The new Dairy Revenue Protection (Dairy-RP) program was designed to provide simpler, more comprehensive risk management opportunities for dairies of any size. This new revenue-based insurance program offers several choices that allow farmers to create a more predictable and sustainable revenue stream.

What is the right approach and/or strategy for each dairy? That will depend on any number of factors, and the right answer to that question will evolve as the program gets a few quarters of operation under its belt.

We discussed the basics of the program and some initial steps and/or strategies with one of the architects of Dairy-RP, Marin Bozic, dairy economist at the University of Minnesota. He drives home the simplicity of the program, its ability to be scaled by farm size, and the flexibility dairy farmers have in leveraging it with other and/or existing programs.

The setup

The program was designed to be simple – but there are still some variables to consider:

1. For each quarter, decide whether to protect the value of Class III and Class IV milk or components (fat and protein). Those decisions are based on the location and production of individual farms and will be described in more detail later.

2. Decide on how much production you want to cover for each quarter. There is no upper limit.

3. The level of coverage ranges from 70 to 95 percent of the revenue guarantee. The greater the protection the higher the premium, as well as the likelihood of receiving an indemnity.

4. Finally, select which quarters to cover, from a single quarter up to a total of five quarters. Since each quarter is a separate contract, each can be customized to meet your specific expectations.

At the end of each quarter, the actual revenue is compared to the guarantee. If that revenue is below the guarantee, you receive an indemnity for the difference, minimizing the loss. If the actual revenue exceeds the guarantee, you benefit from the higher price and you only pay the policy premium.

Class or components?

The choice of protecting the price of milk by class or by components depends on your location, how your milk is sold and the component values of your milk. Milk prices for the quarter are based on a combination of Chicago Mercantile Exchange (CME) futures for Class III and IV milk. Component-based plans are based on the amount of milkfat and protein you want to cover during the quarter.

The American Farm Bureau Federation gives this example: “Consider that during 2016, average mailbox milk prices ranged from $14.31 per hundredweight (cwt) in Michigan to $17.27 per cwt in New England and averaged $15.95 per cwt in all reported areas. There is not a USDA-sponsored risk management tool that can capture this variability in milk prices. However, because Dairy-RP would allow a farmer to value milk based on the milk components or a mix of Class III and IV milk prices, much of the farm-level basis risk can be addressed.”

You could choose the class price option if your herd does not have high solids, and you want to design your price to reflect what is being produced in your part of the country. For example, if a substantial percentage of milk production is going to cheese and dry whey, such as in Wisconsin, you may choose the Class III option. In Florida or the Northeast, most of your milk is bottled or is going for nonfat dry milk powder, so you may take the weighted average of Class III and Class IV.

The component price option may be the best choice for herds producing milk with high solids. Dairy producers can declare the expected butterfat and protein components to come up with a price that reflects what you expect to be paid by the processor.

You also have to decide how many pounds of milk you want to insure per quarter and how much insurance premiums will cost. For example, a Dairy-RP policy covering 90 percent of the milk revenue could cost about 5 to 40 cents per cwt, depending on the quarter and other factors. Unlike the Margin Protection Program for Dairy (MPP-Dairy), there is no tiered premium discounts or surcharges. You might choose to insure 1 million pounds of milk in a quarter with an expected state milk yield of 5,000 pounds per cow for that quarter. If the USDA National Ag Statistics Service (NASS) publishes the milk yield that is lower than 5,000 pounds per cow, the program assumes your production, as well as your revenue, has been reduced by the same percentage. This may increase the payments you receive under Dairy-RP.

Besides the volume of milk covered, you also need to decide how much protection you want (70 to 95 percent). The product of the expected revenue and the coverage level is the Dairy-RP revenue guarantee. With a 90 percent coverage level, you are choosing a 10 percent policy deductible.

Once you know how much of your production you want to insure, you must determine the length of the policy. You can choose to protect only one quarter or up to five quarters in a row. The key is not how long your policy should be, but what quarter you want to protect.

