The bad news: July 2018’s Margin Protection Program for Dairy (MPP-Dairy) margin calculations indicate dairy incomes fell to levels seen earlier in the year. The good news: Milk prices have likely bottomed out.

Milk price declines

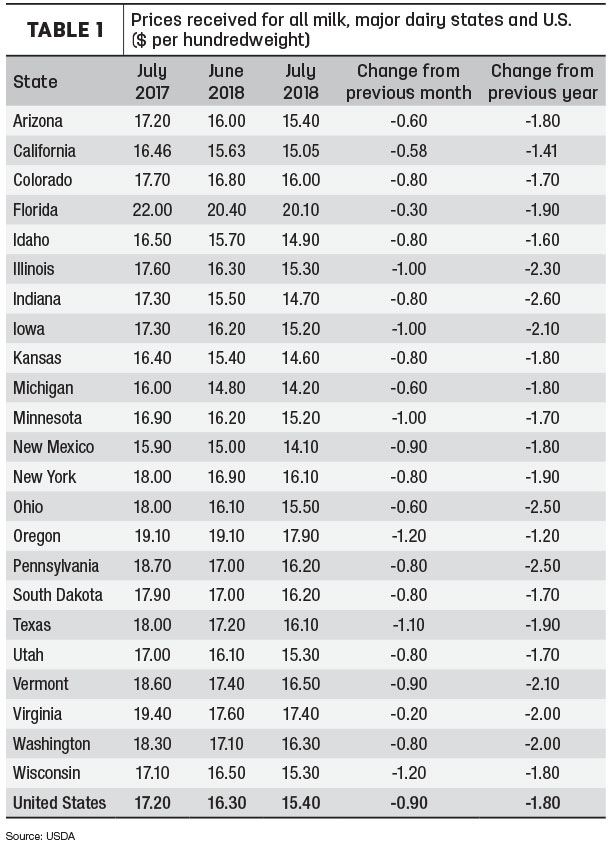

The July U.S. average milk price dropped 90 cents per hundredweight (cwt) from June to $15.40 per cwt (Table 1). The July 2018 average was $1.80 less than July 2017. Through the first seven months of 2018, the average milk price stands at $15.81 per cwt compared to $17.49 per cwt in the same period of 2017.

Compared to a month earlier, July milk prices among the 23 major dairy states were all lower, with declines of $1 or more in Iowa, Minnesota, Oregon, Texas and Wisconsin. Compared to a year earlier, July 2018 milk prices were down $2 or more in Illinois, Indiana, Iowa, Ohio, Pennsylvania, Vermont, Virginia and Washington.

Florida’s average of $20.10 per cwt remained the nation’s high. The lows were in New Mexico and Michigan, at $14.10 and $14.20 per cwt, respectively.

