Had anyone asked a corn and soybean grower in June what their forecast for fall grain prices were, chances are good that the response would have centered around one word … Lower!

However, much has changed – and for most, very quickly. Crop conditions quickly fell to the lowest/worst start since 1988 – the last time the country witnessed a severe drought.

While these reports do not accurately measure the final yield for corn and soybeans, they help to reveal the trend of development and viability on a weekly basis and in a somewhat quantifiable manner.

While grain producers are concerned about the volume of corn and soybeans that they are able to sell, dairy producers ,"ì along with all other end users of corn ‚" are equally concerned about the availability of feed(stocks).

This is a concern that few have had to deal with in recent decades and many are asking the question: "What should I do?" While there is no hard and fast answer that is suitable for everyone, there are some things that we should keep in mind when viewing markets and making decisions.

The first thing to recognize is that the two greatest forces that drive a market are greed and fear, with the latter having the greatest impact. Times of perceived shortage have a way of multiplying this effect. While forecasts remained hot and dry, corn and soybean prices exploded to historic and all-time highs.

This is not just a natural response but a necessary response. Prices are the means to ration supply to the highest need. However, in cases such as this, we often move past rationing and arrive quickly at demand destruction.

How many of you or your neighbors are eager and/or willing to book supplies of corn for extended periods of time at a price of $8 per bushel or $285 per ton (without freight or basis). Chances are slim. This is true not just for the dairyman, but also for ethanol plants and exporters alike. Demand is trimmed and supply is "built" by their collective demand retraction.

Since many have paralleled 2012 to 1988, I believe it is helpful to understand what happened in a year with devastating declines in production due to weather.

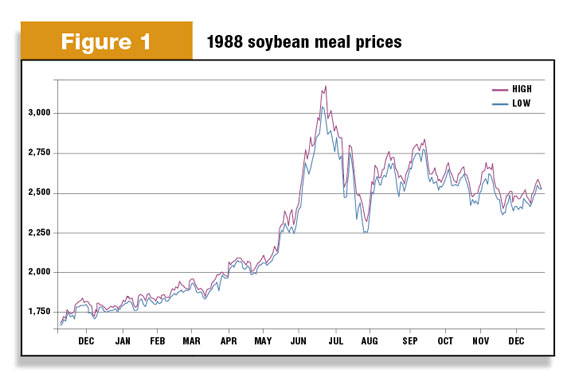

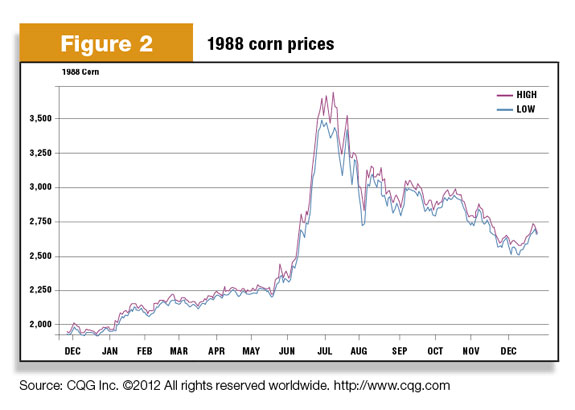

Let's first review the charts for corn and soybeans ( Figure 1 and 2 ). Much can be learned about the markets response to crop failure.

As mentioned earlier, the natural response was to drive prices higher.

But notice what happened when we reached our peak. While the crop did not change, the capacity of the market to maintain these newly discovered prices did.

In order for a market to continue moving higher, it must continue to attract new buyers with an appetite for buying the market at lofty levels.

This obviously becomes a smaller and smaller population as time passes.

There will be a short-lived tug-of-war as old buyers seek to take profits and new buyers enter as prices experience mild corrections.

This happens until the market reaches a saturation point and no more new buyers can be found.

It is at that point that the sellers appear and with them a cast of news stories, events and causes to take prices lower. The market then cascades lower to levels that, again, many have a hard time believing when evaluating the cause for taking prices higher in the first place.

In the case of 1988, corn prices moved from $2.20 to $3.70 and very quickly back to $2.70. While expectations for the crop had not changed, the market had. The obvious lesson learned is the markets are unpredictable and very dangerous if you can only buy into movement or sustainability in a single direction.

So with all of this in mind, it is a good reason to consider call option strategies when tackling feed prices for the coming year so as to allow the market to work through its normal cycle. Again, no single strategy is best for all and there are some exceptions.

For example, many have already committed to silage contracts and feed deliveries. If you find yourself in this pickle, a put option coupled with that commitment is warranted. Have a conversation with your risk management adviser about what is most suitable for you.

So what about milk? The first half of July was proof positive that processors became spooked about the potential for rising prices following the drought and the potential reduction in milk supply that can indeed occur as producers shuffle rations to accommodate scarce or high-priced feed ingredients.

While the jury is still out as to the net effect of this, many buyers have come into the market to attend to the 2013 calendar. The average price has pushed near $18 per hundredweight (cwt) for the entire year. This is the third-highest price average ever.

We should not count on drought to provide an immediate injection of support in milk price. As witnessed in 1988, it took until the fourth quarter of 1989 to make a significant move higher. Will the market move significantly higher this year? We wait to find out.

However, while we continue to manage a cow herd that is nearly as large as that of 2008 and the three-year milk cycle has yet to produce a significantly notable low, we must embrace the possibility of these record prices becoming compromised.

Having a put option strategy in place to handle this is not only advisable but, as proven by historical performances, the prudent thing to do. Again, consult with your risk management adviser as to what is most suitable for you. PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

-

Mike North

- First Capitol ag