Control what you can control. Think about all the risks you have on your dairy farm. There are a lot of them. Some are small and some are big. Some can be covered by insurance or risk management tools. Some are uninsurable.

Price risk is one of the areas where you have lots of choices to reduce risk. First, some of you have Dairy Margin Coverage (DMC) available to you. This is a good start. It is inexpensive and will cover up to 5 million pounds of annual milk production. Next, a more traditional approach would be to consider forward contracting or using Chicago Mercantile Exchange (CME) futures and options.

However, maybe the next step should be to consider Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy). Both of these USDA Risk Management Agency (RMA) backed insurance products are basically subsidized put options for your milk price. They do not guarantee milk production, and they do not cover your cows in case of death.

The beauty of Dairy-RP and LGM-Dairy coverage is you can cover a portion of your milk each time you purchase. You can average out your coverage. It is like building a portfolio of coverage over time. Both products will average coverage levels up or down depending on what the market is doing. They will not control basis risk related to producer price differentials (PPDs) but will provide minimum price coverage based on CME milk futures prices. Watch out for one rule: You can’t use Dairy-RP and LGM-Dairy in the same quarter.

Do they work? Yes. DMC payments have been coming your way. Also, over the past month, Dairy-RP and LGM-Dairy indemnity checks have been sent out.

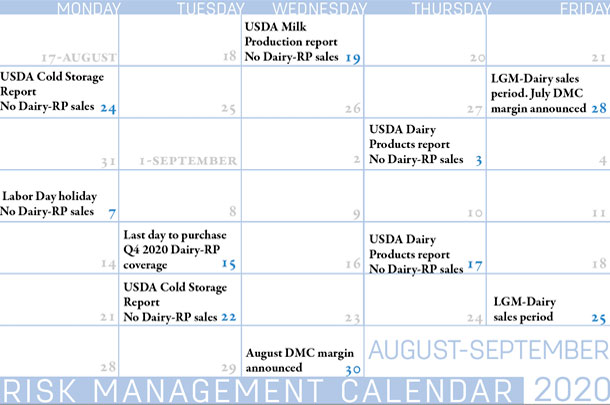

Here’s a short refresher on your two choices for coverage, along with the calendar of critical dates through the end of September:

Click here or on the calendar above to see it at full size in a new window.

Dairy-RP

Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. The next available quarter is the fourth quarter (October, November and December) of 2020. The last day to purchase coverage for that quarter is Sept. 15, 2020. Currently, coverage is available for the last quarter of 2020 and all four quarters of 2021. Dairy-RP is available every day except holidays and USDA report days that could impact markets (see calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

In July, the RMA made improvements to Dairy-RP policies, increasing the declared protein and butterfat ranges and making Grade B milk insurable. Class IV milk components are now available. Visit with your agent about this new addition to the Dairy-RP possibilities.

LGM-Dairy

The next scheduled sales period for LGM-Dairy is Friday, Aug. 28. Coverage is available for up to 10 months, so you will be able to buy coverage for October 2020 through July 2021. You need to select coverage in two-month increments to get the premium subsidy. LGM-Dairy covers milk prices (from falling) and also includes coverage for feed prices rising. LGM-Dairy is not only a milk price put option, but a call option on the price of corn and soybean meal. We are anticipating additional changes to LGM-Dairy in the near future. ![]()

Dairy-RP and LGM-Dairy coverage is available through a licensed and trained crop insurance agent. Ron Mortensen with Dairy Gross Margin LLC provides monthly updates on Dairy-RP and LGM-Dairy coverage for the readers of Progressive Dairy.

-

Ron Mortensen

- Co-Owner

- Dairy Gross Margin LLC