The grain market began the month of April by processing the March 28 USDA Prospective Plantings and Quarterly Stocks reports. The reports caught many off-guard. Cumulatively, corn and soybean acres were estimated at 177 million acres, 3 million acres fewer than the 2017 season.

While this was partly offset by higher-than-estimated stocks, markets moved sharply higher after the news was announced. How will we be able to meet our demand? Where will we find the necessary supplies to meet growing export interest?

While these questions lingered in the days that followed, an answer came abruptly on April 4. That answer took the form of a Chinese response to the Trump administration’s prior $50 billion trade tariff package aimed at closing the trade deficit that exists between the U.S. and Asia’s biggest economy.

China announced it would add a 25 percent tariff to the existing 13 percent tariff on soybeans and would extend that same rate hike to other products including corn, wheat, sorghum, cotton, beef, tobacco, whiskey, fuels, vehicles and a long list of other goods.

To cut to the chase, the concern about any shortfall in supply can be eliminated quickly if demand for our products falls faster. In the U.S., where roughly two-thirds of our soybeans are exported in one form or another, developments such as these can hurt hard, and they can hurt fast. Spot soybean prices dropped 58 cents that morning before finding some relief.

While lower soybean and soybean meal prices can certainly benefit dairymen, it is the vulnerability to the same type of outcome that should be the concern of every U.S. dairy farmer. What if China adds U.S. dairy products to its list of tariffed items in future responses to new tariffs constructed by the U.S.? On another front, what if NAFTA negotiations give way and shrink U.S. market share in Mexico?

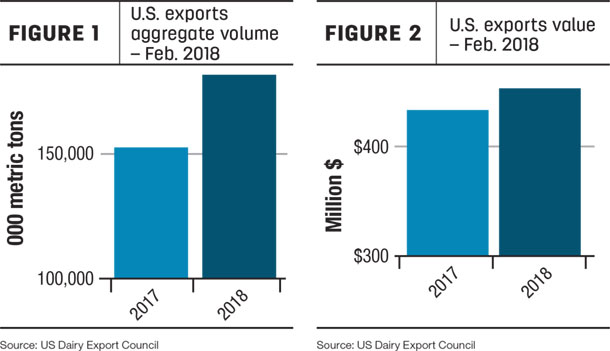

Regardless of whether we talk about trade partners in Asia or North America, exports have become not just an important part of our industry but a vulnerable part of our market structure. With trade, we have an outlet for our expanding industry. Without trade, we find ourselves drowning in a sea of our own production.

In the first two months of the year, Chinese purchases of U.S. dairy products totaled $86 million, $4 million greater than the same year-to-date sales in 2017. For all of last year, $577 million of dairy exports found their way to Chinese buyers. Other nations in Southeast Asia added another $690 million. While these numbers are impressive, they pale in comparison to the dairy export volumes sent to Mexico.

In the 2017 calendar year, $1.312 billion of U.S. dairy products moved south of the border – more than all of our Asian business combined. Together, we are as important to Mexico as Mexico is to us. In 2016, 73 percent of all dairy products consumed there had their origin in the U.S. Unfortunately, that number is falling.

Throughout 2016 and 2017, criticism of foreign trade caused longstanding partners, like Mexico, to explore other supply options. As renegotiations of NAFTA began, further tension was put on this relationship. Simultaneously, the EU has been renegotiating its own agreement with Mexico. One element sought by the EU is the use of geographical indicators. Geographical indicators limit other suppliers’ abilities to label their products with names which originated from a specific region in the world (i.e., mozzarella cheese was initially made from water buffalo milk in southern Italy).

The U.S. provides more than 25 different varieties of cheese to Mexico. Over 40 percent of that is mozzarella. Such an agreement would create enough consumer confusion to slow growth in this category. As added pressure has come on U.S. cheese suppliers, our market share has dropped to 66 percent, an overall 7 percent decline in just two years. European countries were the biggest benefactor of this.

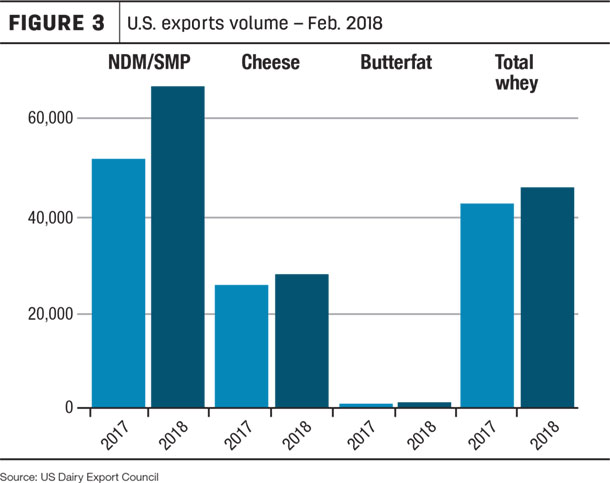

Skim milk powder remains another battleground. Mexican imports totaled 330,763 metric tons in 2017, up 16 percent from the year before. Total U.S. exports totaled 608,091 metric tons last year, up 1 percent from last year. Of that total, 278,209 metric tons found a home in Mexico.

That number fell approximately 1,500 metric tons short of the volumes we delivered to our southern neighbor in 2016. Canada, under its new pricing regime, together with Europe grew their footprint in this space while we lost ground. This is a troubling trend.

While we cannot go forward in fear the sky is falling, we must acknowledge market values are incredibly sensitive to any sudden developments in trade. That said, dairymen face the ongoing possibilities of a black swan event similar to that witnessed in grain markets in early April. While the Chinese news was sudden, eroding market shares in Mexico can be equally damaging to our markets.

They happen more slowly and often without notice by many. Regardless, any degree of optimism fostered by a seasonally advancing forward price curve should be tempered by a very real appreciation of violent headwinds caused by a loss of our product market … in any capacity.

The slow rise in prices throughout winter/spring has offered opportunities later in the year that are far better than the lowest prices realized at the start of the year. Based on current Class III futures values, milk revenues would improve by approximately $2.50 per hundredweight from February prices. What happens to these numbers, however, if demand for U.S. product falls from 14.7 percent on a solids basis, as seen in 2017, to something less?

As Trump’s resolve to stand up to China grows, and new rounds of tariffs are announced, will dairy remain immune from Chinese retaliation? Are you prepared for such a story? What is your plan? Let the recent situations other farmers have encountered when their market shrinks be the catalyst for your own preparations. ![]()

DISCLAIMER: The information contained herein is the opinion of the writer or was obtained from sources cited herein. It should be noted that the impact on market prices due to seasonal or market cycles and current news events may be reflected in market prices. Trading in futures products entails risks of loss which must be understood prior to trading and may not be appropriate for all investors.

For nearly 20 years, Mike North has educated and guided dairymen and farmers in their efforts to manage commodity price risk.

-

Mike North

- President

- Commodity Risk Management Group

- Email Mike North