The current world population is 7.4 billion people, and it is estimated we will reach the 8-billion-person mark sometime in 2024. By 2040, we should reach 9 billion people on the planet. Demands for food, and high-quality proteins in particular, will increase dramatically over the next 10 to 25 years due to a number of factors:

- With increasing population, there are more people to feed.

- As income levels rise in low- to medium-income countries, consumers will purchase more food and a wider variety of foods that includes higher-quality proteins.

- The world population continues to age, which increases the need for high-quality proteins.

High-quality milk protein can be a key ingredient to step forward and fill the need.

One example of the aging world population can be found in Japan. According to Kristi Saitama of the U.S. Dairy Export Council (USDEC), more than a quarter of Japan’s population is 65 or older.

That percentage has been rising 1 percent every few years and, by all accounts, will keep rising through 2060, when more than 40 percent of the country’s population will be 65 or older. The reason: a low birth rate coupled with rising life expectancy.

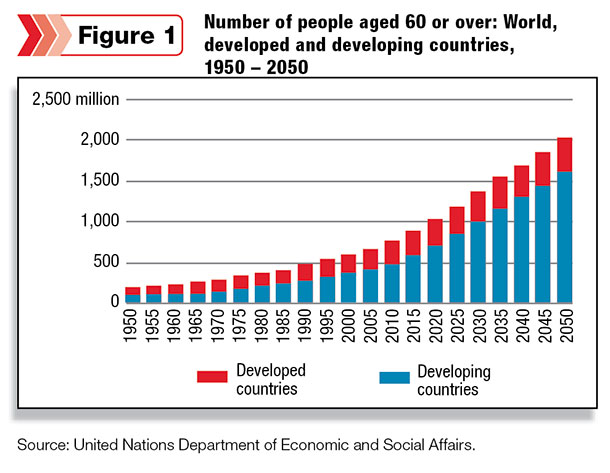

Saitama also states that this phenomenon is not isolated to Japan, as illustrated in Figure 1.

According to the United Nations’ projections, the number of people older than 65 worldwide will triple from 530 million in 2010 to more than 1.5 billion in 2050.

Already, the number of Chinese 65 years old or more is equal to the total population of Japan. By 2050, China will have 330 million people age 65 and older (more than the entire current U.S. population); the U.S. will have more than 85 million.

This aging population is seeking ways to optimize health and quality of life for the later years of life, which presents a huge opportunity to the dairy industry.

Sarcopenia is the age-related loss of muscle mass and strength, as we lose 0.5 to 1 percent of muscle mass annually starting as early as 40 years old, according to Saitama. Whey protein and its high-quality amino acid profile can be a critical protein source for slowing sarcopenia in aging adults.

According to Tom Suber, president of USDEC, the four main drivers of dairy ingredient demand are: nutrition, nutrition, nutrition … in a functional format.

Dairy proteins can improve muscle tone, prevent stunting, slow sarcopenia, stimulate muscle synthesis and growth, change body composition and reduce incidence of low birthweight. In short, the nutrition provided by dairy proteins can improve quality of life from cradle to grave.

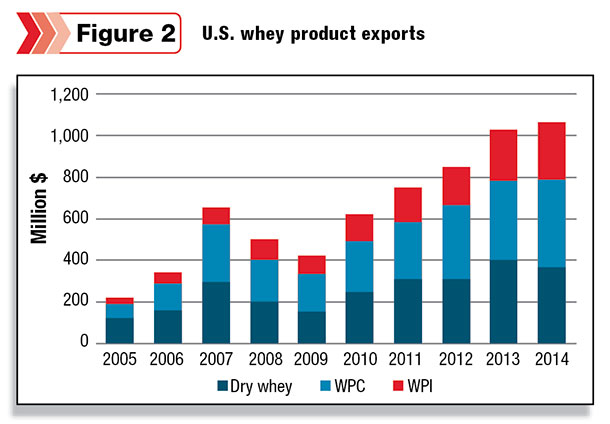

Suber also states that the strength of the U.S. dairy industry is producing high-quality, versatile and nutritious protein. In recent years, U.S. dairy suppliers have channeled more of the whey stream up the ladder toward higher-protein, higher-value products such as concentrates and isolates of whey and milk with more than 80 percent protein (Figure 2).

Close to 60 percent of the whey stream now goes into high-protein ingredients, up from about 30 percent a decade ago. Production of whey protein isolate has doubled since 2008. Production of milk protein concentrate and isolate is up 70 percent in just the last four years.

