Price volatility is an opportunity. Well-managed dairies are seeing long-term benefits from the current market volatility. While price volatility may also be a threat requiring increased risk management focus, those that are able to manage the higher risk and cash flow challenges successfully are experiencing better margins overall. Most farms look at large milk price swings between years as creating difficulties and promoting a stronger emphasis on financial management rather than production. Higher volatility, which we have seen in milk price, input costs and most other aspects of our economy, increases risk and is rewarded in the marketplace with increased profits.

Said another way, volatile milk price and volatile net margins make things difficult, especially in managing cash flow and liquidity, but create rewards for farms who manage these aspects of their businesses well.

Research using Farm Credit’s Northeast Dairy Farm Summary information from the past 30-plus years shows that milk price volatility leads to higher profits when managed properly. These farms have shown that they continue to do better all the time.

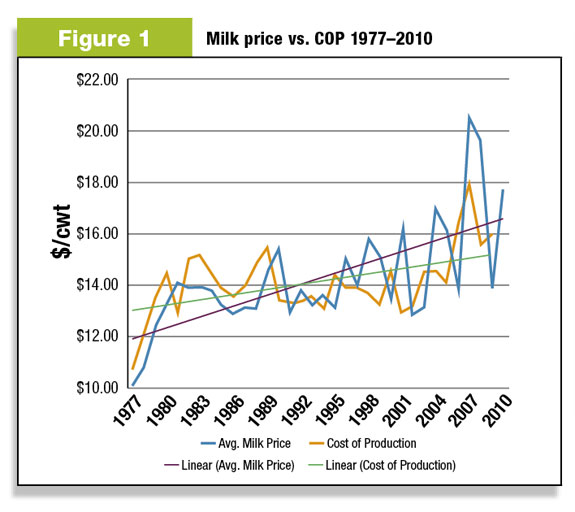

It may not be obvious, but if you look at a milk price and cost of production history chart, not only are milk prices improving over time when we observe long-term trends, but profits are also improving. This is directly related to the increases in volatility.

Looking at milk price history over 30-plus years, we see that the Federal Order blend price has increased on average by 2.6 percent annually.

While that may not quite be keeping up with inflation, at the same time dairy farmers have become more efficient as their net cost of production has increased at an even slower rate over the same period of time.

This is shown graphically in Figure 1 , which displays milk price versus net cost of production from 1977 to 2010.

The average milk price is indicated in blue and the trend-line for the increase is also indicated with a blue linear line.

Net cost of production is indicated in red. We can see that, up until about 2005, net cost of production has been relatively flat for a period of almost 30 years due to improvements in operating efficiencies.

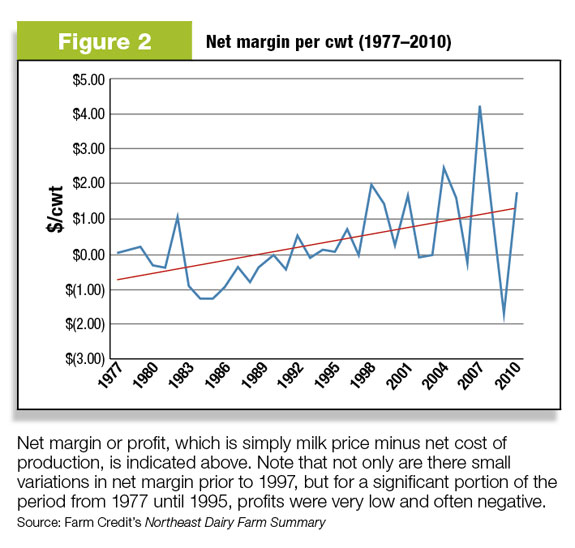

Net margin or profit, which is simply milk price minus net cost of production, is indicated in Figure 2 .

Note that not only are there small variations in net margin prior to 1997, but for a significant portion of the period from 1977 until 1995, profits were very low and often negative when looking at all farms in the Northeast Dairy Farm Summary .

This is not by coincidence. If you consider the history of milk pricing, you will recall that up until 1981 we had a regulated “parity pricing” system.

After 1981, the support price program provided a mechanism for the government to purchase surplus dairy products.

This support price had various ranges that operated anywhere from $13.49 down to the current $9.90 per hundredweight (cwt) instituted in 1999. Since 1996, government purchases of product have been very minimal.

So what changed to make things more volatile and more profitable for dairy farmers?

In 1997, the basic formula price futures and options market was instituted, clearing the way for milk prices to be set by an open market system that did not necessarily rely upon governmentally imposed minimum pricing.

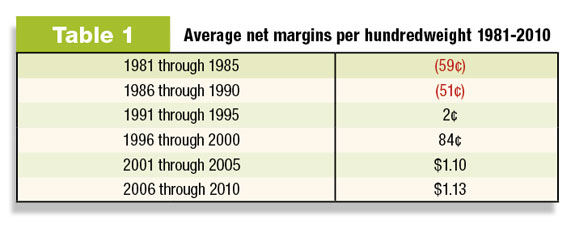

The average net margins per hundredweight over the following five-year periods are shown in Table 1 .

Note the five-year period with the highest average net margin, 2006 through 2010, includes two of the worst years in the U.S. dairy industry’s history.

When we sort the top 25 percent and the bottom 25 percent, the results are much more dramatic.

The top 25 percent farms have improved profits even more significantly than the overall benchmark, while the bottom 25 percent have been relatively flat with an average annual loss of more than $1.00 for the last 25 years and declining performance since the start of increased volatility.

History clearly shows that while volatility has increased significantly, so have the opportunities to make a strong profit. The key to success is for dairy farmers to focus on maintaining a competitive cost of production, exercising self-discipline in borrowing and capital spending and maintaining adequate liquidity to be able to go through the down years.

Those who do not learn cash flow discipline will likely become casualties of the increasingly volatile economic cycles.

If the past is a good predictor of the future, we can expect continued volatility and stronger profit opportunities going forward, depending in part upon the future of industry initiatives and/or government programs. This may boil down to what dairy farmers and their elected officials view as more important – price stability or profit opportunity. PD

—Originally appeared in Farm Credit East’s Knowledge Exchange Partner, Nov. 2011. Updated with current data for this publication.

Bill Zweigbaum

Farm Business Consultant

Farm Credit East

bill.zweigbaum@farmcrediteast.com