With the enrollment period now in full swing, dairy producers are evaluating whether the government’s Margin Protection Program is right for them, and if so, at what level. You have until Nov. 28 to enroll in the program and make your coverage decisions for 2014-2015.

Unlike LGM-Dairy, you actually have to lay down some money upfront when you sign up for this program, so you might be considering this decision even more carefully than the government’s previous offerings. Let’s look at MPP-Dairy, what it actually protects, and why a hybrid you create may be the best way for you to remain in the driver’s seat when it comes to your farm’s feed and milk pricing.

Up to four million pounds, take the insurance

For almost any size dairy, the math shows that producers should take the insurance, typically at the highest level of protection, up to the four-million-pound production mark because the premiums are advantageous. Plus, there is a 25 percent discount the first year you enroll (2014-2015), so why not take it?

Many Progressive Dairyman readers have more than four million pounds of production per year. If this is you, it is very important that you find ways to protect against price risk other than this very basic level. Do not stop here. Do some math.

For producers with more than 16 million pounds of production, this strategy will need to change as you will not have the ability to only cover four million pounds of production under the MPP-Dairy rules. Again, the math is important, so read on.

After four million pounds, do the math

The pricing in the tier above four million pounds of production is not necessarily advantageous. Producers should evaluate the protection available in the program at that level compared to what is available in the marketplace to provide equivalent levels of protection.

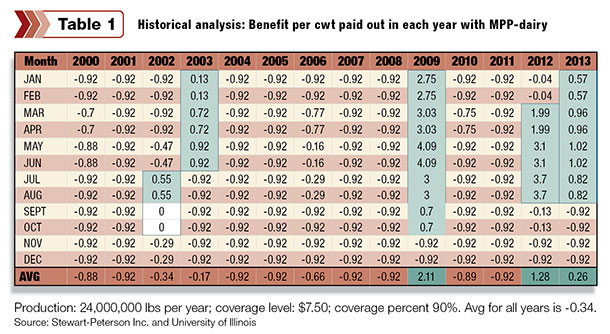

To help with this evaluation, the University of Illinois has an excellent tool available. This tool uses historical prices to examine when the MPP-Dairy program would have paid benefits had MPP been in place from 2000 through 2013, and at what level. You can use this tool to enter your expected production and preferred coverage level and then view which price scenarios would have generated benefits paid to you.

Following is an example for a dairy producing 24 million pounds per year. For this example, we selected the threshold level of $7.50 as our trigger for coverage and coverage for 90 percent of production.

Dairy producers receive a margin protection payment when actual dairy production margins are less than the threshold levels set to trigger a margin protection payment. Table 1 shows how often that would have occurred for our example dairy.

As you can see from the bottom line average, using historical data, MPP-Dairy would have been triggered for this particular example dairy in only five years, with three of those years netting enough benefit to outweigh the premium costs for the year (2009, 2012 and 2013).

These are the times when the MPP-Dairy calculations for milk and feed margins industry-wide, less premium expenses, triggered a benefit payment. The color on this table reveals just how few times the calculations trigger benefits payments.

You vs. the national average

Each individual dairy will need to examine how its own feed costs compare to the nation-wide average calculation used by MPP-Dairy.

In a year such as 2006, for example, when Class III milk prices dipped below $12, the national feed cost average, as would have been calculated by MPP-Dairy, was also low and so the threshold would not have been reached to trigger a payment. If your dairy’s feed costs were higher than the national average that year, you would have felt the margin squeeze regardless of your participation in MPP-Dairy.

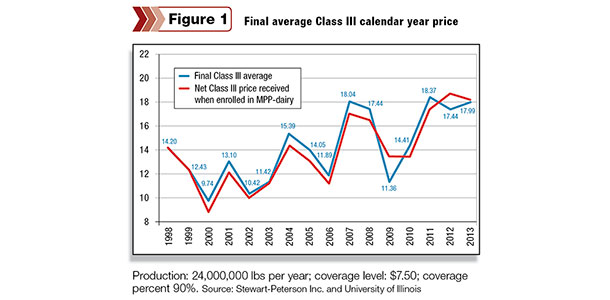

Looking at this data another way, Figure 1 displays the final average Class III calendar year price our example dairy would have received, along with the net Class III price our example dairy would have received if enrolled in MPP-Dairy.

