A cold front hangs over the country both in terms of temperatures and the near-term outlook for dairy markets. Meanwhile, the USDA updated milk prices, feed costs and income margins from November.

November milk prices steady

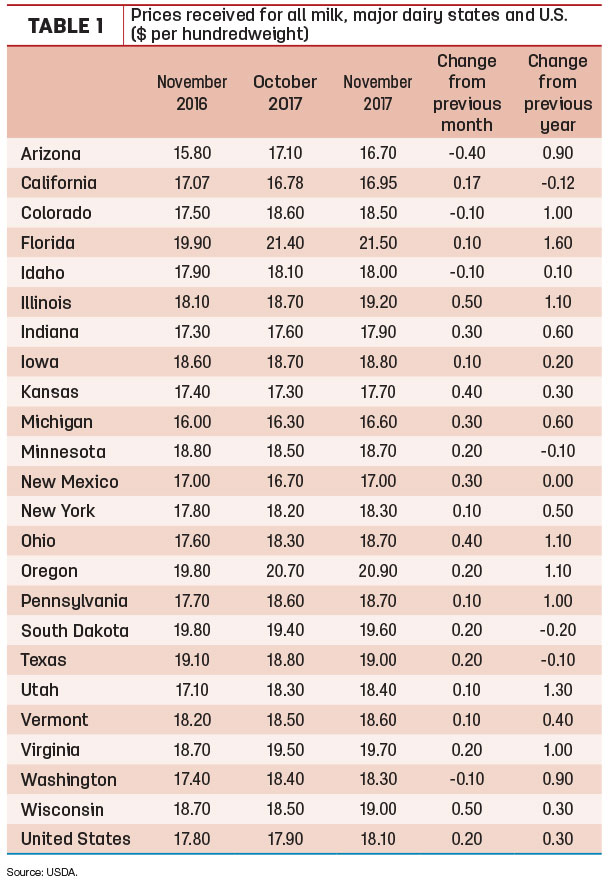

November 2017’s U.S. average milk price of $18.10 per hundredweight (cwt) was up 20 cents from October and up 30 cents compared to November 2016, according to the USDA’s monthly Ag Prices report. The January-November 2017 average of $17.66 per cwt is $1.61 more than the same period a year earlier.

With small changes in the national average milk price, the same was true in individual major states (Table 1). Illinois, Kansas and Ohio dairy farmers saw prices rise 40-50 cents per cwt compared to a month earlier, while prices were down in only four states, led by Arizona (down 40 cents per cwt).

Compared to a year earlier, November 2017 milk prices were up $1 or more per cwt in Colorado, Florida, Illinois, Ohio, Oregon, Pennsylvania, Utah and Virginia. Prices were lower in California, Minnesota, South Dakota and Texas.

MPP-Dairy margin improves

The slight improvement in milk prices combined with lower feed prices to push the November income over feed cost margin to its highest level since February, according to the USDA Farm Service Agency’s (FSA) MPP-Dairy calculations (Table 2).

November national average prices were lower for all feedstuffs included in the MPP-Dairy calculations: corn ($3.15 per bushel) was down 11 cents from October; hay ($148 per ton) was down $4; and soybean meal ($313.52 per ton), was down $1.71. Those prices resulted in total feed costs of $7.71 per cwt of milk sold, down 19 cents from October and the lowest average since December 2016.

Subtracted from the average milk price, the November MPP-Dairy income margin was $10.39 per cwt, up 39 cents from October and the largest margin since February.

The November calculations are the first half of two-month factors used to determine potential indemnity payments under MPP-Dairy. The December margin average will be announced Jan. 30.

Based on milk and feed futures prices as of Dec. 28, the Program on Dairy Markets and Policy projected monthly MPP-Dairy margins to decline sharply through May 2018, falling under $7.50 per cwt from February through May. Those margins would trigger MPP-Dairy indemnity payments for those insured at the top level.

Basse: Supply will drive outlook

There’s potential bullishness for dairy markets in the second half of 2018, according to Dan Basse, president of AgResource Company, an agricultural advisory and research firm.

Sharing economic and market insights during a Professional Dairy Producers of Wisconsin (PDPW) “World Class Webinar,” Basse said market trends are starting to go sideways, the first step toward improvement. However, without new demand drivers, any upturn in the dairy market will require a big upturn in exports, or a sizeable decline in cow numbers. Pressure on profitability will persist, with some green sprouting in the latter half of the year. Among other hightlights, Basse said:

• Global dairy product stocks are flattening out the “seasonality” of milk markets, creating less pricing opportunities for those using the futures market. China will provide some support for milk powder markets during the first quarter of 2018. European cow will grow sideways, with stronger output per cow leading to a 1.5 to 2 percent increase in milk production in 2018. Growth in milk per cow will boost New Zealand production by 1.5 percent.

