Editor's note: Market commentary from Mark Stephenson, director of dairy policy analysis at the University of Wisconsin – Madison, and Bob Cropp, dairy economics professor emeritus, has been added. May 2018 U.S. milk production posted another small year-over-year increase, but cow numbers reversed course, moving higher again, according to the USDA’s monthly Milk Production report, released June 19. At 19.1 billion pounds, May U.S. milk production was up just 0.8 percent from a year earlier. USDA also revised April 2018 production downward slightly. The April revision represented a decrease of 18 million pounds, or 0.1 percent from last month's preliminary production estimate.

May 2017-18 recap

Reviewing the USDA estimates for May 2018 compared to May 2017:

• U.S. milk production: 19.1 billion pounds, up 0.8 percent

• U.S. cow numbers: 9.404 million, up 3,000 head

• U.S. average milk per cow per month: 2,031 pounds, up 15 pounds

• 23-state milk production: 17.94 billion pounds, up 0.9 percent

• 23-state cow numbers: 8.74 million, up 10,000 head

• 23-state average milk per cow per month: 2,052 pounds, up 15 pounds

Source: USDA Milk Production report, June 19, 2018

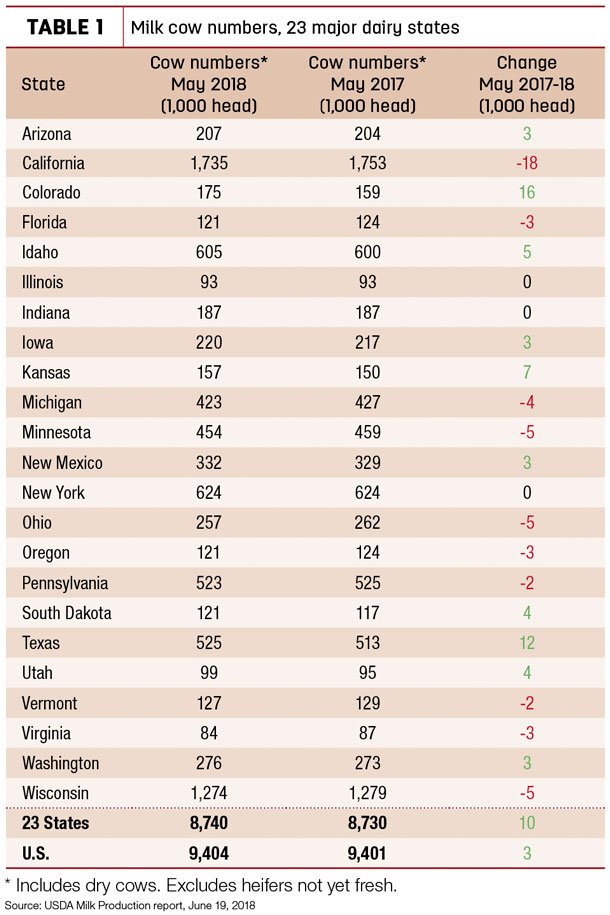

Cow numbers

The USDA’s monthly Milk Production report estimated May 2018 U.S. cow numbers at 9.404 million head, up 2,000 head from March and April, and 3,000 more than May 2017.

Among the 23 major dairy states (Table 1), dairy producers in 10 states had more cows than a year ago, led by Colorado (+16,000), Texas (+12,000) and Kansas (+7,000). Producers in 10 states had fewer cows than a year earlier, led by California (-18,000 head) and Minnesota, Ohio and Wisconsin (each -5,000 head). Cow numbers in Illinois, Indiana and New York were unchanged from a year earlier.

