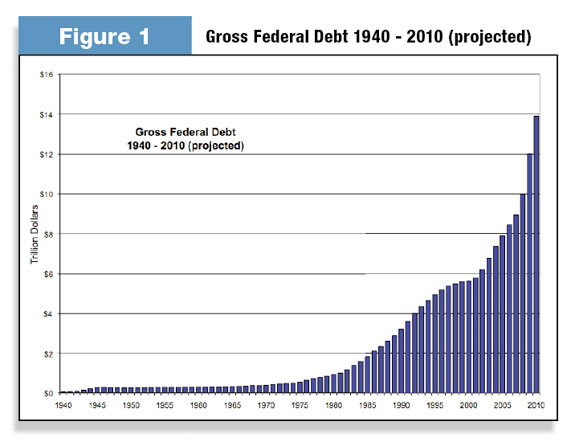

How much is $13,552,485,816,852? Let’s consider one billion first. One billion seconds ago it was 1959. Now multiply one billion by 13,552 and you have our national debt. But don’t stop there – it is constantly growing. A number that is easier to comprehend is $43,371 – each American’s share of the debt. Why don’t you go ahead and tack it on to your balance sheet? How did we get here? In all but four of the last 30 years, our U.S. government has spent more money than it has brought in. The most recent federal budget deficit, fiscal year 2009, was $1.4 trillion – the largest in the history of the U.S. In terms of gross domestic product (GDP), the deficit was 10 percent in 2009 – the highest since World War II. Final numbers are not available for 2010, but the Congressional Budget Office (CBO) estimates it will be around $1.3 trillion.

For a quick comparison, let’s think about this in dairy terms – as if the U.S. was a dairy business. The national debt is total liabilities on the balance sheet versus total revenue or Gross Domestic Product (GDP). GDP is like a dairy’s total farm sales, and the budget deficit is net margin – in this case, a loss of 10 percent of total sales. Usually, a dairy would calcuate debt per cow. But don’t confuse the debt per citizen figure in the opening paragraph to be calculated the same way a dairyman would do it. A dairy only measures debt based on producing units in a year. To get a similar figure, we would divide the total U.S. debt by the portion of the producing units (population employable) and get a much larger amount – about $88,000 per person. Maybe we should be calculating debt more like a dairyman?

Implications for farmers and for all Americans

One of the biggest problems about the current fiscal situation is that foreign countries control a large portion of the debt, leaving the U.S. in a precarious position. Eventually the federal debt may get so high that the U.S. would be seen as a bad credit risk. This will leave us less able to secure more funds should an urgent need arise.

Higher interest rates are also a potential concern, reflecting a higher risk for our investors. This would affect all U.S. borrowers. For those working with higher leverage and industries operating in volatile marketplaces, this is especially bad news.

Unfortunately, the U.S. and its citizens have grown accustomed to spending money but never actually paying for it; similar to using a credit card and only paying the minimum payment. At some point spending needs to be controlled if debts are going to be paid. This means cutting expenses. When the time comes for making real cuts in the U.S. budget, all pieces will be scrutinized – including farm payments.

Another difficulty with this issue is that while it continues to get worse, it seems other needs get more attention. We are not in a crisis yet, and what needs to be done is not appealing or popular in a political arena – cut budgets and raise taxes.

Cut spending or increase taxes

The federal government spends more than half the revenue it collects on five major items, including national defense, Medicare, Medicaid, Social Security and interest on our debt. Examples of other areas of the budget include education, Homeland Security, transportation, economic stimulus and farm programs to name a few. With the recent bailout programs, this “everything else” category jumped dramatically in the past two years yet is expected to contract quickly, making the first five major areas even more prominent.

While every area of the budget should be up for review, it is important that the U.S. spend the appropriate amount of money on our national defense. This portion of the pie is not expected to have sustained increases in the long-run. Similarly, a hope is that interest on the federal debt would be kept under control as we remain current with interest payments and actually start paying down our debt.

This leaves three areas of fiscal focus – Social Security, Medicare and Medicaid. As people live longer and the baby boomers retire, these expenditures will continue to rise.

Fixing Social Security

A few options get the most discussion for fixing Social Security. The least popular is immediately lowering benefits. This would limit opportunities to plan for less income by those already receiving benefits or close to it – let’s not forget the average dairy producer is 52 years old.

More palatable options exist. These include increasing the normal retirement age and indexing it to longevity. Since the Social Security program was created in 1935, life expectancy has increased by 18 years, yet the full-benefit age only by two. An age adjustment beyond that scheduled into law (from 65 and 66 to 67 in 2027) is needed; however, this alone will only solve about a quarter of the program’s long-term funding gap. Revenue options to consider include boosting payroll taxes, lowering the income level for taxable benefits and increasing the maximum taxable earnings on current employees. Ultimately, the most politically viable option will be a combination of actions.

The Medicare and Medicaid challenge

Controlling Medicare and Medicaid spending is difficult as there is no set budget for these programs. They pay out what they are billed. Payouts are growing while revenues to cover them are not. In 2009, spending in this area was $767 billion and 5 percent of GDP. Projections for 2018 reach $1.5 trillion and 10 percent of GDP.

Capping Medicare and Medicaid spending would ration care, which simply will not do. Instead we need to focus on the underlying healthcare costs. Spending on healthcare has outpaced economic growth by 3 percent annually for the past 40 years. In 1970, health expenditures were 7 percent of GDP. In 2009 they were 18 percent. There are many ways to curb medical costs, and some are addressed in the Health Care and Education Reconciliation Act of 2010.

Clearing up a few misconceptions

When discussing medical expenditures, some credit rising costs to our “pay for procedure” health care system, pointing to excessive testing and unnecessary procedures. The CBO projects tort reform could save $5.4 billion per year on average – not enough to correct a deficit in excess of $500 billion.

Another misconception is that halting earmark spending will solve our deficit issue. When looking at a total budget outlay of $3 trillion, cutting earmarks that generally account for $30 billion will not get us very far.

Final thoughts

Consecutive budget deficits have added to a growing national debt, which is a cancer limiting our opportunity for a healthy, growing economy. Tough decisions will need to be made for cutting spending but also to raise revenue – meaning taxes. Without considering taxes somewhere, it is unrealistic that the federal budget can be balanced.

It seems there is little trust that the federal government will spend the taxes collected efficiently, and even it if did, that assumes everyone agreed on how to spend. The fact is that over the past eight years, the federal government has been taking in almost 1 percent below the historical 50-year average of 18 percent of GDP. Even when we average 18 percent, we only have had a budget surplus five times.

It is our moral responsibility to fix our deficit problem. If we do not, we leave it for our future generations to pay. PD

-

Joanna Samuelson

- Director of Knowledge Exchange

- Farm Credit East

- Email Joanna Samuelson