Despite the current downturn in global dairy markets, a new U.S. Dairy Export Council report says the fundamentals driving long-range global dairy trade demand should remain positive through 2020.

The report, “2020 Global Demand Forecast for U.S. Dairy Exports,” is part of USDEC’s ongoing strategic planning it conducts with Dairy Management Inc., the industry’s dairy checkoff program.

The new report says the U.S. dairy industry appears poised to capitalize on opportunities and identifies these five multi-year market trends, among others, for the U.S. dairy industry:

- Despite the currently tough market, prospects are positive for global growth.

- Growth will be driven by economic and population dynamics in developing countries.

- The U.S. dairy industry is positioned to build share in global dairy markets.

- The U.S. dairy industry will be particularly well positioned to capture growth in cheese, skim milk powder and whey, with EU suppliers providing the toughest competition.

- Cheese presents the most significant growth opportunity for the U.S. dairy industry.

“There will be growth,” said Ross Christieson, senior vice president of market research and analysis, who oversaw the report. “The U.S. is still well positioned to take advantage of this growth, but our competitors are also well positioned.

We need to continue to improve what we do with product, customer service, marketing and supply chain efficiencies.”

Analyzing data and forecasts from previous years while projecting to 2020, the report notes:

- On a liquid milk equivalent basis, total global dairy trade grew 5.4 percent annually from 2007-2014.

- From 2014-2020, total global dairy trade is forecast to grow 3.7 percent annually.

- From 2007-2014, global cheese exports grew 6.2 percent annually.

- From 2014-2020, global cheese exports are forecast to grow 3.2 percent annually.

- Developing countries imported more cheese than developed countries in 2014, a trend likely to continue.

“We are encouraged to see that, despite the recent prolonged soft export market, long-term global dairy demand fundamentals are still in place that will again pressure available milk supplies,” said USDEC President Tom Suber. “This should bring both higher prices and a resumed export upside for U.S. suppliers. Yet with a resurgent EU industry, U.S. exporters will need to up their game.”

Dairy production in the U.S. remains strong with continued improvement in production per cow due to factors such as management improvements, nutritional advancements and genetic progress to improve the efficiency, health and production capabilities of the cow.

It is projected that annual milk production per cow will hit 25,000 pounds in 2020.

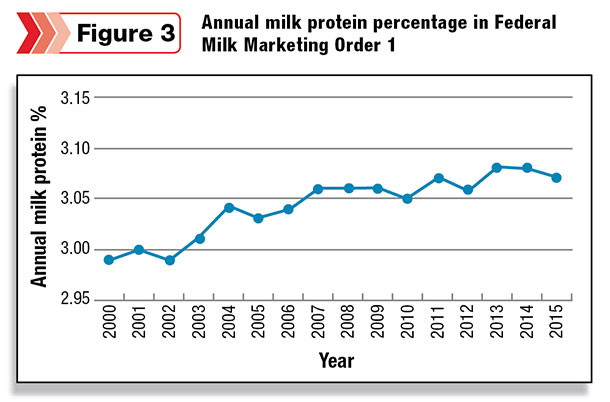

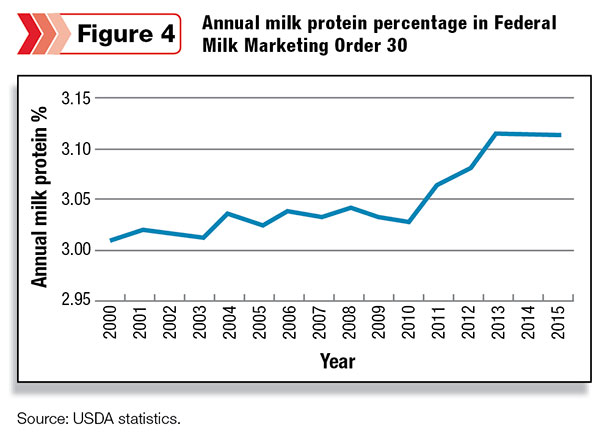

There has also been a strong trend for increased milk protein percentage over the last 15 years in the U.S. milk supply as illustrated in Figures 3 and 4.

As a result of the continued increase in milk per cow and milk protein percentage, there has been a dramatic increase in milk protein production in the U.S. The U.S. dairy industry should be well positioned to supply the growing global demand for milk proteins. PD

-

Clay Zimmerman

- Protein Platform Specialist

- Balchem Corporation

- Email Clay Zimmerman