Here’s a summary of the numbers from the U.S. Dairy Export Council (USDEC):

- Volume basis: U.S. suppliers shipped 170,731 tons of milk powders, cheese, whey products, lactose and butterfat in September, up 2% from last year. Exports of NDM/SMP hit a 16-month high, aided by a surge in shipments to Mexico and Southeast Asia. With European Union intervention stocks mostly moved through the global supply chain, buyers increasingly turned to the U.S. for powder.

Cheese exports at 27,433 tons were up 12% from a year earlier, even though U.S. benchmark prices were well above world indicators. Gains were led by sales to Mexico, the United Arab Emirates (UAE) and South Korea.

In contrast, total whey exports were down 11% from last year, as sales to China were depressed due to retaliatory tariffs and African swine fever’s impact on the need for hog feed supplementation. Lactose exports were down 7% and the lowest in seven months.

-

Value basis: The value of all dairy product exports was $508.8 million, up 17% from a year earlier and the highest total since May 2019.

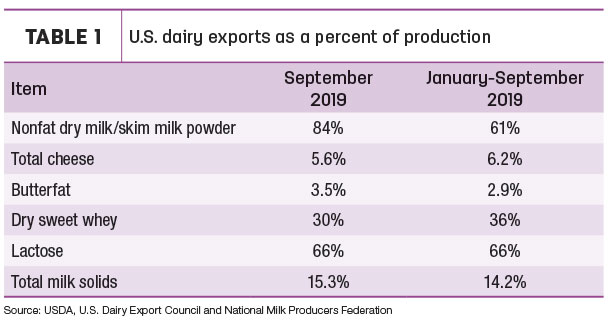

- Total milk solids basis: U.S. exports were equivalent to 15.3% of U.S. milk solids production in September (Table 1). Exports accounted for 14.2% of production in the first nine months of the year.

September yields small ag trade surplus

Overall, U.S. ag trade turned in a small surplus in September: Exports were valued at $10.3 billion, while ag imports were estimated at $10.1 billion, resulting in a $220 million trade surplus.

With September’s total, fiscal year 2019 (Oct. 1, 2018 – Sept. 30, 2019) ag trade surplus was about $4.6 billion. Exports totaled $135.6 billion; imports were valued at $130.9 billion.

Dairy heifer exports: Surge coming in fourth quarter

Looking at other export categories followed by Progressive Dairy, it was another slow month for exports of U.S. dairy replacement heifers, although prospects for the final quarter are brightening substantially.

September sales fell to 920 head. Of that total, shipments to Mexico and Canada were almost evenly split at 440 and 439 head, respectively. Another 41 heifers moved to Colombia.

Year-to-date dairy heifer exports stand at 9,950 head, the smallest nine-month number since 2016 and the second smallest total for that period since 2009.

September dairy heifer exports were valued at about $1.4 million, raising the year-to-date total to about $16.4 million, also the lowest nine-month total since 2016.

The U.S. should see a jump in dairy heifer exports when the USDA releases October and November totals in early December, according to Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri. His company shipped 1,745 head of Holstein heifers to Pakistan, departing Oct. 22 and set to arrive Nov. 19.

Two shipments (from separate companies) totaling more than 4,000 head were set to depart for Egypt in October and November, and Clayton’s company has a shipment of 3,000 head moving to Egypt in early December.

The end of the year is traditionally a time when dairy cattle exports rebound, and that’s being aided by an increasing global demand for animal protein, said Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia.

“The future of exporting dairy and beef heifers looks better compared to the beginning of the year due to the renewed interest in consuming more milk products in emerging markets [China, Russia, Pakistan, central Asian countries and Vietnam] and the desire to eat more animal protein from large ruminants,” he said.

However, despite reports that Russia is importing large numbers of dairy cattle to improve its dairy self-sufficiency, the U.S. isn’t benefiting from that opportunity. That’s because Russia requires a four-generation-deep pedigree on imported cattle. Quassdorff said U.S. cattle exporters are working with U.S. breed associations to overcome that obstacle.

“As an industry, we are pushing for the adoption and acceptance of genomic testing in those countries that offer [buyer] subsidies on purebred cattle with papers,” he said. “So far, countries like Russia and Commonwealth of Independent States [CIS, part of the former Soviet Union] are not changing their regulations. The U.S. breed association should enter in negotiations with those emerging markets to persuade them to accept and adopt the entire Registered Holstein Ancestry percentage system so a majority of U.S. Holstein heifer population may qualify for exports and subsidies at the importing country.”

Due to the distance to foreign markets, transportation costs from the U.S. are higher than European and Australian supplier, making U.S. dairy heifers more expensive. On the other hand, the U.S. has plenty of dairy and beef heifers to supply those emerging markets year-round, Quassdorff said.

China pushes alfalfa exports up

September alfalfa hay exports surged to 245,147 metric tons (MT), the highest monthly volume since June 2017. September’s total pushed the 2019 year-to-date total to just under 2 million MT, ahead of last year’s sales pace.

Based on USDA records, sales to China at 97,371 MT were also the highest since June 2017. Purchases by the UAE were the highest since April, and sales to South Korea were the highest of the year. That offset slight declines in sales to Saudi Arabia and Japan.

Meanwhile, exports of other hay slipped to 111,151 MT, the second-lowest monthly total for the year, even though September shipments to Japan, South Korea and the UAE were up from August. Year-to-date exports of other hay nudged above 1 million MT, also ahead of last year’s pace.

Just returning from a trip to South Korea and Japan, Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington, said U.S. hay export companies have been busy seeking sales. There are two areas of focus for exporters.

The first concern is whether there is enough volume of exportable new-crop alfalfa to supply customers. In China, a rollback in tariffs to 7% on U.S. alfalfa has increased demand for all grades, bringing brokers and direct-buying companies back in the market, and it may be difficult to fill all requests, Mastin said.

Although supplies of rained-on and feeder hay are more plentiful, 2019 weather conditions hampered harvest of high-quality hay. In addition to export demand and tightening alfalfa supplies, early snowfall in the U.S. at the end of September has increased domestic demand from buyers concerned about how cold and long the winter will be.

The second area of focus for exporters is carryover and large new-crop supplies of lower-quality timothy. Most foreign customers are asking for higher-quality timothy at the same price or less than last year. Suppliers are reducing prices of the lower-quality timothy in an attempt to move it.

For more on hay exports and market conditions, check out Progressive Forage’s Forage Market Insights update. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke