Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) are the two insurance-based risk management products available to dairy producers.

Dairy-RP seeks to limit downside risk in milk revenue due to lower milk prices or lower milk production. LGM-Dairy seeks to limit downside risk in income margin due to lower milk prices or higher feed (corn and soybean meal) prices.

Premiums for both products are subsidized by the USDA, making them similar to subsidized put options to protect you from falling milk prices.

Like put options, if milk prices go higher, you benefit from the market and there are no margin calls. You will only have to pay the premium.

Coverage under the Dairy Margin Coverage (DMC) program, from your Farm Service Agency (FSA) office, is a fixed value. If you bought $9.50-per-hundredweight (cwt) margin coverage, that is what you get, regardless of what the market is doing.

However, both Dairy-RP and LGM-Dairy are market-based. That means the price coverage levels change with the market: the higher the market price of milk, the higher the coverage. The beauty of these products is: They allow you to look into the future to capture floor prices.

Premium costs compared

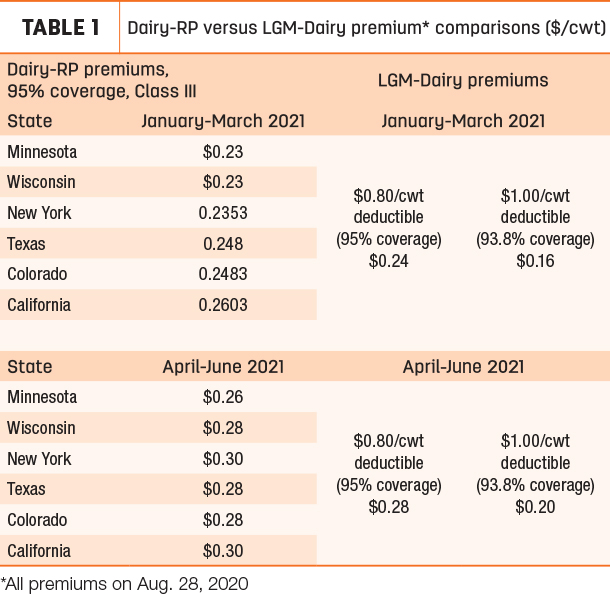

Dairy-RP and LGM-Dairy have different premium structures. Table 1 shows approximate Dairy-RP and LGM-Dairy costs for similar coverage periods – January-March 2021 and April-June 2021.

Dairy-RP premiums are calculated daily, and LGM Dairy premiums are only calculated once a month. The premiums in the table are for Aug. 28, 2020, when both Dairy-RP and LGM Dairy were available for purchase.

The Dairy-RP premiums (left columns) show coverage for 95% of expected revenue in six major dairy states (premiums vary by state or region based on risk factors). For the first quarter of 2021, Dairy-RP premiums range from 23 cents per hundredweight (cwt) in Minnesota and Wisconsin to 26.03 cents per cwt in California. The second-quarter premiums range from 26 cents to 30 cents per cwt.

LGM-Dairy premiums are different every sales period too, but unlike Dairy-RP, there is a single national rate. As of Aug. 28, the LGM-Dairy premium (right columns) for the first quarter of 2021 at the 80-cent-per-cwt deductible (comparable to 95% Dairy-RP coverage) was 23.85 cents per cwt; for the second quarter, the premium was 27.78 cents per cwt. For coverage with a $1 deductible (approximately 93.8% coverage), premiums were 16.49 cents and 19.64 cents per cwt for first and second quarters, respectively.

Other details: Dairy-RP

Coverage is available out 15 months, with subsidized premiums paid at the end of the insurance period. Policies can be purchased on an almost daily basis. Coverage above 95% is not available. Coverage is purchased for three months (one quarter of a year). State milk per cow is part of the math, so indemnities can be impacted by this state milk-per-cow number.

Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. The deadline to purchase coverage for the first quarter of 2021 (January, February and March) will be Dec. 15, 2020.

For 2021, coverage for all four quarters of 2021 is currently available. Coverage for the first quarter of 2022 should be available in October. Dairy-RP is available every day except holidays and USDA report days that could impact markets. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down. Most producers are using 95% coverage levels; a few have used 90% coverage.

In July, the RMA made improvements to Dairy-RP policies, increasing the declared protein and butterfat ranges and making Grade B milk insurable. Class IV milk components are also now available. Visit with your licensed crop insurance agent about these new additions to the Dairy-RP possibilities.

Other details: LGM-Dairy

Coverage is available out 11 months (skips the first month), with subsidized premiums which are paid at the end of the insurance period. Policies can be purchased once a month. Coverage with a “zero” deductible is available if you want. LGM-Dairy is more flexible than Dairy-RP. You can purchase less than three months of coverage, but in order to get a premium subsidy, coverage must be purchased for two months. The amounts do not need to be the same. Coverage for a large amount of milk can be purchased for one month and a small amount can be purchased in the second month. Corn and soybean meal prices are part of the math. The amount of these feed ingredients in the policy can vary depending on needs. The corn and soybean meal price changes can be less impactful than the milk-per-cow number in Dairy-RP. LGM-Dairy uses a three-day price average, which can be helpful if prices are falling in that period.

LGM-Dairy coverage is available only once per month (the last Friday), and the next scheduled sales period is Oct. 30. You will be able to buy coverage for December 2020 through August 2021. As noted previously, you need to select coverage in at least two-month increments to get the premium subsidy. LGM-Dairy covers milk prices (from falling) and also includes coverage for feed prices rising. LGM-Dairy is not only a milk price put option but a call option on the price of corn and soybean meal. We are anticipating changes to LGM-Dairy in the near future. Most producers have been using $1-per-cwt deductible (93.8% coverage).

Strategies: Be systematic

There are lots of ideas on how to decide which coverage to choose, but do what makes you comfortable. The basic premise is to look into the future to capture value.

Dr. Marin Bozic, assistant professor at the University of Minnesota, says it best: “Protecting distant quarters is necessary if one wants to always be able to lock in decent prices. Futures prices in nearby months are heavily influenced by current events. A major drop in demand due to a recession or public health crisis can depress futures prices for the next three to four quarters. Take, for example, Class IV; those that planned to wait until summer to cover the second half of 2020 lost that chance once COVID-19 struck in March. That’s why we designed Dairy-RP to offer coverage for five forthcoming quarters. Now is a good time to start booking the second half of 2021.”

What is appropriate and realistic for you? Consider looking at prices and premiums two to three times a week or at least every week. Purchase a percentage of coverage each time you buy. Cover months that are at least six to 12 months in the future. Be more aggressive if floor prices are above breakeven.

Dairy-RP and LGM-Dairy coverage is available through a licensed and trained crop insurance agent.