All over the business world the prevailing opinion is that market volatility is here to stay. As a result, the world’s leading businesses are taking action to manage risk. In fact, a 2011 study by the consulting firm Accenture says risk management has moved up the ladder of importance significantly since the same study was performed in 2009, and companies are putting people and systems in place to manage risk. Will this trend extend to America’s dairy farm businesses?

For the participants in Progressive Dairyman’s trading simulation groups, learning how to manage market risk and opportunity was important enough for them to commit to a six-month to 12-month simulation. Progressive Dairyman has followed their progress throughout the year.

Now, after eight months of learning about marketing tools and strategies through simulated trades and monthly teleconferences, the participants were asked the question: “Will you actually use what you learned on your dairy as you plan for 2012?”

Their answers reflect the dilemma facing today’s dairy producers where marketing is concerned: It’s important to do, and so is everything else on the dairy.

What they learned

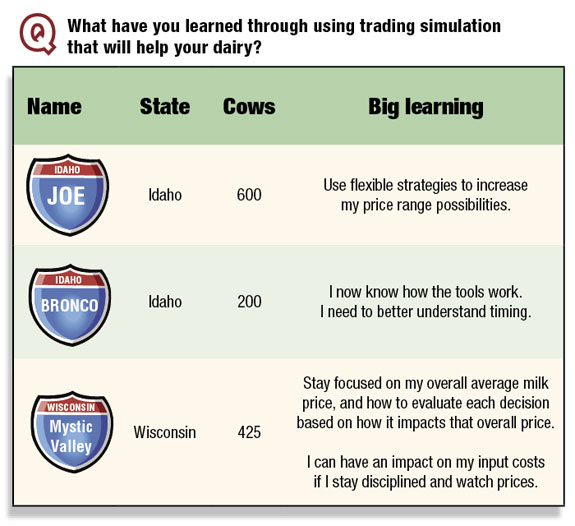

First, here’s a sampling of what some of the participating producers say they have learned from the simulation.

JOE: “Before joining this group I was always fixed on targeting one price. Now I understand fence strategies, although I still am not real comfortable doing them myself.

I feel a lot better being able to set high and low parameters, so I can capture some of the move in the market. I don’t mind giving up a certain amount of price if I can get a range to work in. That goes for inputs and for milk.”

BRONCO: “The hard part is knowing at what point in the price cycle you are – the very top or the very bottom. I understand what we’re trying to do, it’s a matter of is this the right timing or not.”

MYSTIC VALLEY: “A big learning from me was that the balance in my trading account is not my only measure of success. If I sell 40 percent of my milk with a futures contract, and the price goes up, I still have 60 percent of my milk that is unpriced. I need to take the extra step to calculate my total average price for a true measure of that decision.

“I am trying to make sure I have my inputs priced. Since working in the simulator and participating in these discussions, I feel like I do a better job of keeping track of prices. The discussion and paying attention is helping me work on that.”

Coach weighs in on the ‘commitment question’

Learning how marketing tools work is an important first step, says Mark Ludtke of Stewart-Peterson, who is coaching the groups and facilitating the monthly teleconferences. Then the producers could move to strategy questions, like how much to sell and when.

Now, Ludtke wants to help the participants connect what they are learning to their own farm business as they plan for 2012. When asked if they were ready to make that connection or likely to incorporate what they learned, here’s how some of the producers responded:

BRONCO: “I know I need to incorporate this into my dairy somehow, and I’m not exactly sure how. I can see it would take my attention almost every day for me to do it right.”

JOE: “I was pretty active on the simulator and did a lot more trading than I would have normally, but then life got busy and I found it hard to keep with it. I don’t know how normal that is, but that’s what happened with me.

“Right now we’re continually working on securing our input prices. There’s still some opportunity there. So that’s what I’m working on for 2012.

I have a certain amount of fear that we could see another downturn in milk and that could be quite costly. So I think we are going to get some help with our marketing.”

MYSTIC VALLEY: “It takes a lot of work and sometimes it’s hard to decide if you got anywhere with all the time you put in it. You think you did some things that were right, and you look at your positions and, whoa, you’re down.

You get frustrated because you try to do some things and you find out that, at least this summer, maybe doing nothing was smarter than doing a lot of things. And next summer we can all stand here and have the same conversation and think, ‘Wow, if only we would have ...’ ”

Ludtke says this group is a microcosm of the industry right now, which stands at the brink of either consistently embracing the risk management challenge or accepting the market price and dealing with the effects of volatility.

“Every day, producers vote on what is important and what can be put on the back burner,” Ludtke says. “With the increasing volatility of commodity prices, just accepting the market price is becoming a riskier endeavor.”

Ludtke encouraged all the participants to remember that this simulation experience represents a snapshot in time and only one small part of a long price cycle for milk and inputs.

“The participants in this round had the experience of making decisions when the market is moving upward, which presents its own challenges. If they stick with it long enough to also see what it’s like in a downward-moving market, you could have a more true evaluation,” he says.

“A true application of marketing cannot really be evaluated in a few months. Consistency and discipline have long-term paybacks, much like building a herd average or great genetics in a herd over time. It’s a product of many better-than-average decisions over time.”

Payback perspective

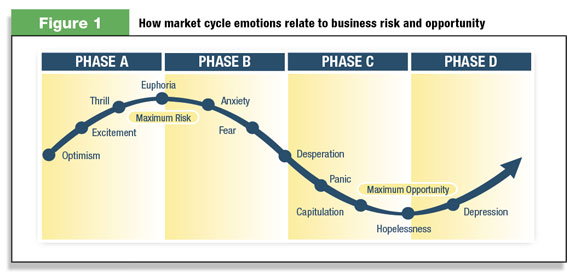

The typical milk price cycle lasts between 30 and 39 months from peak to peak or trough to trough, according to Ludtke. Marketing consistently through a full cycle is important for producers to experience.

Even better perspective comes when stepping back and viewing several cycles, along with the risks and opportunities present in each cycle.

“Consistent marketing is really about positioning your business well for the long term,” Ludtke points out. “Sometimes the greatest opportunities are present when you feel like there is the least opportunity and, actually, the greatest risks are present when you are feeling the best about prices.”

He offers an example: “If a producer simply takes the market price, decisions to reinvest in or expand the business would be made at the time when cash flow is the best – which is exactly the time when there is the greatest risk of prices falling. (See Figure 1 .)

“Businesses positioned to reinvest when there is maximum opportunity are the ones that will be the most sustainable over time. So you have to evaluate marketing based on how well it contributes to the long-term goals of your operation.”

Perhaps that is why many of the world’s leading businesses are elevating the importance of risk management. “In 2009, the business community was still in a state of shock and struggling to recover from the global economic meltdown,” writes Accenture’s Steven Culp in a recent issue of Forbes magazine. “Today, companies are looking to address the full range of business risks in a way that supports long-term growth.”

Observing this simulation, and considering all that is happening both inside and outside the dairy industry, leaves one more big question to ponder:

In the year 2013, when we look back on this price cycle, will dairy producers mark this as the moment when they elevated the importance of consistent, disciplined marketing? Or will it be as the Mystic Valley producer put it, “Wow, if only we would have …”

Time will tell. PD

Futures trading involves the risk of loss and should be carefully considered before investing.

Angie Molkentin is a writer from Oconomowoc, Wisconsin. She has access from Stewart-Peterson to observe the FACTSim dairy trading group and the interactions of producers in the program.