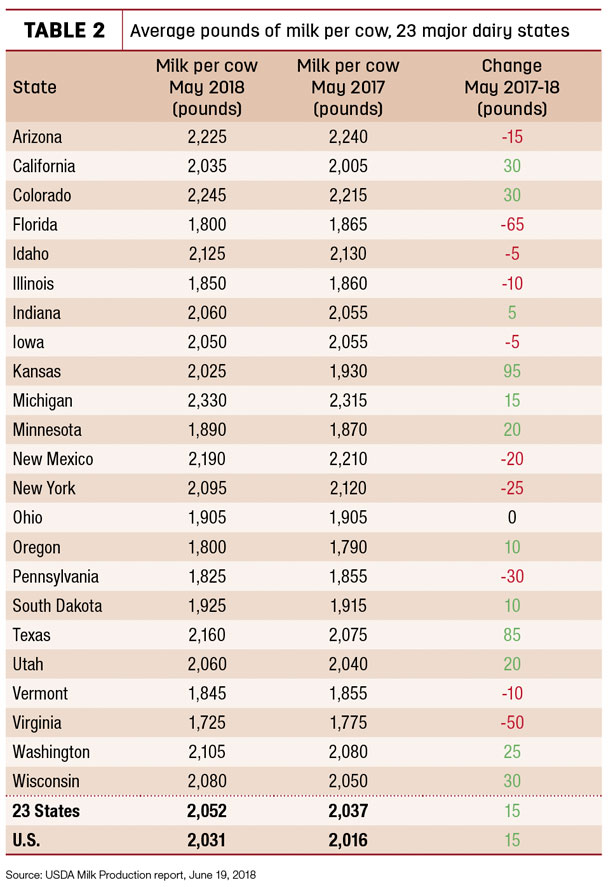

Milk per cow

Nationally, monthly milk per cow increased just 0.75 percent compared to a year earlier (Table 2). May 2018 per cow production was up 95 pounds in Kansas and 85 pounds in Texas, offsetting 50- to 65-pound declines in Virginia and Florida, respectively.

Milk production

On a percentage basis, year-over-year milk production growth was centered in three states: Colorado output was up almost 12 percent, Kansas was up about 10 percent and Texas up about 7 percent. In contrast, eight states saw year-over-year declines, led by Virginia and Florida.

Texas led all states for growth on a pounds basis, increasing production by 70 million pounds compared to a year earlier. The year-over-year increase in Colorado (41 million pounds) was nearly equal to the combined increase (44 million pounds in dairy behemoths California and Wisconsin).

Cropp-Stephenson outlook: Trade wars impacting market

In their monthly podcast, Mark Stephenson, director of dairy policy analysis at the University of Wisconsin – Madison, and Bob Cropp, dairy economics professor emeritus, discussed the impact of escalating trade wars on dairy markets.

Cow numbers are up, but production per cow continues below trend, Cropp noted. With overall U.S. milk production growth at under 1 percent, the news surrounding domestic sales, stocks and record-high exports should point toward higher milk prices. However, escalating tariff wars between the U.S. and Mexico and China are having a chilling effect.

“We’ve been rattling the sabre pretty hard on trade, and we’ve gotten some blowback on dairy,” Stephenson said. The impact has been negative on the spot market for cheese, butter, nonfat dry milk powder and whey. It’s also pushed milk futures prices lower.

“Absent of any trade war discussions, I think most of the market fundamentals would have been supportive of $17 [per hundredweight] milk prices,” Stephenson said.

Cropp said he believes the markets have overreacted to ongoing tariff retaliation announcements. It remains to be seen if the tariffs are all implemented and what impact they’ll have on dairy prices. He expects milk prices will be higher than current futures markets provide.

Global Dairy Trade index down again

Overall Global Dairy Trade (GDT) dairy product prices slipped again, declining 1.2 percent during the auction held June 19.

Prices were lower for cheddar cheese [down 3.6 percent, to $3,847 per metric ton (MT)] and whole milk powder [down 1 percent, to $3,189 per MT]. The butter price was up 0.8 percent, to $5,611 per MT. The price for skim milk powder was not available. The next GDT auction is July 3.

Margins start June mixed

Dairy margins were mixed over the first half of June, weakening in the third quarter and holding steady in the fourth quarter of 2018, then improving slightly in the first half of 2019, according to Commodity & Ingredient Hedging LLC. The main feature since the end of May was a sharp selloff in both milk and feed markets. Heavy commodity fund liquidation has been noted over the past couple of weeks, fueled by tariff wars between the U.S. and major trading partners. In addition, high percentages of both corn and soybean crops remained in good to excellent condition.

‘Protecting Your Profits’ risk management call is June 27

Alan Zepp, risk management program manager at Pennsylvania's Center for Dairy Excellence (CDE), will host the monthly “Protecting Your Profits” call on Wednesday, June 27, at noon (Eastern). In the 15-minute call, Zepp typically reviews dairy market fundamentals and risk management options using the Margin Protection Program for Dairy (MPP-Dairy), the Livestock Gross Margin-Dairy (LGM-Dairy) program and puts and options on the Chicago Mercantile Exchange (CME) futures market.

To register and obtain the conference line information, call (717) 346-0849 or email Alan Zepp. All calls are recorded and archived. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke