Read: DMC enrollment deadline nears as dairy outlook turns weaker.

One other date of note: Due to the Thanksgiving holiday, the next scheduled sales period for Livestock Gross Margin for Dairy (LGM-Dairy) is Friday, Nov. 20. Coverage is available for up to 10 months, so you will be able to buy coverage for January-October 2021. You need to select coverage in two-month increments to get the premium subsidy. LGM-Dairy covers milk prices (from falling) and also includes coverage for feed prices rising. LGM-Dairy is not only a milk price put option, but a call option on the price of corn and soybean meal.

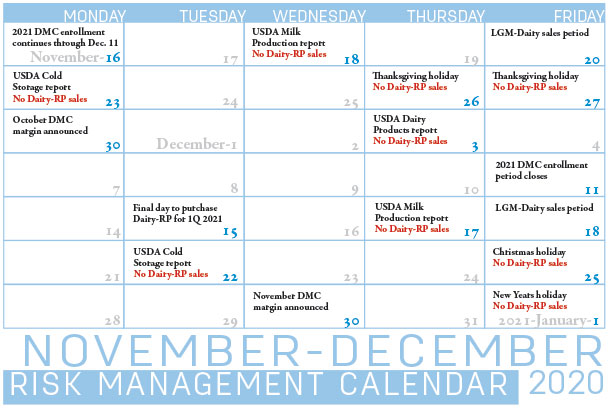

Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. Dairy-RP is available every day except holidays and USDA report days that could impact markets (see the calendar below). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

Click here or on the calendar above to view it at full size in a new window.

If you still have questions related to DMC enrollment and other risk management tools, here are some upcoming webinars and other resources:

-

Risk management miniseries. Ohio State University (OSU) Extension will offer another webinar in its Dairy Outlook and Risk Management miniseries, Nov. 24, noon-1 p.m. (Eastern time zone). Kenny Burdine, livestock marketing management specialist with the University of Kentucky, and Christopher Zoller and Jason Hartschuh, OSU Extension educators, will discuss risk management tools. Register for the program here.

-

Protecting Your Profits webinar and podcast: The Pennsylvania Center for Dairy Excellence (CDE) is hosting its monthly “Protecting Your Profits” webinar on Nov. 25, beginning at noon (Eastern time zone). Zach Myers, CDE risk education manager, will provide a look at dairy markets to help guide decision-making and risk management strategies. He’ll also provide an update on DMC margins. No registration is necessary. The session lasts approximately 15 minutes. Individuals can join via conference call (phone [646] 558-8656, meeting ID 848 3416 1708, passcode 474057) or webinar. In addition, a podcast format is now available.

-

Farm Credit East/Crop Growers LLC webinar. The webinar, "Dairy Markets – The 2020 Impact and Bracing for 2021," features University of Minnesota dairy economist Marin Bozic and Farm Credit East business consultant Gregg McConnell. They’ll review current market conditions and forecasts and discuss decision support tools to assist dairy producers. Register here.

- NMPF webinar: The National Milk Producers Federation (NMPF) is offering dairy farmers, cooperative members and state dairy associations a free webinar to help them develop effective risk management plans for 2021. The session is set for Dec. 2, beginning at 1:30 p.m. (Eastern time zone). NMPF chief economist Peter Vitaliano will provide a dairy price outlook for 2021 and review the value of risk management tools, including the DMC program. Register for the program here.

Based on current market conditions, Vitaliano estimates DMC will offer indemnity payments of $1.05 per hundredweight (cwt) in the first eight months of 2021 for those producers who select the maximum $9.50 per cwt coverage level. Visit NMPF’s Risk Management webpage for additional information.

- Cow-Side Conversations podcast. In the first monthly episode of the Cow-Side Conversations podcast, Mark Mosemann, a partner at the 450-cow Misty Mountain Dairy in Fulton County, Pennsylvania, shares how the dairy uses risk management to protect both their input costs and milk price margins. The podcast is hosted by Jayne Sebright, executive director at Pennsylvania’s Center for Dairy Excellence.

On the input side, risk management tools include locking in feedstuff protein prices up to eight to 12 months in advance when possible, participating in a buyer's group to lock in corn seed prices for next spring, and early purchasing of fertilizer and nitrogen stored on farm to take advantage of lower prices in fall. On the milk marketing side, the dairy uses a layered approach, utilizing the DMC at the Tier I level, Dairy-RP and contracting milk through their co-op, Maryland and Virginia Milk Producers Cooperative Association. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke