December margin: $8.78 per cwt

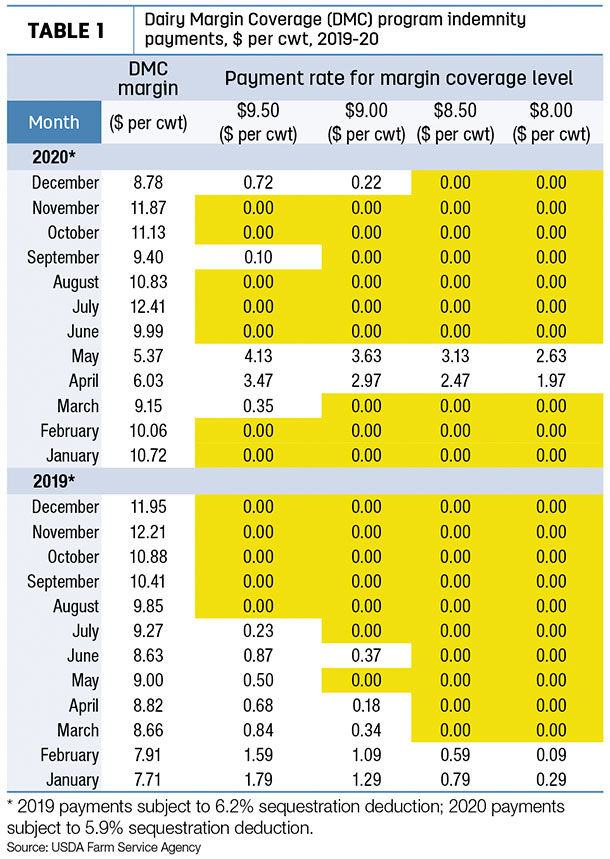

The USDA released its latest Ag Prices report on Jan. 29, including factors used to calculate monthly DMC margins and payments. The December DMC milk income over feed cost margin is $8.78 per hundredweight (cwt), the slimmest margin since May 2020 and triggering a 72-cent indemnity payment on Tier I milk insured at the $9.50 per cwt level. Milk insured at the $9 per cwt level will receive a 22-cent indemnity payment (Table 1). DMC payments are subject to a 5.9% sequestration deduction.

Milk price slumps

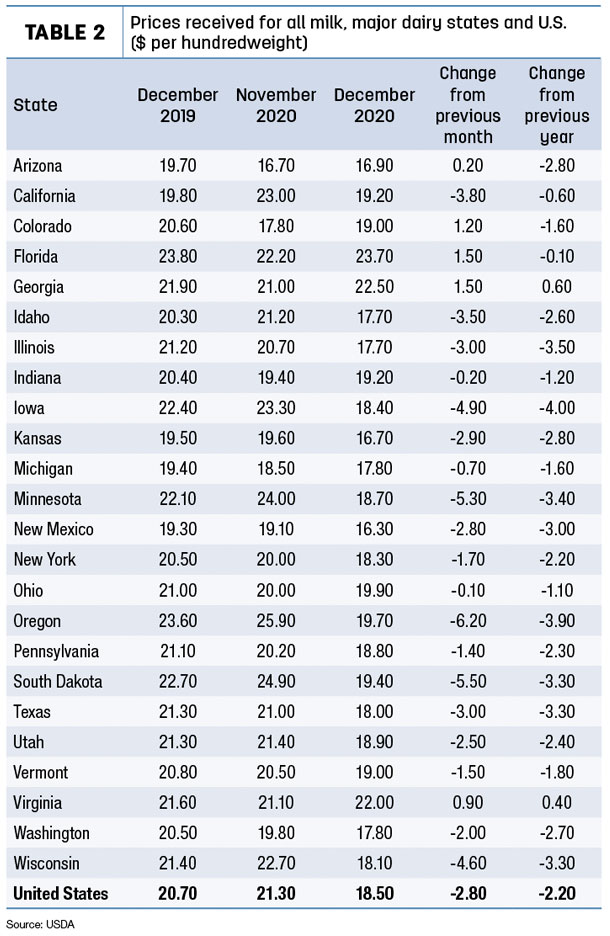

The December 2020 announced U.S. average milk price fell $2.80 from November to $18.50 per cwt, a three-month low. It was $2.20 less than December 2019.

With December’s milk price, the 2020 U.S. average milk price is $18.32 per cwt, down 31 cents from in 2019 but still the second-highest average since 2014.

Among major dairy states, December milk prices were substantially lower than November in a number of states, led by a decline of $6.20 in Oregon (Table 2). Month-to-month prices were also down $4.60-$5.50 in Iowa, Minnesota, South Dakota and Wisconsin. Compared with November, December prices were up $1.20-$1.50 in Colorado, Florida and Georgia.

The lowest announced price in December 2020 was in New Mexico ($16.30 per cwt); the high was in Florida ($23.70 per cwt).