• Cull dairy cows in the first quarter of 2018 when beef prices will be the highest. Look for record-high meat production in 2018, a negative for beef prices. USDA has recalibrated cameras used to grade beef quality.

• The U.S. is the currently the high-cost producer for corn, wheat and soybeans, as well as dairy.

• The big surprise from the 2017 crop year was test weights (higher corn ear and soybean pod weights). If higher plant populations and ear weights are maintained in 2018 crop year, an abundance of acreage means there won’t be any worries for a runaway to the upside on feed prices unless there’s a dramatic weather problem.

• Hay prices are relatively cheap, but prices will trend upward if dry conditions in the West persist. Hay stocks are down in Oregon, Idaho and New Mexico, and there will be a pull on hay supplies from the eastern part of the country in the new year. Hay/forage prices are a greater concern than grains.

Class I base starts year lower

The January 2018 Federal Milk Marketing Order (FMMO) Class I base price declined $1.44 from December 2017, to $15.44 per hundredweight (cwt). It’s down $2.01 from January 2017, and the lowest since June 2017.

November cull cow prices fall

U.S. average cull cow prices declined again, falling to the lowest average price since December 2016. November 2017 cull cow prices (beef and dairy combined) averaged $63.40 per cwt, down $2 from October, but up $1.50 from November 2016. Year-to-date, the cull cow price average is $70.25 per cwt, down $5.90 from January-November 2016.

Dairy cow slaughter

With a larger dairy herd, the pace of 2017 dairy cow culling remained ahead of a year earlier, according to monthly USDA data. For November 2017, federally inspected milk cow slaughter was estimated at 243,700 head; 17,300 less than October 2017 but 500 more than November 2016.

Through the first 11 months of 2017, dairy cows slaughtered under federal inspection were estimated at 2.741 million head, about 108,400 more than January-November 2016.

USDA’s latest milk production report indicated the November 2017 U.S. dairy herd was about 53,000 head larger than last year.

Global Dairy Trade index improves

The first Global Dairy Trade (GDT) auction of 2018 provided some good news on dairy product prices. The price index for the Jan. 2 auction was up 2.2 percent, with most of the increase seen in milk powders.

Among major products, auction prices were higher for butter [up 0.6 percent, to $4,501 per metric ton (MT)], skim milk powder [up 1.6 percent, to $1,699 per MT] and whole milk powder [up 4.2 percent, to $2,886 per MT]. Cheddar cheese was down 2.1 percent, to $3,317 per metric ton.

The next GDT auction is Jan. 16.

Rabobank: Rising tide of milk weighs on market sentiment

Pressure will continue to build in global dairy markets, but exportable surpluses won’t completely overwhelm markets, according to the latest RaboResearch report, “Dairy Quarterly Q4 2017: Rising Tide of Milk Weighs on Sentiment.”

Second-quarter 2017 growth in milk supply accelerated in the third quarter of the year. Growth in exportable surpluses gained momentum in the third quarter of 2017 as well, and is expected to continue pressuring global markets, said Michael Harvey, Rabobank dairy senior analyst.

Geopolitical tensions and dairy policy uncertainty are contributing to the weaker market sentiment. Attention is now focused on production trends in Europe in the coming six months. Growth in production is expanding, but milk price signals and efforts to curb production loom as disruptors. A tinkering of the intervention scheme next season may see an increase in milk diverted to cheese and whole milk powder production in Europe.

Oceania’s spring milk production peak stumbled due to unfavorable weather conditions. In addition, China’s robust import program has continued, assisted by a lower-than-expected domestic milk supply and some improvements in demand.

Beverage milk consumption decline impacts farm receipts

Milk price volatility, the proliferation of imitation “milk” and bottled water products, reduced consumption of ready-to-eat cereals, and legislation limiting school milk options all contributed to the decline in milk sales, according to John Newton, director of the American Farm Bureau Federation’s Market Intelligence.

Prior to the 1980s, more than 50 percent of the milk regulated by the USDA’s FMMO program was in beverage milk production. By 2015, only 33 percent of milk in the FMMO program was in fluid milk. During this time, per capita consumption of beverage milk declined by 25 percent to approximately 18 gallons per person.

From 2012 to 2016, annual conventional milk sales declined by more than 4 billion pounds, or approximately 8 percent¸ as USDA Agricultural Marketing Service data indicates. Organic sales captured some of this market, increasing by 20 percent, or 425 million pounds.

Using average milk prices from the Bureau of Labor Statistics of $3.45 per gallon, the decline in milk sales represents an annual decline in fluid milk sales of $1.7 billion. Based on USDA’s farmers’ share of the food dollar estimates, the decline in fluid milk sales represents $884 million per year in farm-level dairy cash receipts – and has resulted in lower U.S. average milk prices.

Read: Trends in beverage milk consumption ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke