The Dairy Revenue Protection (Dairy-RP) insurance program has been in place for nearly two months. Some farmers have written endorsements, some are hoping there will be milk price increases before stepping in, while still others are in the learning mode trying to understand the program to determine if it’s worth getting involved.

Released in early October 2018, Dairy-RP was a welcome addition to the risk management toolbox. This insurance protects milk revenue regardless of feed costs.

Participants can select protection through the choice of either a Class III/Class IV pricing option or the component pricing option that uses butterfat, protein and other solids. The class pricing option is similar to using the Class III and Class IV options market through the Chicago Mercantile Exchange (CME). Both provide a floor price while leaving the upside open if one were to develop.

The component pricing uses a calculation of prices for butterfat, protein and other solids on a daily basis. The producer chooses the level of butterfat and protein for their individual herd.

Potential strategies

Depending on what you want to protect, let’s take a look at some strategies for utilizing Dairy-RP and the CME for risk management.

Dairy-RP coverage is based on quarters, out to five quarters into the future. Producers have until Dec. 15 to write an endorsement for the first quarter (January – March 2019). After that date, the earliest quarter will be the second quarter (April – June 2019).

If you are looking to protect milk prices for the first two quarters of 2019 under Dairy-RP, you should look first at the milk utilization of the Federal Milk Marketing Order (FMMO) or area you are located to get an accurate representation of prices you are trying to protect.

Then decide the weighting factor for either Class III or Class IV milk. Most of the interest I have seen in the Midwest is for 100 percent Class III weighting. That’s probably due to the fact much of the milk utilization is for cheese, and producers are more familiar with Class III futures.

The current outlook for milk prices indicates more potential for weaker prices in the first half of the year. So no matter which percentage of Class III and Class IV milk you choose, it makes the most sense to choose the 95 percent coverage level and the 1.25 to 1.5 protection factor, even though the premium cost is higher.

If there is no loss, the higher premium must still be paid. However, with concern milk prices could move lower during the first and second quarters, revenue losses could result. If that occurs, the higher protection factor results in higher indemnity payments.

If you are looking to protect the highest available floor price, it is more advantageous to utilize put options through the CME to protect a higher price on 100 percent of the milk you are seeking to cover.

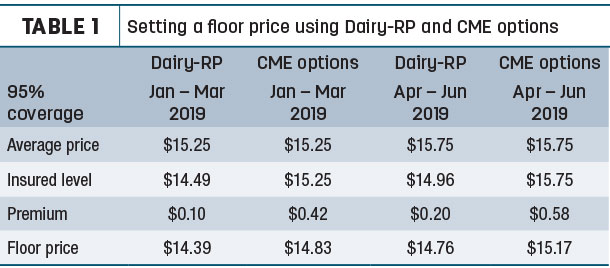

As an example (Table 1), if the average Class III price is $15.25 per hundredweight (cwt) for the first quarter of 2019, covering at Dairy-RP’s maximum 95 percent coverage level leaves you a floor price of $14.49 per cwt, minus the premium you need to pay for insurance (about 10 cents per cwt in the Midwest).

A $15.25 per cwt, January, February and March CME Class III put options have an average cost of 42 cents per cwt, putting your floor price at $14.83 per cwt after the cost of the put option is deducted, or about 44 cents per cwt higher than Dairy-RP.

The results described above are very similar for the second quarter of 2019, only with higher prices. The cost of the insurance goes up and so does the cost of the put options. Thus, if your desire is to protect the best possible floor price for your milk, utilizing put options is the best choice in the nearest two quarters.

However, we must look at all of the factors involved. If the average milk price declines, resulting in a revenue loss, and a higher protection factor is chosen, it clearly swings in the favor of Dairy-RP due to higher indemnity payments. In addition, the insurance premium is not due until the end of the insurance period.

If milk prices move higher, there will be a greater loss of premium with put option contracts. However, options are on a monthly basis, which improves coverage, whereas Dairy-RP is based on the average of three months.

When seeking protection out further into the calendar, third- and fourth-quarter coverages under Dairy-RP are more attractive than using straight put options due to the time value contained in the option premiums.

Third- and fourth-quarter endorsements are best using the 85 to 95 percent coverage, even at a higher premium price. However, it seems best to utilize the 1.00 protection factor due to cost and the possibility of milk prices strengthening during the second half of next year. The average is higher, so a lower percentage still provides protection if milk prices remain under pressure and cost is an issue.

There are various CME put option strategies used in marketing that reduce the initial premium of the hedge. They consist of selling the premium of an option to reduce the cost of the option purchased. The strategy that best aligns with Dairy-RP is the put option spread, which consists of the purchase of a put option and the sale of a put option at a lower strike price to reduce the cost.

This is best used for utilizing options in further months in order to keep the cost reasonable. It is not a marginable position, with no other cost other than the initial premium.

Dairy herds with higher components have a real advantage with Dairy-RP, as butterfat, protein and solid prices can be protected to better align with your actual milk prices. It also can align more closely with areas of the country that have a high utilization of Class I milk. Due to there being no component contracts on the CME, there is nothing to compare pricing with.

This option clearly seems advantageous for higher-component herds, with the decision being made of revenue needing to be protected.

Overall, Dairy-RP is a good risk management tool that needs to be understood and then utilized when it will achieve the goals for your dairy operation. It may not be advantageous to use it all the time but, when used in conjunction with other risk management strategies, it is a win-win. ![]()

Robin Schmahl is a commodity broker and owner of AgDairy LLC, a full-service commodity brokerage firm located in Elkhart Lake, Wisconsin. Email Robin Schmahl or call (877) 256-3253.

Disclaimer

The thoughts expressed and the basic data from which they are drawn are believed to be reliable but cannot be guaranteed. Any opinions expressed herein are subject to change without notice. Hypothetical or simulated performance results have certain inherent limitations. Simulated results do not represent actual trading. Simulated trading programs are subject to the benefit of hindsight.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. There is risk of loss in commodity trading, which may not be suitable for recipients of this publication. This material has been prepared by an employee or agent of AgDairy LLC. Do not rely solely on this communication for making trading decisions.