U.S. milk production posted another 1.8 percent increase in February, fueled primarily by year-over-year gains west of the Mississippi River. Cow numbers grew for a fourth consecutive month.

USDA: February recap

Reviewing the USDA estimates for February 2018 compared to February 2017:

• U.S. milk production: 17 billion pounds, up 1.8 percent

• U.S. cow numbers: 9.41 million, up 45,000 head

• U.S. average milk per cow per month: 1,807 pounds, up 24 pounds

• 23-state milk production: 15.93 billion pounds, up 1.8 percent

• 23-state cow numbers: 8.75 million, up 49,000 head

• 23-state average milk per cow per month: 1,822 pounds, up 23 pounds

In addition to February’s growth, January 2018 milk cows, milk per cow and total production were adjusted higher from last month’s preliminary estimates.

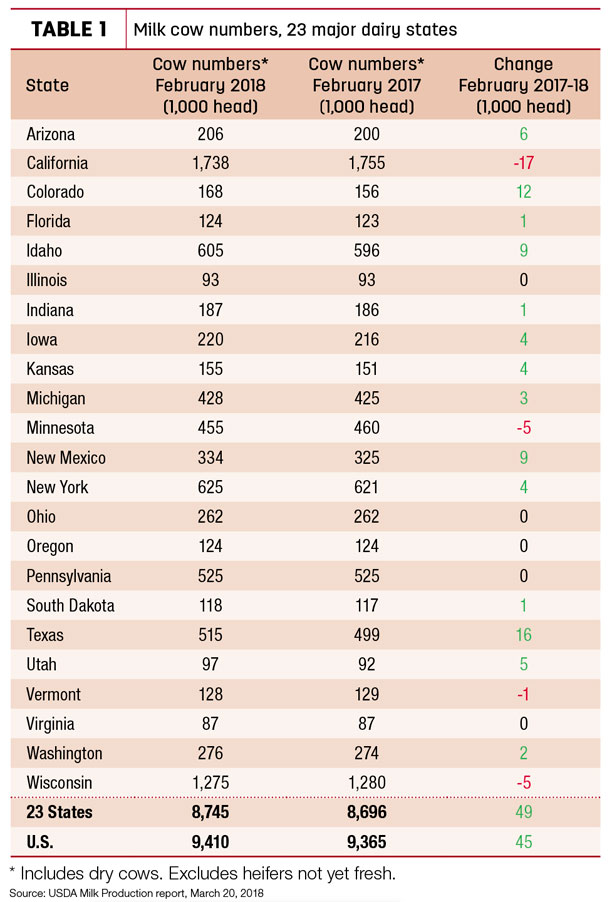

Cow numbers

The cow number story continued along previous trends. Compared to a year earlier, the largest growth in cow numbers was in Texas (+16,000 head) and Colorado (+12,000 head), with New Mexico (+9,000 head), Arizona (+6,000 head) and Utah (+5,000) also posting significant gains (Table 1). California (-17,000 head) and Minnesota and Wisconsin (each -5,000 head) led decliners.

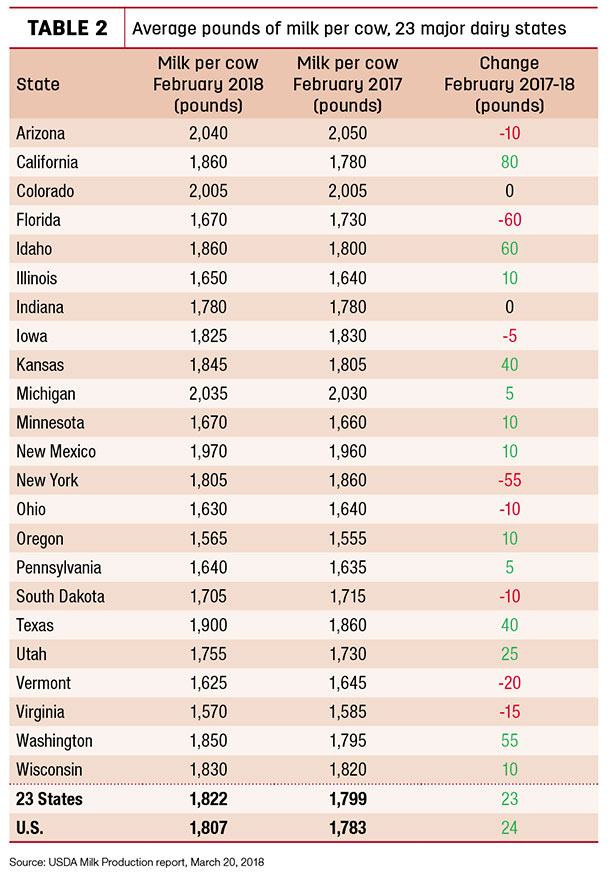

Milk per cow

February output per cow increased, although it’s difficult to identify regional consistency. Compared to a year earlier, February 2018 per-cow production was up 80 pounds in California, 60 pounds in Idaho and 55 pounds in Washington (Table 2), offsetting a 60-pound drop in Florida and a 55-pound drop in New York.

