive to changes in the price of milk and feed – which are volatile and to a certain extent uncontrollable. We would be wise to bump up the discount rate on the barn NPV calculation to reflect Joe’s exposure to price risk.

Let’s keep things simple and assume that Joe will finance the investment with 50 percent debt and 50 percent equity. Let’s also assume that Joe’s required rate of return on his equity is 10 percent, and that the bank would charge an annual interest rate of 5 percent. If Joe’s effective tax rate were 25 percent, then the cost of capital would be:

Cost of Debt = Annual Interest Rate × (1 - Effective Tax Rate) = 5 percent × (1 - 25 percent) = 3.75 percent

Cost of Capital = (Weight of Debt × Cost of Debt) + (Weight of Equity × Cost of Equity) = (50 percent × 3.75 percent) + (50 percent × 10 percent) = 6.875 percent

We will use the 6.875 percent cost of capital as the discount rate for the bin investment option. For the barn investment option, we will adjust the discount rate to 12 percent to account for the price risk exposure that we discussed above.

Step 3 – Calculate net present value of the future cash flows

The NPV calculation is best handled in a computer spreadsheet or with a financial calculator. Financial calculators have built-in NPV functions. Read the user-guide of the calculator for instructions on how to use this function.

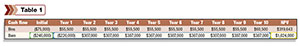

In Microsoft Excel, we can lay out annual cash flows in a table format. Table 1 shows our expected cash flows for each investment.

Click here or on the image at right to open it in a new window.

To calculate NPV of the barn investment option in Excel, we need to type the following command into an empty cell: =NPV(0.12,Year 1:Year 10)+Initial investment.

Back to Joe and his dilemma. The five feed bins have a NPV of $320,000. The barn investment has a NPV of $1.024 million. Both investments would create value, but if Joe can only choose one option, he should build the freestall barn and expand the herd. PD

Degan is a sales manager with Renaissance Nutrition.

John Degan

Sales Manager

Renaissance Nutrition