Feed prices higher

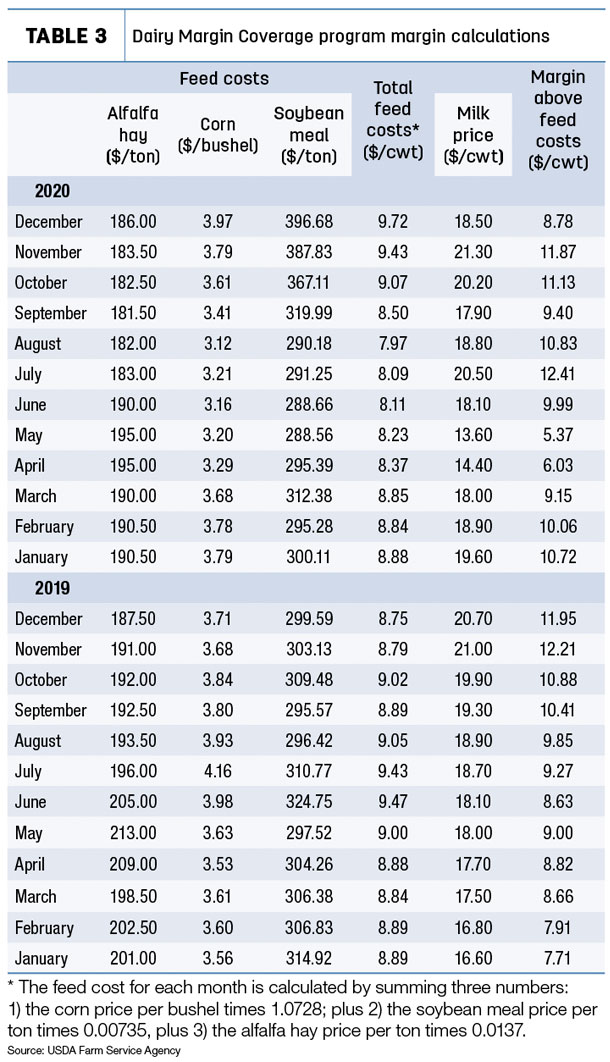

U.S. average feed costs continued their ascent in December. The average price for a blend of Premium and all alfalfa hay used in DMC calculations was $186 per ton, up $2.50 per ton from November and the highest since June. Compared to a month earlier, prices were also higher for corn ($3.97 per bushel, up 18 cents) and soybean meal ($96.68 per ton, up nearly $10). The corn price was the highest since July 2019; the soybean meal price was up more than $106 per ton since August and the highest since June 2016.

That yielded an average DMC total feed cost of $9.72 per cwt of milk sold (Table 3), up 29 cents from November and the highest since December 2014, calculated under the old Margin Protection Program for Dairy (MPP-Dairy).

Indemnity payments expected in 2021

Based on current market conditions, DMC could pay monthly indemnity payments well into 2021. The January 2021 margin and any indemnity payments will be announced Feb. 26.

Factoring into milk income, the Federal Milk Marketing Order (FMMO) January Class I base price was previously announced at $15.14 per cwt, down $4.73 from December. January 2021 Class III and Class IV milk prices will be announced Feb. 3, but based on Chicago Mercantile Exchange (CME) milk futures prices as of Jan. 29, are up only slightly from December averages.

At the same time, average feed costs are expected to move well above $10 per cwt of milk sold in 2021, with corn and soybeans prices pushed higher due to lower ending stocks and substantial export market activity by China.

Production history adjustments still pending

Also factoring into 2021 payments is a provision approved in the recent COVID-19 relief bill that allows smaller dairy producers to update their milk production history baselines and receive a supplemental DMC payment on a portion of any increased milk production.

While the original DMC program established an eligible baseline on milk production in years 2011, 2012 and 2013, adjustment provision allows producers to use actual milk production in 2019. The adjusted milk production baseline is effective January 2021 through the life of the current farm bill and DMC program, ending in 2023.

With DMC Tier I production limits remaining at 5 million pounds of milk or less annually, the adjustment primarily benefits smaller operations by allowing them to increase annual milk production eligible for DMC coverage and indemnity payments up to that cap. No supplemental payments are permitted on milk production above 5 million pounds per year.

Not all of the increase in the production history will be eligible for a supplemental payment. The bill limits that payment to cover 75% of the difference between an eligible dairy operation’s actual 2019 milk production and its previous DMC milk production history.

The USDA has not yet established a sign-up period for producers eligible to make production history adjustments. Once the USDA Farm Service Agency (FSA) determines a sign-up period, eligible producers must contact their FSA office with 2019 actual milk production records if they wish to adjust production history on an existing operation.

Those eligible to cover additional milk under the DMC production history adjustment must already be enrolled in DMC for 2021. Coverage levels (percentage of milk production covered and margin covered) on the additional milk must be equal to the coverage selected previously for 2021 (and beyond) on the original production history.

Any increase in milk production history covered under DMC also means the producer will have to pay the additional margin insurance premiums on that milk. All 2021 DMC indemnity payments are subject to a 5.7% sequestration deduction, down from 5.9% in 2020 and 6.2% in 2019. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke