Milk price and feed costs drive margins at the farm level. Certainly, sources of revenue other than milk and expenses other than feed impact profitability – but not of the same magnitude.

To gauge the economic health of the dairy industry in the Midwest, we have calculated margin based on mailbox milk price of several Midwestern states and estimated the market cost of a ration.

Because feed prices change constantly, and no one feed is a good indicator of total feed cost on a dairy, a ration was standardized to 10 percent rumen-degradable protein, 6 percent rumen-undegradable protein, 32 percent neutral detergent fiber, 40 percent non-fiber carbohydrates and 5 percent fat.

Nutrient costs are derived using the nutrient composition and monthly average market prices for a basket of 27 feeds available in the region. Income over feed cost (IOFC) is calculated as the mailbox milk price less the feed cost of producing a hundredweight (cwt) of milk, assuming a feed efficiency of 1.45.

Nutrient costs are derived using the nutrient composition and monthly average market prices for a basket of 27 feeds available in the region. Income over feed cost (IOFC) is calculated as the mailbox milk price less the feed cost of producing a hundredweight (cwt) of milk, assuming a feed efficiency of 1.45.

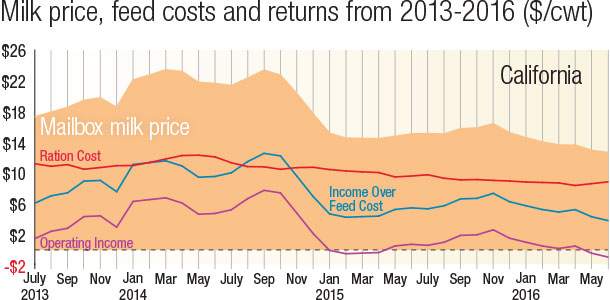

Operating income is IOFC less non-feed operating costs that are published biannually by the USDA’s Economic Research Service.

The accompanying graph shows the mailbox milk price, ration cost, IOFC and operating income for the Midwest over the last six years. Operating margins reached a historical high during the latter half of 2014, peaking at more than $11 per cwt, which is substantially higher that the long-term average of $4.13 per cwt.

The record-high margins of 2014 were mainly attributable to higher milk prices, but lower feed costs also helped push margins higher. Dairy margins are considerably off the highs experienced two years ago, with operating margins hovering just under $1 per cwt. Since milk price is a major driver of dairy margins, the drop in margins has followed the decline in milk price.

June data is preliminary, but it appears that feed margin has settled right at $7 per cwt. This is 31 percent lower than the long-term average of $10.33 per cwt. For several months now, feed cost has remained in the upper-$7-per-cwt range or about $0.115 per pound dry matter.

Operating margins near $1 per cwt are well below the long-term average of $4.13 per cwt but may have found a bottom at the mid-point of 2016. Feed margin percent is running at 48 percent, meaning that $0.48 of each milk revenue dollar is left after feed expense has been covered, which is down about 12 percent from a year ago. PD

-

Patrick French

- RP Feed Components

- Email Patrick French