Only 115 shopping days until Christmas! I’ll bet you can hardly wait! Likely, you have been losing sleep over what gifts you will buy for those special people in your life. Perhaps you are spending endless hours combing through catalogs and surfing the Internet for ideas. Maybe you have even begun scripting your first rough draft of your own list. Sound ridiculous? Quite! … at least to me. However, it is this same kind of spirit that should be applied when talking about milk marketing.

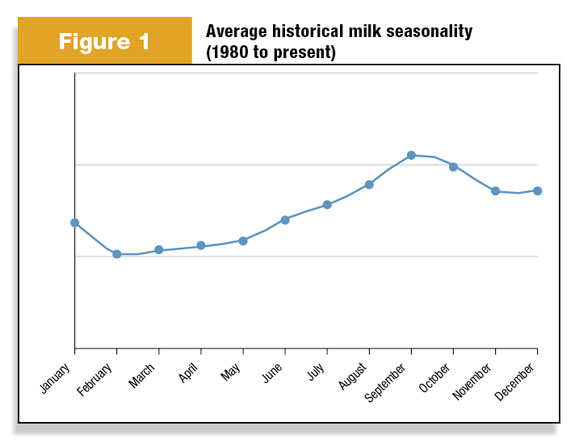

This is the time of year when milk markets are normally reaching their seasonal highs (see Figure 1 ). Notice that we typically experience our lows in February, then climb into September/October highs and subsequently work lower into the next year. This average historical movement through the calendar year is what we call seasonality.

Look familiar? At the time of this writing, the September contract is posting the highest price that will potentially be experienced in 2010. As you read this, that outcome may already have changed – a characteristic well known by anyone who devotes any time to watching commodity markets. However, if the market has held this market structure together, it will once again maintain a very seasonal appearance and we will be experiencing some of the best prices of the year. Is it a relief to a painful first half? Perhaps! However, I don’t want to make this discussion about 2010. It is all about 2011.

In a previous issue, we discussed several different means by which you can monitor markets for profitable margins while attending to opportunities at hand. Seasonality is one of those methods. Seasonal tendencies are not isolated to just the milk market. They are a characteristic of every agricultural commodity known to mankind. For example, corn usually makes its highs from March to June, works lower into harvest and then rises into spring. Each commodity is sensitive to its own set of factors. However, they all are influenced by a normal seasonal pattern.

As we arrive at this time of year, milk is usually finding its peak. By now, end users have awoken to the idea that there will be another year ahead and their actions to protect against whatever may happen should already be well under way. By this time, producers should be filtering through, if they haven’t already done so, what next year’s milk price and feed costs will ultimately look like. What better time to be talking about milk and feed prices, than when milk is near its seasonal highs and feed is near its seasonal lows?

Another feather in your cap is the market structure of milk. Often, the balance of futures contract offerings for the time beyond this seasonal September/October peak are at or near this same level. This is not always the case, of course. However, the tendency is strong. This allows producers to analyze opportunities very similar to what is being experienced today … or at least close. When the market is making seasonal highs, what better time to address it? Very simply, now is the time to be sure that you have a plan in place for 2011 if you haven’t already done so.

Although the market tends to abide by seasonal tendencies, there is no way of knowing what the market will do or where price will go. This time of the year offers producers an opportunity to address both milk and feed. Call your market adviser, talk with your feed buyers, visit with your co-op or do whatever else is necessary to start or finish connecting the dots in your margin management program. Making good decisions at opportune times is what good marketing and risk management are all about.

Oh ... and have a very merry early Christmas! PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

-

Mike North

- Milk Marketing Specialist

- First Capitol Ag