Milk production

Western milk production continues to show the strongest gains. On a percentage basis, February milk production was up 7.7 percent in Colorado and 5.5 percent in Texas. California milk production was up 3.5 percent from the same month a year earlier, and Kansas and Idaho milk production grew 4.8 percent.

Elsewhere, production has slowed. Among the other largest states, Wisconsin production was up just 0.1 percent, while Pennsylvania output was up 0.3 percent. Michigan production was up just 0.9 percent. With lower milk per cow, New York production slumped, down 2.3 percent, and Florida output was down 2.8 percent.

Cropp outlook

Thanks to better cheese and butter prices, March farm milk prices should be higher than February, according to Bob Cropp, professor emeritus at the University of Wisconsin – Madison.

Higher cheese prices will increase the Class III price to around $14.30 per hundredweight (cwt), compared to $13.40 per cwt in February. Higher butter prices will increase the Class IV price to around $13.25 per cwt in March, compared to $12.87 per cwt in February.

While stocks of dairy products remain relatively high, improved domestic sales and dairy exports helped strengthen prices, Cropp said in his monthly Dairy Situation and Outlook report.

Milk prices for the rest of the year will depend on domestic sales, dairy exports and the level of milk production. With a stronger economy, domestic sales should be positive, but dairy exports will continue to face stiff competition, especially the European Union (EU), where milk production continues to show strong growth.

Milk production is up slightly in Australia, but lower in New Zealand and Argentina.

Also on the positive side, U.S. dairy products remain very price competitive on the world market, Cropp said, with butter, cheese, nonfat dry milk and dry whey prices all lower than EU or Oceania prices. The world economy also is improving. So U.S. should see some growth in dairy exports during 2018.

Unless milk production slows down and/or dairy exports show greater increases, it appears milk prices will continue to slowly improve. Class III prices could improve to the $15s per cwt by July, and possibly top out near $16 per cwt by October, averaging no higher than $15 per cwt for the year. That compares to $16.17 per cwt last year. The Class IV price could improve to the $14s per cwt by July, but remain below $15 per cwt thereafter, averaging no higher than $14 per cwt in 2018. That compares to $15.16 per cwt last year. Hopefully, lower milk production and higher exports will push milk prices higher, Cropp concluded.

Margins improve to start March

Dairy margins improved slightly over the first half of March, due primarily to falling feed prices, according to Commodity & Ingredient Hedging LLC. Milk values were steady to a little higher. Nearby margins remain below average and negative, while projected margins are slightly above breakeven in the second half of the year.

Although the milk market remains oversupplied, and production has increased at a faster rate than handlers’ ability to process into dairy products, low prices may be stimulating demand and helping to move excess supplies. January export data was encouraging, with all dairy products showing impressive year-over-year increases.

Both corn and soybean meal prices have retreated recently following rainfall in Argentina that has brought some relief to drought conditions there. However, corn prices remain supported by a larger-than-expected cut to U.S. projected ending stocks in the March World Ag Supply and Demand Estimates report.

Cutter cow price forecast steady

The USDA’s latest Livestock, Dairy and Poultry Outlook forecasts fairly steady national average cutter cow prices in 2018, although there’s some downside risk as the year progresses. Projected midpoint prices are $62.50 per cwt in the first quarter of the year; $64 per cwt in the second quarter; $63 per cwt in the third quarter; and $62 per cwt in the fourth quarter. If realized, the 2018 cutter cow price would average $62.50 per cwt (midpoint), down from $65.16 per cwt in 2017; $70.07 in 2016; and $99.56 per cwt in 2015.

Through Feb. 24, U.S. dairy cull cow slaughter was running about 3 percent ahead of the same period a year earlier.

Global Dairy Trade index slips

Global Dairy Trade (GDT) dairy product prices were mostly steady to lower in the auction held March 20, with the overall index down 1.2 percent. Among major products, prices were lower for cheddar cheese [down 3.9 percent, to $3,609 per metric ton (MT)] and skim milk powder [down 8.6 percent, to $1,887 per MT]. The butter price was unchanged [$5,281 per MT], with only whole milk powder showing a small improvement [up 0.1 percent, to $3,236 per MT].

The next GDT auction is April 3. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke