Today, many dairy operations find they need the flexibility of exchange-traded options, which allow you to not only protect attractive margins, but also capture future incremental improvements.

If you’ve avoided options due to their complexity or cost (or both), an understanding of delta can help you overcome these hurdles so you can gain the pricing flexibility you need.

Delta reflects protection

Put simply, delta is the sensitivity of an option’s value to a futures price change. If an option position is held until expiration, it either essentially becomes a futures contract or it expires worthless. But until then, option positions have value – expressed as a premium – that vary over time and in response to changes in the underlying commodity futures contract.

For each option position, or combination of option positions, we can measure the extent to which its value will change when the futures price of the underlying commodity changes. That is the position’s delta.

Just as the premium of an option is an objective reflection of its value, delta is an indicator of the amount of protection afforded by each option position. Together, premium and delta allow you to calibrate the precise cost/protection balance of an option position.

Calibrate your delta to match your needs

Delta is measured as a percentage from 0 to 100, and can be positive or negative, depending on the direction of the change in value. If a futures contract rises by $1, a call option on that contract with a delta of 25 percent would rise in value by about 25 cents, while a put option on that same futures contract with a delta of negative 50 percent would decrease in value by about 50 cents.

The higher the absolute delta, the stronger the hedge and the higher the degree of protection the position will provide to an adverse change in price.

For example, let’s say Class III milk futures are trading at $17 per hundredweight (cwt), and corn is at $4 per bushel. If you want to protect that milk price, and leave open the possibility of participating in further price gains, you could purchase a put option with a strike price of $17.

A put option gives you the right, but not the obligation, to sell milk at the strike price. Because the strike price of the put is the current market price, this option will have a delta of negative 50 percent.

If milk futures then rise to $19, or by $2, the value of your option might lose most, if not all, of its value, but you will be able to sell your milk on the cash market for $19. What happens if milk futures decline instead by the same $2? The value of your put option will rise by $1, and you have the right to sell milk at $17.

If the cost of that protection seems too high, you could consider adding a second piece to your hedging strategy. In addition to buying the put option (establishing a $17 price floor), you could sell a call option at a strike price of $19.

This position establishes an obligation to sell, but at a price that is above the current market. The combined position has a lower total cost since the premium you collected from selling the call would offset some of the cost of the put.

It also has a higher delta (closer to negative 75 percent) than the put option alone, and thus will provide more protection against declining milk prices. The trade-off, however, from that higher delta is less opportunity to participate in higher prices.

Manage both sides of the margin equation

A savvy dairy producer will manage margins by addressing not only milk revenues, but also feed costs. With feed prices hovering near historical lows, it might make sense to simply book feed ingredients in the cash market with a local supplier.

On the milk side, however, there’s more room for both gains and losses. Even if your current projected margin compares favorably with historical levels, you may want to preserve the opportunity to participate in higher milk prices if the market continues moving up. And it’s always a good idea to protect your operation against the risk of significant declines.

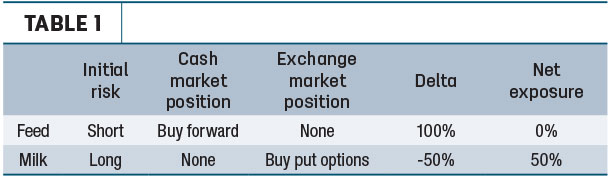

You can accomplish this dual goal by purchasing a put option against milk prices, as described previously. These milk and feed positions are illustrated in Table 1.

Since the strategies for feed and milk are different, they carry different net exposures and deltas. With feed ingredients priced in the cash market and no corresponding exchange positions, the delta (protection) of the feed position is effectively 100 percent and net exposure is 0 percent.

Since the strategies for feed and milk are different, they carry different net exposures and deltas. With feed ingredients priced in the cash market and no corresponding exchange positions, the delta (protection) of the feed position is effectively 100 percent and net exposure is 0 percent.

We know the delta on the milk position is neutral, with a delta of negative 50 percent and net exposure of 50 percent, providing a balance between protection against price declines and an equal opportunity to participate in gains.

This exposure is consistent with an expectation that milk prices may rise, as well as the operation’s relatively strong forward profit margins.

Protection in stronger margin environments

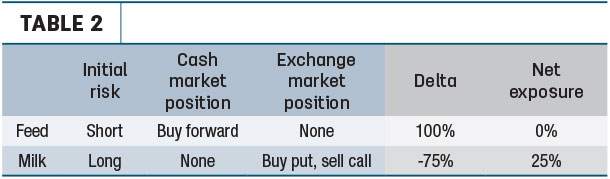

But we can also imagine a very different margin environment, where prices are relatively high and margins are very strong. For example, let’s say milk is trading at $19 per cwt and feed ingredients are already secured in the cash market.

In this case, you might have a more negative bias, expecting prices to decline over time. For that reason, it would make sense to have a stronger delta on the milk revenue side of the equation.

You could protect the historically attractive milk price by selling a futures contract. The delta on that position would be negative 100 percent. If, however, you still believe there is some opportunity for milk prices to rise and you would like to participate in further price increases, you may choose a strategy with a strong delta.

Let’s assume you buy a $19 put option and simultaneously sell a $21 call option. This strategy will likely have a delta of around negative 75 percent, meaning that you are protecting 75 percent of risk from lower prices while allowing for 25 percent opportunity to participate in higher prices. In this case, your overall hedge profile would look like Table 2.

These examples are simplified in that they show a static delta. In fact, both delta and premiums will fluctuate over time as the futures market changes. This is true for both a single-option position as well as a multi-option position. As prices change, margins will also vary.

These examples are simplified in that they show a static delta. In fact, both delta and premiums will fluctuate over time as the futures market changes. This is true for both a single-option position as well as a multi-option position. As prices change, margins will also vary.

You may find that over time, as prices and margins fluctuate, you wish to maintain a different degree of protection, and thus a different delta. That’s why you may wish to adjust a hedge position – and your delta – to maintain the cost/protection balance that’s right for your operation. ![]()

There is a risk of loss in futures trading. Past performance is not indicative of future results.

Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois. E-mail Chip Whalen or call (866) 299-9333.