For the most part, the net Class III milk price received for the example dairy enrolled in MPP-Dairy tracks pretty closely with the final Class III average milk price the dairy would have received if not enrolled and not protecting its milk or feed prices in any other way.

What is most instructive about this figure is seeing what MPP-Dairy does and does not protect. Some dairy producers may assume that MPP-Dairy will help protect against low milk prices, and this simply is not the case.

Milk prices were particularly low in 2000, 2002, 2006 and 2009, and this example dairy would not have received benefits in all of those years. This is because feed prices in 2000, 2002 and 2006 in particular were relatively low when calculated as a national average.

MPP-Dairy is designed to protect against the most devastating times when, industry-wide, feed prices are high and milk prices are low, as they were in 2009. And this combination must occur over a two-month period of time or more in order to trigger a possible benefit.

The ‘free’ option is the most expensive option

Doing the math reveals another important truth: The most expensive coverage option is actually the free option. It lulls a producer into thinking you have done something to protect yourself when, in effect, you have not protected yourself adequately.

That is an expensive mistake. The “free” option would have paid out only twice in the last five years. The first time, in 2009, it stayed below the $4 level for a total of eight months, and in 2012 it stayed there for four months. There is a lot of risk and opportunity in the remaining months.

If you are growing or expanding, beware

Under MPP, your production history is equal to the highest annual milk sales for your dairy operation during any one of the 2011, 2012 or 2013 calendar years. If your dairy grew significantly in 2014, or plans to grow in the coming years before 2018, you will not be covered for the portion of your milk that is above your best production level in 2011, 2012 or 2013.

Under the MPP-Dairy rules, production levels will be updated to reflect annual changes in the national average milk production if national production increases. Until a change is made, if you recently grew or plan to grow, you will have to seek some sort of protection for milk produced beyond the initial amount you are eligible to insure.

Let it ride?

So now that you know what MPP-Dairy does and doesn’t cover, you still may be thinking, “I’ll just cover my first four million pounds and let the rest ride.”

May we suggest a hybrid? How about a beautiful marriage between government’s good intentions and private-sector know-how?

The math proves that a hybrid is best. Insurance under MPP is really catastrophic in nature. In the middle ground between a catastrophic price drop and today’s prices, producers could benefit from actively pricing their milk and hedging feed.

For example, if a producer buys the highest level of insurance on all his or her milk up to four million pounds, at the $8 margin protection level, milk would have to go from its current price of around $24 all the way down to around $15.75 before the producer would see a penny of benefit.

That’s the kind of crash we would need to see for MPP to trigger a payment, and that assumes no change in feed prices from August and no basis (PPD) changes.

Furthermore, if you had purchased the bottom tier – the $4 margin protection level with no cost other than the $100 administrative fee – the milk price would need to crash to $12.75 before any payment would be triggered, holding August feed prices constant. There is a lot of room in there for a producer to actively manage their milk and feed prices for better results than the market average.

Another scenario from the feed side: If you are in an area of the country that is better off than the national average, and you’ve actively managed your risk using tools beyond the MPP program, you could receive the benefit of both your market positions and your insurance payment. A concrete example of this is our clients’ experience during the 2012 drought.

Our clients had corn prices locked in at a futures price average of $6.01 in 2012 and were able to keep a healthy margin during the drought. Had this program been in place, it would have triggered a payment, and our clients would have benefited from both their own price risk management decisions and the government’s MPP.

So the savvy producer will use the government program up to its financially advantageous point and then continue to use all available tools to protect prices and create opportunity. The most expensive option is doing only a little because you are paying for false security. The combination of this insurance and actively managing risk and opportunity is very powerful.

The bottom line:

For your first four million pounds, take the insurance at the highest ($8) margin protection level. It is heavily subsidized, especially with the 25 percent discount for 2014-2015. For larger producers, add your own protection and pricing opportunities, essentially creating a hybrid.

There is quite a difference in mindset between the person who insures to protect and a person who insures and also continues to actively manage for the best possible price. As the numbers prove, a hybrid mentality is the best approach for the progressive dairyman.

If you would like to run the numbers for your dairy, I would be happy to assist. Call me at 800-334-9779. PD

DISCLAIMER: Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Reproduction of this information without prior written permission is prohibited.

Patrick Patton

Director of Client Services

Stewart-Peterson Inc.