Tighter lending criteria in the last five years has led many enterprising dairy producers to look after their lending relationships almost as carefully as they do their cows. While cows generate the cash, it’s the lender who can make modernization, growth and smooth sailing through unexpected cash flow troughs possible.

Today’s best-managed dairies have found ways to demonstrate their production capabilities and managerial competencies to impress lenders and meet even the strictest lending criteria.

There’s one managerial activity that is icing on the cake when it comes to maintaining a dairy operation’s good relationship with a lender: Developing and executing a consistent marketing strategy. While every dairy operation is unique and has unique needs, agricultural lenders say it is a hallmark of a well-managed operation.

Keep cash flowing

If you’re a dairy looking to borrow money, demonstrating past and current profitability is essential; demonstrating future expectations for profits and cash flow can be even more valuable, according to Sam Miller, managing director of agricultural banking, BMO Harris Bank.

“Agricultural enterprises are commodity-based with uncertain earnings from year to year. Marketing strategies have historically allowed for a smoothing of this market uncertainty and can demonstrate the ability to handle increased balance sheet leverage.”

Some dairy producers are protecting prices for milk, feed, energy and even cull cattle these days. The ability to generate more consistent cash flow – smoothing out the peaks and valleys – is one of the benefits they seek.

“Marketing is all about consistently protecting against or capitalizing on the meat of a market move,” says Matt Mattke, dairy team lead adviser for Stewart-Peterson Inc. “If corn rallies from $3 per bushel to $8 per bushel, corn bought at $4 is great protection. When that is done year-in and year-out, the benefit is compounded.”

Consistency in price risk management activities is important to lenders when evaluating a dairy’s borrowing capacity. For a more favorable view, “the dairy producer needs to show consistent use of risk management tools over an extended period,” says Jim Moriarty, vice president and senior director industry specialist with AgStar Financial Services.

By “extended period,” Moriarty means “several years, not just six months or a year.”

That is a particular challenge for dairy producers, many of whom have dabbled with forward contracts at various times and eventually abandoned the effort, inconclusive as to whether it was worth the trouble.

“We see a lot of abandonment when prices are high,” Mattke says. “Producers want to capture the highest price possible and leave themselves open to risk.”

He gives this example: “If milk rallies from $14 per hundredweight (cwt) to $22 per cwt, is it a disaster to have milk sold at $20.50 per cwt? No, because the meat of the market move was capitalized on, and when that happens consistently, moves at the fringes matter less and less.”

Fad or future?

Moriarty says that price risk management has elevated to an important factor in a dairy’s financial success. “It wasn’t as much of a focus until we began to see swings of up to 50 percent in milk and feed prices in recent years,” he says. “If not managed, these price swings can completely offset the financial benefits of productivity gains.”

Moriarty notes that price risk management can be achieved a number of different ways, including working for higher milk components to enhance premiums, raising more of your own feed to stabilize costs or forward-pricing more purchases. He says producers are increasingly including commodity marketing tools and hedging as part of an overall plan.

Kurt Petik of Rabo AgriFinance says that hedging production other than milk can fit into some price risk management plans. “With record-high beef prices, cull cow sales and steer sales have become larger line items in the budget.”

BMO’s Miller points out that the constantly changing market conditions for multiple commodities can be more challenging to deal with than the more routine management tasks that are in the typical dairy producer’s comfort zone.

“Marketing decisions have multiple options and opportunities,” he says. “Developing this skill will require time and attention but can have an outsized impact on the bottom line for the dairy farm business.”

“Outsized” is lender-speak for “noticeable.” Both Moriarty and Miller say that when written goals and strategies for price risk management are in place and consistently followed, results can be evaluated.

The lender will look at the financial statements compared to the price targets and forecasts. The more these numbers align, the wider your lender’s smile may be.

Keys to success

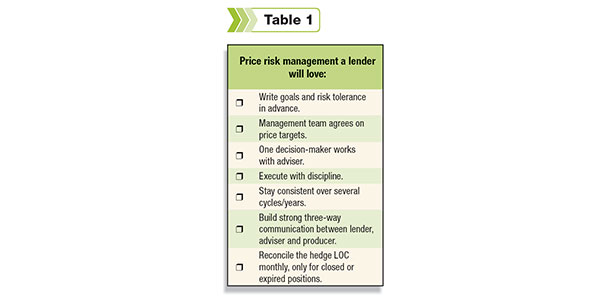

When a dairy operation decides to develop its price risk management approach, there are a few keys to success.

“Write and share your goals with everyone on the financial team,” advises Mattke. “An adviser needs to understand your risk tolerance in order to create the right approach and match the strategies to the goals.”

With goals in place, consistent execution is important on the part of the producer and the lender.

“There is less value in the risk management approach if producers are in and out of the market or do not follow through on their approach,” Moriarty says.

An example of inconsistency is the producer who decides to wait beyond the appointed price targets to see if the milk price goes higher, or the corn price goes lower.

Incidentally, Mattke says he sees this all the time. “We call it ‘moving the goalposts.’”

Lenders own a share in consistency, too. Moriarty says, “Lenders should be willing to provide financing to support approved risk management strategies, such as funding for margin calls or option costs.”

This financing is set up as a “hedge line of credit” (LOC), separate from the operating line of credit. It’s crucial to keep those two separate, Mattke says, so that marketing decisions can be made independent of cash flow issues on the farm.

An issue percolating between lenders and dairy producers right now is how those hedge LOCs are maintained. Miller says the first step to obtaining a hedge LOC is making sure all parties involved have a clear understanding of the price risk management strategies that will be used, and how the hedge LOC will support the strategies.

Then, the adviser will usually provide an estimate of the size of margin and potential margin calls, and this allows the lender to size the line appropriately.

The financial position of the borrower must be strong enough to handle at least partially securing the hedge LOC, Miller says. “If a producer is highly leveraged from a balance sheet perspective, they will often use forward contracts in order to limit margin calls and additional borrowing.”

Most lenders will require monthly reconciliation of the hedge account statements and the hedge line of credit. Terms for reconciling should be discussed in advance so there are no surprises in the heat of a market move.

The hedge line should be repaid from either the return of margin funds or the sale of the commodity as the hedge or options positions are lifted or offset.

Before hedging a commodity like energy, Petik advises producers to consider whether there will be margin calls, and if the savings on the purchase of the energy will be enough to be able to reconcile the LOC.

“The lender will want to know if the hedge truly matches usage or if it is a speculative position,” Petik says. Lenders frown on using hedge LOCs for speculative activity.

Mattke emphasizes the importance of choosing a lender who understands the purpose of engaging in price risk management and the tools involved.

“Hedging often involves market positions that protect a price for months ahead, and trying to reconcile the positions before they expire defeats the purpose of the hedge,” Mattke says. “There needs to be good communication about the goals, strategies and expectations.”

Another key to achieving results, according to Moriarty, is appointed decision-makers to implement the strategies in a timely manner. This avoids the “too many cooks in the kitchen” situation.

“Most farms work with an adviser to provide market information and discipline,” Moriarty says. “Then they have one person from the family or management team take the specific risk management actions.

The entire family or management team should be involved in price targets, but it often takes too long to get a group together to decide on actual positions when opportunity arises.”

Finally, Petik encourages strong three-way communication between the lender, adviser and producer through phone calls, emails and joint educational meetings. “It is critical that the marketing adviser and lender both participate in on-farm team meetings.

Lenders need to be included in the monthly reporting of trades and positions. Producers need to provide full disclosure to both the lender and adviser. Having a written price risk management plan goes a long way toward the goal of keeping all three parties on the same page when it comes to expectations.”

From predictable to flexible

With all the management responsibilities on today’s dairies, owners may be hesitant to add price risk management and its learning curve to the “to-do” list.

For those dairies highly leveraged, price risk management may be necessary to maintain strong lending relationships. For those not as leveraged, Mattke observes that it is being used as a broad-based management tool to combat the cyclical nature all commodity-based businesses face.

“We have clients who are able to re-invest in their business on their own timetable, even if that is in a down market,” he says.

Being in a “counter-cyclical” position has many advantages, Mattke says. “The savings realized when purchasing animals, raw materials and other equipment off-peak can really add up and create the opportunity for a faster return on investment.”

Predictable and flexible: Two smile-generating words in the ag-lender’s world today. PD

Molkentin is a freelance writer and had insider access from Stewart-Peterson to each of those bankers interviewed for this article.

Sam Miller

BMO Harris Bank

“The hedge line of credit should only be used for hedging and options activity related to the products being produced or purchased. For dairy producers, this generally means milk, grain and petroleum.

Most importantly, the line must be repaid from either the return of margin funds or the sale of farm products like milk, as the hedge or options positions are lifted or offset. This is the responsibility of the borrower, but the lender will monitor through the reporting provided by the broker or advisory firm.”

Kurt Petik

Rabo AgriFinance

“The hedge line needs to be reconciled at the end of each month. Lenders should work closely with the market adviser and producer to accomplish this. It can become a very cumbersome process, even with correct and detailed reporting.

“Equally as important as maintaining the hedge line’s good standing is maintaining the operation’s good standing. Management needs to execute the plan as written, review their budget-to-actual numbers, and keep a close eye on liquidity.

Hedging in a price that we all assumed provided profits and positive cash flow based on the budget, only to find the operation did not cash flow and had to use all of their liquidity to reconcile the hedge line, is not a pleasant surprise for anyone.”

Jim Moriarty

AgStar Financial Services

“As positions roll off or expire, the producer should pay down the hedge line by at least the cost of the positions that have rolled off or been lifted. Timely and accurate reporting of hedge positions is important for the lender to be able to properly evaluate the hedge line performance.

“Over the longer term, the hedging strategies and hedge line should contribute to more consistent profitability for the producer.”