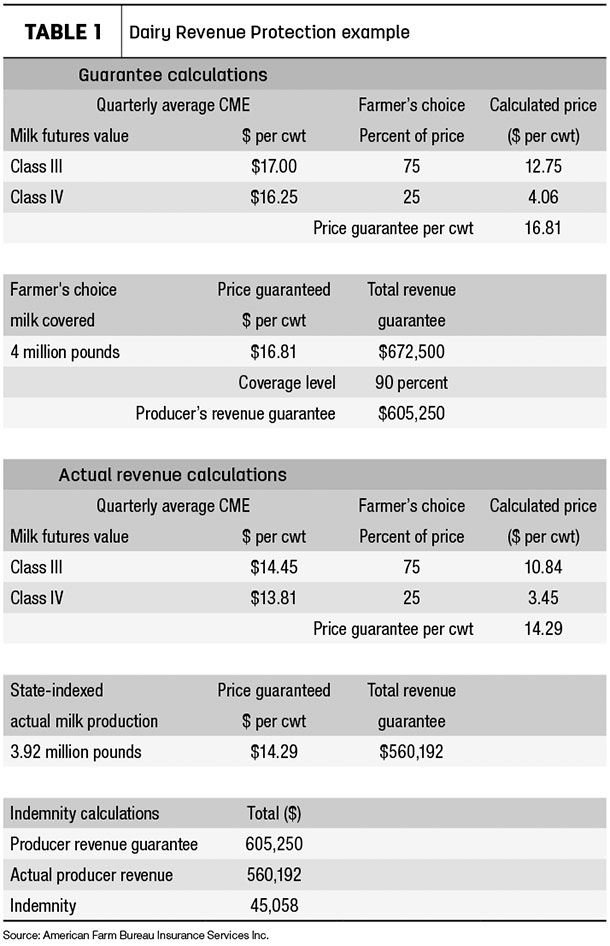

Table 1 provides an example of a dairy operation covering 4 million pounds of milk using the class option (75 percent Class III and 25 percent Class IV) and selecting the 90 percent revenue coverage level.

Financial advantages and flexibility – now and in the future

Dairy-RP premiums for a given quarter are due at the end of that quarter. “The first premium comes after the first quarter is up,” Bozic says. “You still don't have to pay the other four quarters at that time. So it's very friendly to the cash flow.”

You may want to add to Dairy-RP in increments. For example, when a quarter first becomes available, you may buy coverage for 25 percent of production in that quarter, then keep adding 25 percent every 30 days until 100 percent is reached. Producers have different risk management styles and preferences, and you should design a program that works best for your risk tolerance.

The new program also allows dairy farmers to stretch their horizon. Bozic cites his research published in the Journal of Dairy Science showing that markets usually bounce back within 12 months from even the deepest price drops, such as what happened in 2009.

“So we designed this program to go out 15 months, five quarters,” he says. “Even if we have a crisis, those distant prices will hopefully be good enough so that people can cover risk at that horizon. It follows that if a person will do that regularly, if they would always be using the Dairy-RP, the crisis would come and go before they ever find themselves without protection.”

It is also important to note that Dairy-RP premiums can be lower with shorter-term approaches. USDA Risk Management Agency subsidies make them even more attractive.

“Over the long run, over many years and many Dairy-RP contracts – when you sum up all your premiums that you paid and when you sum up all the payments that you would've received, payments should be about twice the premiums paid,” Bozic says. “That is due to the subsidy. Even for the highest coverage level, producers never pay more than 60 percent of the actuarially fair premium. The subsidy per quarter will also vary. For example, you could be looking at 7 cents for the nearest quarter and up to 20 cents for the most distant quarter. That will help in long-term planning because the producer will have a better idea of return on investment for up to 15 months. That makes it beneficial for the farmers because not only will they remove the valleys, but they may overall lift their revenue over the long term by the amount of the subsidy.”

Dairy-RP also allows expansion-minded producers to lock in anticipated revenue before they increase their herd. With Dairy-RP, you can start hedging the milk you’re not making today, but that you know you will be making tomorrow. That's an advantage of going 15 months out, because you can lock in your revenue for the period you would be most fragile. Presumably, you will be at the highest level of debt just as those cows come into the barn, and you start shipping milk.

How to make Dairy-RP work for you

Dairy-RP is designed to work in tandem with other risk management programs, not just as a replacement, Bozic says.

“The farm bill [MPP] designers wanted to have a program that favors smaller family farms,” he says. “They designed the premium so that the first 5 million pounds is really cheap. Nobody can beat it considering the newly proposed $9 margin level of protection through MPP-Dairy. I would not feel comfortable telling producers [to] ditch [MPP-Dairy]. [For the] first 5 million pounds, most likely, the [MPP-Dairy] is going to be a preferred option to anything else.”

Bozic suggests that producers with high purchased-feed costs may want to contemplate protecting the first 5 million pounds with both programs.

“Those are two different sources of risk that we are protecting,” Bozic says. MPP-Dairy is protecting margin risk; Dairy-RP is protecting price risk. “MPP-Dairy is going to be with us, and it's going to be certainly part of the tool box for many producers.”

Livestock Gross Margin for Dairy (LGM-Dairy) is a conventional insurance product that works much like MPP-Dairy, since it factors income over feed cost. The best advice is to consult with an experienced dairy risk management expert to determine the best strategy for using Dairy-RP in place of, or in conjunction with, other risk management practices and/or activities.

“What matters is finding a consistent hedging program that covers your basis; that takes into account your financial situation – your balance sheet position, your equity position – so that you don't carry more risk than you can take care of through the depletion of equity,” Bozic says. “Dairy-RP puts you in charge.” ![]()

Ryan Yonkman is with Rice Dairy LLC and is a licensed insurance agent with Rice Dairy Risk Services LLC, offering Dairy-RP policies in 20 states.

-

Ryan Yonkman

- Vice President

- Rice Dairy Risk Services