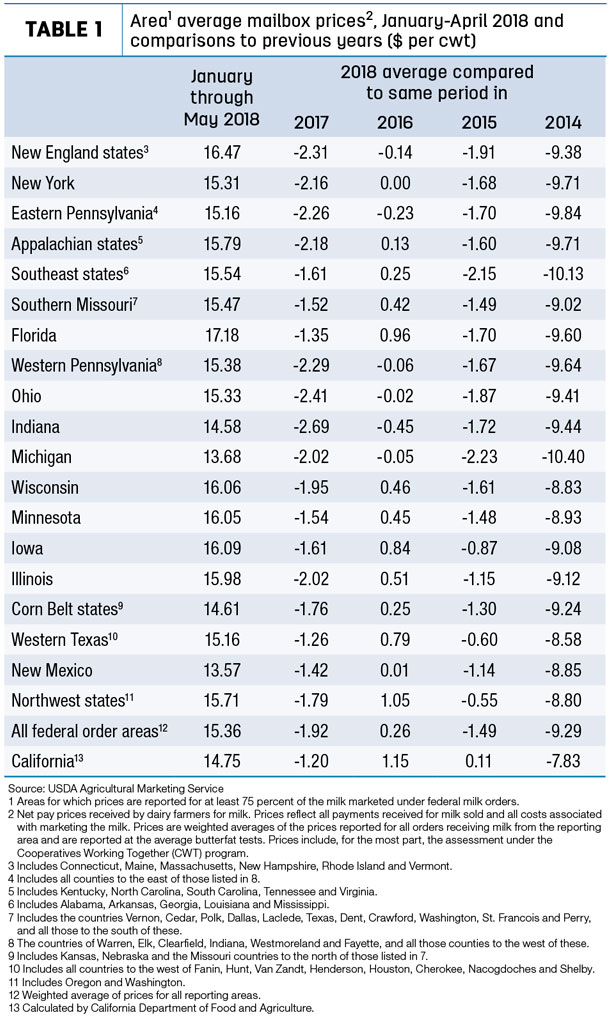

Dairy farmers’ walks to the mailbox have not been fun this year. Through the first five months of 2018, average Federal Milk Marketing Order (FMMO) “mailbox prices” – approximating the net price received by dairy farmers for milk after adding any premiums and deducting costs associated with hauling and marketing – was about $1.92 per hundredweight (cwt) less than the same period in 2017 (Table 1). For those with a longer memory, average mailbox prices were running $9 to $10 per cwt less than the record highs of 2014.

So far in 2018, New Mexico and Michigan dairy producers have seen mailbox milk price averages near $13.60 per cwt.

May 2018 highlights

In May 2018, mailbox milk prices for selected reporting areas in FMMOs averaged $15.70 per cwt, up 29 cents from the April 2018 average but down 45 cents per cwt from the May 2017 average. Mailbox prices in May 2018 ranged from $17.40 in the Florida reporting area to $13.84 in the New Mexico reporting area.

January-July cow slaughter total up

Federally inspected milk cow slaughter was estimated at 239,600 head in July, 2,100 head more than June and 13,800 more than July 2017, according to the monthly USDA Livestock Slaughter report, released Aug. 23.

Through the first seven months of 2018, the culling total is 1.808 million head, about 87,300 head more than the same period a year ago and the highest January-July total since 2013. So far, 2018 daily dairy cow slaughter in running about 500 head more than 2017.

The USDA’s latest Milk Production report indicated there were 9.396 million cows in U.S. dairy herd in July 2018. Based on the slaughter estimates, about 2.6 percent of the herd was culled during the month.

September Class I base price improve

The September 2018 FMMO Class I base price is $14.85 per cwt, up 70 cents from August but $1.86 less than the September 2017 price of $16.71 per cwt.

Through the first nine months of 2018, the Class I base average is just $14.58 per cwt, about $1.83 less than the average for the same period in 2017.

LGM-Dairy policies on sale Aug. 31

For dairy producers who didn’t enroll in the Margin Protection Program for Dairy (MPP-Dairy) in 2018, the monthly sales period for Livestock Gross Margin-Dairy (LGM-Dairy) is open Aug. 31 to Sept. 1; the September sales period is Sept. 28-29. Policies are available through authorized crop insurance agents.

Alan Zepp, risk management program manager at Pennsylvania's Center for Dairy Excellence (CDE), reviewed various risk management options during his monthly “Protecting Your Profits” conference call, Aug. 22. All calls are recorded and archived. Zepp’s next Protecting Your Profits call will be Sept. 26.

Cropp-Stephenson outlook: Production numbers should be bullish

In their monthly podcast, Mark Stephenson, director of dairy policy analysis at the University of Wisconsin – Madison, and Bob Cropp, dairy economics professor emeritus, reviewed milk production and cold storage numbers. With the small increase in production and a decline in cow numbers, USDA’s Milk Production report provided news that should be bullish for prices.

“The hot, humid weather knocked the heck out of production per cow in some states,” Cropp said. “There was also a big drop in cow numbers, showing there has been some exiting. Clearly, the trend is that cow numbers are down; milk production per cow may pick up as temperatures cool this fall.”

Adding bullishness to the outlook, the Cold Storage report indicated some improvement in butter stocks relative to a year ago. Tempering that outlook, however, were American cheese stocks, which grew along traditional seasonal patterns.

An overreaction to tariffs

Exports reported through June have been very good, although retaliatory tariffs could negatively impact cheese sales in July. Some of the strength in June sales may have been the result of purchases in anticipation of the tariffs.

“It appears dairy prices may have overacted late June and early July to retaliatory tariffs to be implemented about mid-July by Mexico, China and Canada,” Cropp wrote in his monthly dairy situation and outlook.

Drought continues to plague parts of the European Union, reducing crop production and raising feed prices. New Zealand, the second largest exporter, may see some recovery in milk production, but that rebound is only projected to be about 2 percent. Any slowdown in world milk production could support world prices.

Updating his milk price forecasts, Cropp said uncertainty continues, subject to change as more information on milk production and dairy exports come available. The production side should be be bullish, domestic sales will be decent and export sales will not totally collapse.

He projects August Class III price at about $15, up 90 cents from July, then moving to the mid- to high $15s and closer to $16 by October and November. However, if production remains softer, it has to boost prices, Cropp said. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke