Math is integral to your dairy operation. You routinely crunch numbers ahead of making important decisions. Those numbers tell you whether it’s wise to, for example, expand the herd, add employees and purchase new equipment.

So it goes with marketing. You can run numbers ahead of finalizing marketing decisions, enabling you to see possible outcomes and develop strategies accordingly.

You will need to consistently plan for possible price scenarios, the “what ifs” that can occur. Importantly, you must focus your goal not on the next month or remainder of the year – rather, start preparing to build a strong overall average price for the long haul.

Practically speaking, what does it mean to manage your marketing in this way? Let’s look back to feed and milk markets from approximately the past year. We’ll consider possible price scenarios, make hypothetical decisions and create preliminary scenario-planning grids.

I’ll begin with scenarios for feed from December of 2015. I’m choosing this time frame because it provides a good example of the need to consistently manage price risk, regardless of whether market sentiment is strongly bearish or bullish.

Developing feed-price scenarios

Back in December, we were telling feed buyers to protect low prices being offered on soybean meal. Few buyers felt the need to do so. Growers had produced another annual record soybean yield, and market sentiment was strongly bearish.

The record crop could have easily put a lid on price or driven it down. Additionally, we had the largest U.S. soybean carryout since 2006. Projected at 465 million bushels for 2015-2016, U.S. carryout supported continued low prices. We also had abundant world carryout.

On the other hand, we knew back then (based on our research) that the average soybean price rally in the year after a record-yielding crop was 75 percent, and that soybean meal prices had rallied the year after every record soybean yield, dating back to 1970.

Even when subtracting the largest of those rallies from our calculations, the average rally after a record-yielding year was about 35 percent.

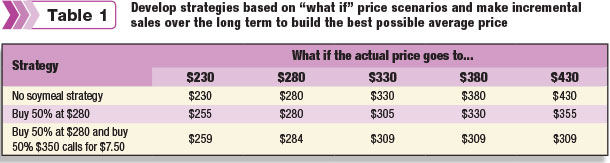

Let’s pause and do the math. Based on the front-month continuous soybean meal price at the time of $280 per ton, a 35 percent rally would result in a price of about $380 per ton. This is one figure we will add to our scenario planning calculations (Table 1).

In addition to price-trend analysis, feed buyers should also look at market fundamentals, such as the next year’s supply-and-demand picture. Imagine a scenario in which farmers planted 83 million acres of soybeans for the third year in a row in 2016, carryout for 2015-2016 remained the same as the December estimates, and demand for 2016 increased at a normal pace. Continued low feed prices might be a possibility.

What if you also tweaked that scenario by assuming a slight decrease in yield to, for example, 44 bushels per acre from the projected (at the time) 47 bushels per acres? Carryout would begin to disappear. Projected ending stocks of 460 million bushels could drop to approximately 210 million bushels. In this scenario, a price rally would be more likely.

Last, let’s factor in price value at the time. Simply put, it was quite possible that the soybean meal price of $280 per ton had nowhere to go but up. Using 2009 to 2015 as your benchmark price range, $280 was a good value. Back in 2009, an extraordinary year for commodity prices, the low price for soybean meal (using front-month contracts) was $258.50.

Using this combination of market fundamentals and historical analysis, begin creating a picture of future price potential (Table 1). This will help you see how certain decisions could play out, assuming the scenarios you envisioned were to unfold, and guide your strategy decisions.

Running the numbers for milk

At the time of this writing, the Class III milk price had just rallied more than $3 per hundredweight in only two weeks from the lows on some contracts. Prior to that, the price had been trending downward since June of 2015.

Massive cheese and butter inventories were behind the decline. The April Cold Storage report showed cheese inventories up 12 percent from April of 2015. That gain reflected an all-time record high. Butter inventories in April were up 28 percent from the same time last year.

Cow numbers continued to grow through 2016, adding to the prevailing belief that the milk price would remain depressed or decline further. Herd size wasn’t growing at a high rate; we added only 22,000 cows between January and April this year. Nonetheless, the numbers were increasing.

News was consistently bearish. Even the mainstream media was writing about the glut in cheese supply. It was a particularly good time to be asking “What if?” What if the price stopped declining – or turned around and rose to $15 per hundredweight or even $17 per hundredweight?

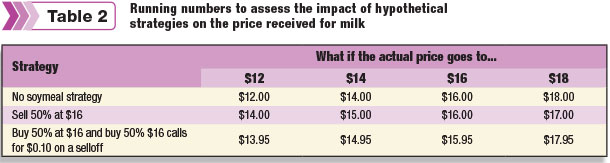

Let’s look back over recent history, when the milk price began trending lower, and consider hypothetical scenarios for selling milk (Table 2).

If you decided to take the market price month after month, you were ahead of the current market as long as prices continued down; you were behind if prices went up. Yet, being ahead of the current market price makes it easy for farmers to turn attention away from marketing and toward other aspects of running a dairy business.

Instead, try to always envision what could happen. Prepare for those possibilities within reasonable risk parameters.

To strengthen your long-term average price, make incremental sales. Decide at what point you will make those sales. Incremental decisions that gradually build your average price take the pressure off each individual decision.

When you build the best possible price for milk and feed individually, you also incrementally build the best possible margin for yourself.

What if the sell-off continued? There comes a time to consider the impact of purchasing inexpensive protection in the form of call options. The less likely we are to see a particular move in price, the more affordable it is to purchase protection against that move.

A big part of your job as a scenario planner is to always be asking yourself “what if” questions, with your mind open to the possibilities. Develop strategies for those questions and evaluate them by calculating their impact on your average price. To be successful, you must constantly chart your strategies, view their effects on price and make decisions about what you will do.

The ultimate scenario

One of the biggest constraints to doing a good job with marketing is time. Farmers don’t have enough of it. What if you found the time – or hired a trusted adviser? How might that influence your overall average prices for milk and feed?

As we have seen with both milk and feed prices, price changes can occur quickly. Despite whatever picture is being painted by market fundamentals, the actual market price can reflect the opposite. The seemingly impossible can happen. To manage your marketing well, you have to consider market possibilities and then prepare for them the best that you can. PD

-

Patrick Patton

- President

- Stewart-Peterson Inc.

- Email Patrick Patton