Feed prices down

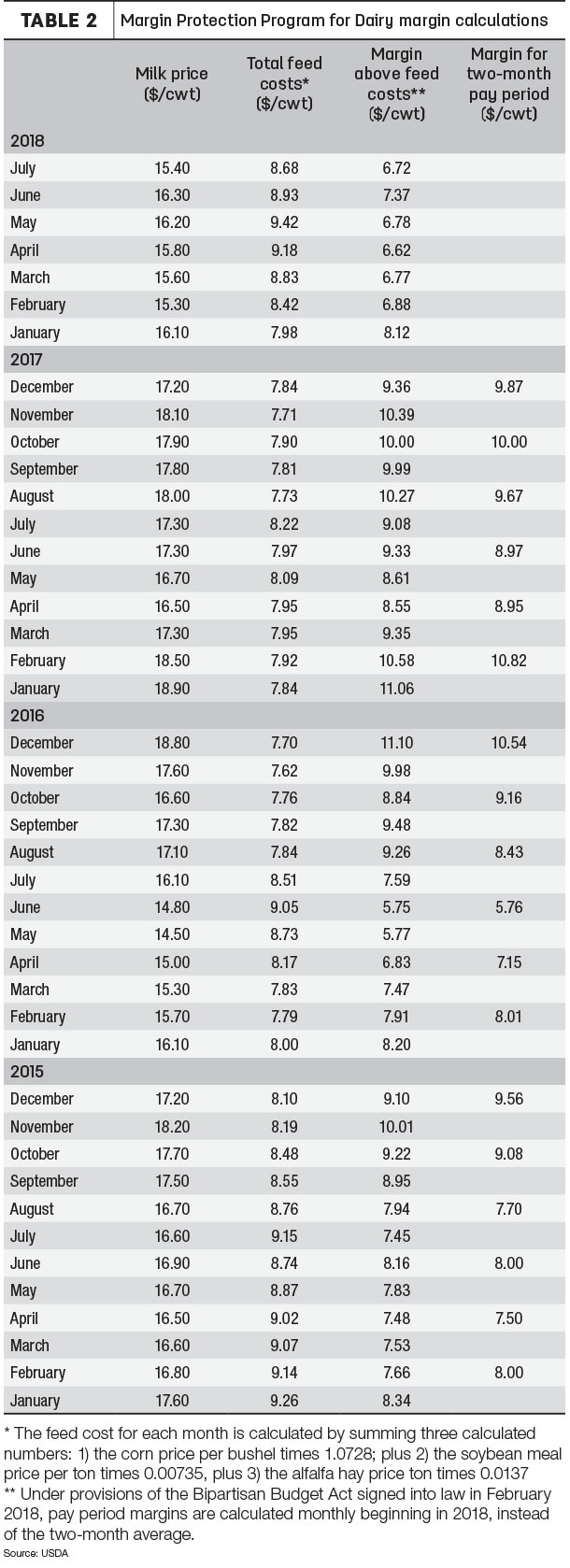

July 2018 U.S. average feed prices declined about 25 cents from June, to $8.68 per cwt of milk sold (Table 2). The soybean meal price fell about $14.60 per ton from June; the U.S. average corn price dropped 11 cents per bushel; and the alfalfa hay price declined $2 per ton.

MPP-Dairy margin moves below $7 per cwt

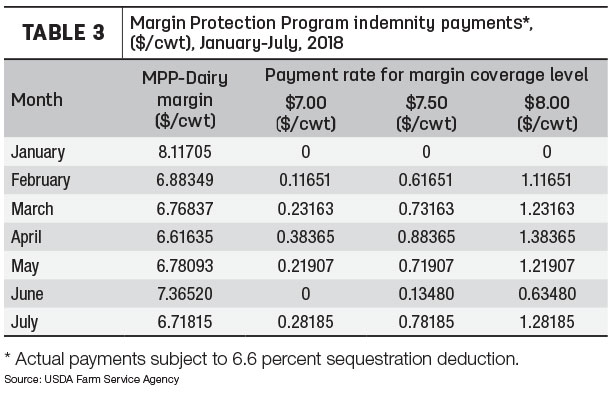

The lower feed costs weren’t enough to offset lower milk prices, sending the national average milk income over feed cost margin to about $6.72 per cwt in July. As a result, dairy farmers who enrolled in MPP-Dairy and elected $7, $7.50 and $8 per cwt margin coverage will all see payments for milk marketed in July (Table 3).

Dairy farmers insured at the $8 per cwt margin level will receive a base payment of about $1.28 per cwt on July milk, less the 6.6 percent sequestration deduction and any premium costs. Producers insured at the $7.50 margin level will see a base payment of about 78 cents per cwt, and those insured at the $7 per level will see a payment of about 28 cents per cwt.

For example, insured at the $8 level, a dairy herd with annual production history of 6.25 million pounds of milk and electing to cover 80 percent of that milk (5 million pounds) would be eligible for payment on 4,167 hundredweights (5 million pounds divided by 100 divided by 12) per month. The 4,167 hundredweights multiplied by about $1.28 per cwt would yield a base payment of $5,334 for July. Subtracting the sequestration deduction of about $352, the payment drops to about $4,982. That does not include any deductions for premiums. Payments are issued directly to producers via electronic deposit; there are no paper checks.

As of Aug. 28, the Program on Dairy Markets and Policy projected August’s margin to rise to about $7.50 per cwt. Margins are forecast to climb back to $8.50 per cwt in September and surpass $9.50 per cwt in October 2018 through January 2019. If realized, those margins would be the largest since the second half of 2017.

August Class III, IV prices improve

August 2018 federal order Class III and Class IV milk prices are higher.

The August Class III price is $14.95 per cwt, up 85 cents from July but still $1.62 less than August 2017. The year-to-date Class III price average stands at $14.44 per cwt, down $1.65 from the same period a year earlier.

The August Class IV price is $14.63 per cwt, up 49 cents from July but $1.98 less than August a year ago. The January-August Class IV price average is $13.85 per cwt, down $1.62 from the same period a year earlier.

Tariff aid coming

Most dairy farmers could also see some direct federal financial aid in early fall, when the USDA distributes $127 million under its Market Facilitation Program. That program is designed to offset economic losses due to trade wars and retaliatory tariffs imposed by two primary dairy export customers, China and Mexico. Payments will be 12 cents per cwt, paid on 50 percent of a dairy farm’s annual milk production history. (Read: Dairy disappointed in USDA tariff assistance package.)

LGM-Dairy sales this Friday

Also, a reminder for those dairy farmers not enrolled in MPP-Dairy. The monthly sales period for Livestock Gross Margin-Dairy (LGM-Dairy) is open Aug. 31-Sept. 1. LGM-Dairy policies for sale cover a 10-month period from October 2018 to July 2019. According to Ron Mortensen, Dairy Gross Margin LLC, nearby milk income margins have improved thanks to lower feed prices. Longer term, January-July margins also look better, with strongest margins in March-May 2019. Policies are available through authorized crop insurance agents. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke