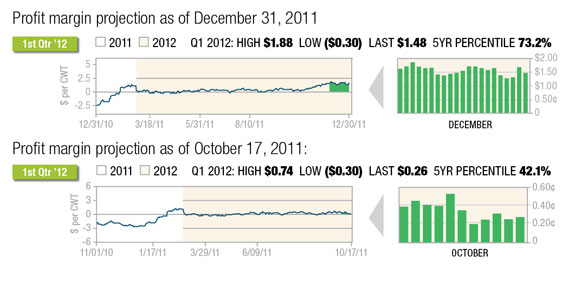

Profit margins for dairy producers have improved significantly over the past quarter since our last update in October, due primarily to an increase in the value of milk. While feed costs did come down over the last couple months due to lackluster demand, a recent sharp advance in price has been noted in both soybean meal and, especially, corn due to weather concerns in South America. From a historical standpoint, margins are stronger in nearby periods through the first half of 2012, but above average throughout the entire year. While not overly profitable, it is still possible for a dairyman to protect a positive margin throughout the entire year with flexible strategies that would allow for improvement over time.

Milk prices based off Class III futures at the CME Group have increased around $1.50 per hundredweight (cwt) over the past few months as demand has been very strong – particularly for exports.

For the first time, the All-Milk price average will exceed $20 per cwt for the whole year.

The 2011 average will be about $20.10, up 24 percent from 2010. Forward futures prices that had been carrying a discount to spot values rose during November and December with evidence that cash strength will carry over into the first part of this year.

Dairy exports continue to be supportive, with shipments through the first 10 months of 2011 totaling $3.96 billion – up 29 percent from 2010 on a value basis and up 9 percent based on volume. The gains were led by cheese which increased 31 percent, NDM/SMP up by 15 percent and butterfat, which was 17 percent above the previous year.

The USDA’s Cold Storage data also paint the picture of strong demand for cheese. American cheese stocks plunged during November, the largest drawdown for that particular month since 2004.

American cheese stocks on November 30 totaled 586.4 million pounds, down 28.8 million or 4.7 percent from October.

Total cheese stocks were lower as well, down 42.8 million pounds on the month to 970.6 million. That data suggest very robust cheese sales this fall. In addition, butter stocks on November 30 were 99.5 million pounds – less than half of the level in storage three months earlier, according to the USDA.

Milk production has shown a steady increase, with the USDA’s latest Milk Production report for November reflecting all 50-state production at 15.775 billion pounds – up 1.8 percent from last year and largely in line with the long-term trend.

Meanwhile, feed costs have been steadily increasing over the past month, although they are down quite a bit from the highs established earlier this summer.

A rebound in feed grain production out of the Black Sea region this past year has intensified competition for U.S. corn recently in the global market.

Cumulative year-to-date corn export sales are down 6.1 percent from last year while shipments are 5.0 percent lower as well. Additionally, larger soybean crops this past season in South America, as well as increased competition from India, have likewise led to reduced demand for U.S. soybean meal in the global market.

Soybean meal export sales commitments are trailing last year by 16.2 percent, while shipments are down 8.7 percent from the previous marketing year.

Concerns have been rising, though, over the past few weeks due to expanding drought conditions in Brazil and Argentina. All of Argentina has received less than 50 percent of normal precipitation throughout the month of December, with corn crops currently pollinating in the country.

With temperatures in the 90s to lower 100s and soil moisture deficits during the critical reproductive period of development, some private forecasters have cut their corn crop estimate for Argentina to as low as 22 million metric tons, 7 million below the USDA’s latest forecast in the December WASDE.

Similar dryness in Brazil has likewise trimmed corn production estimates there from private analysts to a range of 57-60 million metric tons from 61-63 million previously. The USDA currently estimates Brazil’s corn crop at 61 million metric tons.

Unfortunately, with the ongoing influence of La Niña, the forecast does not look favorable for a break in the drought pattern, as soybeans are next in line to reproduce. There is some modest rain in the forecast for Argentina and southern Brazil over the next week but generally less than an inch with no sign of any tangible relief in the longer-range model that runs through the middle of January.

While most private analysts still hold out hope for the soybean crop and expect record production in Brazil, there are clearly concerns that production losses will grow without significant precipitation over the next few weeks. The market has responded to these concerns, as corn futures have rallied 80 cents over the past three weeks while soybean meal futures are $40 per ton higher as well.

Given relatively attractive forward margins for dairymen throughout the year, many different strategies to protect this profitability may be considered. The key to taking advantage of these opportunities, though, is remaining flexible with tactical strategies.

As an example, assuming you did not already own corn and soybean meal equivalents for your feed rations, would you really want to make a firm commitment to price at these levels following the 14 percent increase we have just observed?

As another example, with Class III Milk futures trading in the low-to-mid $17-per-cwt level throughout 2012, would you feel comfortable committing to a firm sale price after watching recent contracts in November and December trade above $19 per cwt?

Another dimension of remaining flexible is being willing to make adjustments when opportunities present themselves to improve profitability. If you choose to protect the $17 price level in milk without making a firm sale commitment, then at what price level would you make that commitment?

Similarly, if you protect the cost of future feed needs at current price levels without making a firm purchase commitment, at what price would you be comfortable owning those rations at? These will be different answers for different people, but the main point is that you retain flexibility in tactical strategies in order to hopefully improve upon your profitability over time.

Once better margins show themselves either through higher milk prices and/or lower feed costs, one has to be willing to make adjustments in order to realize that profitability. This is what being a margin “manager” is all about – actively adjusting strategies over time in order to achieve better results.

There are an array of contracting choices available to dairymen in both the cash market as well as the futures market, and a wealth of resources at your disposal to help you make better decisions in navigating these choices. It is important to leverage all of the tools available to you, particularly those that offer flexible contracting features.

For many, this means grasping basic concepts of how options work and how they differ from fixed price alternatives. Committing to firm price levels is fine so long as profitability is robust. Unfortunately, you don’t often find yourself in a position where you can lock in strong profit margins very far forward in time.

Because of this, it is necessary to manage profitability around constantly changing prices for both your costs and your revenues. This, by nature, means you must be flexible and strategic with your planning and decision making in order to maximize your profitability in forward time periods and hopefully improve the financial performance of your dairy. PD

Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois. Email him at cwhalen@cihedging.com .