USDA’s May World Ag Supply & Demand Estimates (WASDE) report raised 2016 U.S. milk production and marketing estimates, adding more pressure on prices. Conditions should improve in 2017.

Milk production was projected at 212.4 billion pounds for 2016, up about 600 million pounds from last month’s forecast. If realized, the 2016 total would be up about 1.8 percent from 2015. The cow inventory is expected to expand slightly, and growth in milk per cow during the first half of the year is forecast higher.

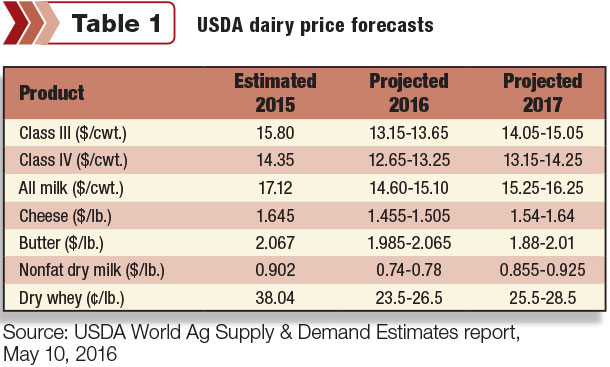

Cheese, butter and nonfat dry milk (NDM) prices are forecast lower due to weaker demand and larger supplies, but whey prices are raised. Both Class III and Class IV prices are reduced (Table 1). The all-milk price is forecast lower at $14.60 to $15.10 per hundredweight.

USDA also offered its first dairy estimates for 2017, projecting that near-steady cow numbers, improved forage availability and favorable feed costs will support increased milk production per cow. At 215.2 billion pounds, 2017 production would be up about 1.3 percent from 2016.

The higher 2017 milk production forecast is the result of a slower reduction in the cow inventory, combined with growth in milk output per cow.

With stronger domestic and export demand, the 2017 Class III price is forecast higher on stronger cheese and whey prices, and the Class IV price is forecast higher as a weaker butter price is more than offset by the higher NDM price. The 2017 all-milk price is forecast at $15.25 to $16.25 per hundredweight.

Beef outlook

Impacting cull cow prices, the WASDE 2016 beef production outlook was reduced, based primarily on lower carcass weights during the first half of the year. The fed cattle price forecast was lowered from last month, as prices have weakened and cattle supplies remain relatively large.

Looking ahead, 2017 beef production is forecast higher, as larger 2015 and 2016 calf crops are expected to support year-over-year increases in cattle placements in late 2016 and early 2017. Marketings of fed cattle are forecast higher during 2017, while carcass weights are expected to increase with good forage conditions and lower feed costs. As a result, fed cattle prices are projected lower.

Feed situation

All hay stored on U.S. farms was estimated at 25.1 million tons on May 1, 2016, up 3 percent from a year ago, according to USDA’s May 10 crop production report.

The Northern Plains, including Montana and North and South Dakota, showed the largest year-to-year declines in hay stocks. Major dairy states with smaller hay inventories included Indiana, Iowa, Ohio, Michigan, Missouri, New York and Utah.

Colorado, Oregon, Texas, Washington and Wisconsin entered the 2016 growing season with larger hay inventories compared to a year earlier.

A 5.6-million-acre increase in corn plantings will translate into more production and supplies, according to WASDE. U.S. corn production for 2016/17 is projected at 14.4 billion bushels, up 829 million from 2015/16 and 214 million higher than the previous record in 2014/15. The U.S. corn yield is projected at 168.0 bushels per acre, down 0.4 bushels from 2015/16. Corn supplies for 2016/17 are projected at a record 16.3 billion bushels, up 886 million from 2015/16.

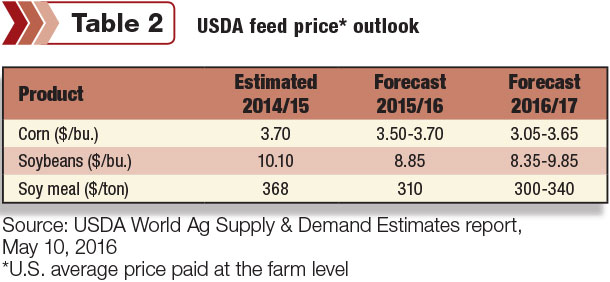

The 2015/16 season-average corn price received by producers was raised to $3.50 to $3.70 per bushel, with the first projection for the 2016/17 crop at $3.05-$3.65 per bushel (Table 2).

U.S. soybean production is projected at 3.80 million bushels, down 129 million from the 2015 crop on lower harvested area and trend yields. Supplies are projected at 4.230 million bushels, up 1.9 percent from 2015/16 with higher beginning stocks more than offsetting lower production. Domestic soybean meal disappearance is projected to increase with expected gains in U.S. meat production.

Soybean prices were projected at $8.85 per bushel in 2015/16 and in a range of $8.35 to $9.85 per bushel in 2016/17. Price ranges for soybean meal were projected at $310 per ton in 2015/16 and in a range of $300 to $340 per ton in 2016/17.

See the full World Ag Supply & Demand Estimates report. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke