It seems that every time the market moves from high prices to low prices, there is some sort of discussion that follows regarding how we can fix the market and return back to better prices. Consequently, low prices create such talk that are the very force that ultimately cause supply reductions either through more aggressive culling practices or exit of market participants. The shortened milk supply leads to the manufacturing of fewer products.

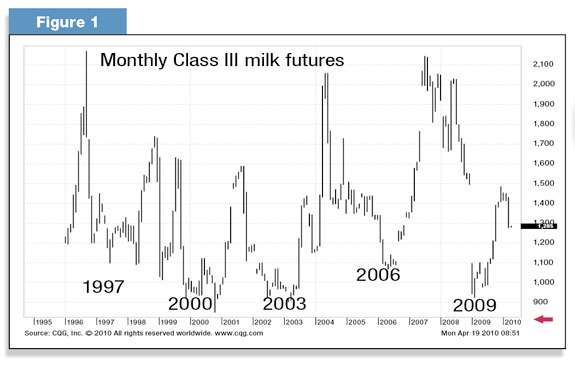

Consumers, both domestically and abroad, then must fight for available inventory and future production. Processors, in response to the demand for their product, must more aggressively seek milk supplies. This sends a signal to the market in the form of higher prices for more milk. It may appear to be a whipsaw of market activity, but it is the normal market cycle of the milk market. It is a cycle that has endured for decades and continues to repeat itself nearly every three years.

The fallout of 2008/2009 wasn’t a first-time event. Rather it was a moment in time that repeats itself frequently. It was perhaps a bit overdone by the economic crisis that has rocked our nation. It was certainly more painful when considering the bloated cost of production that producers have faced in recent years. However, it was not anything that caught the veteran producer by surprise ( see Figure 1 ).

This cycle is not unique to itself. We see cycles in grain markets, cattle markets, financial markets, and otherwise. Why do such cycles exist? They can be a function of the seasons, business cycles, weather and otherwise. With regard to milk, it is, in part, a function of the gestation cycle of the cow. In part it is a function of the perishable nature of milk (you cannot store excess milk until the next demand run). There are many different views as to why the cycle is what it is. However, since I am not an animal physiology expert, I am not going to elaborate on the biological reasons for the timeline. I would like to talk more specifically about the milk market cycles and our response as an industry.

For nearly a year there has been much talk about supply management as a means of handling the low cycles of the market. The case is made that we need to control the volume of milk produced in a consistent manner in order to produce better margins at the farm. There is perhaps some merit in predictability, but at what expense? Who would establish the appropriate amount of production necessary to meet domestic and growing global demand? Who will establish fair market values for these throttled volumes? Who will determine how milk will be used and consequently how investment will be directed among processors? Global food demand is expected to double in the next 20 years. How do we anticipate world demand as foreign markets continue to grow? What degree of tariffs will we need to block the mass influx of imported product that is likely to arrive on our shores as a result of elevated domestic pricing? How do we participate in a global market, given such measures? How do we allow the next generation to participate in the future of the industry without huge barriers of entry? How do we maintain the production efficiencies that we have worked so hard to grow in recent decades? These are questions often asked of me as people digest the idea of supply management. They are all valid questions. However, as I listen to these questions, I can’t help but ask where we have missed the mark. How have we come this far?

What about the tools that we already have? There already exists a means by which producers can manage market volatility, price fluctuation and revenue uncertainty. Since 1995, producers have had a free-market mechanism available to them for the very purpose of creating predictability to price, both on the feed and milk sides of the cash flow statement. Through the use of local contracts with feed vendors and milk processors, as well as futures contracts and options on futures contracts, producers can personally manage the ongoing risk that is inherent in their operation.

Producers have become masters at production. There is no other nation that can match the efficiencies and performance of U.S. producers. Skills, knowledge and expertise do not happen by accident. They come through applied focus, the seeking of knowledge, intense study, trial and error, and a willingness to be greater and to do greater things.

The financial performance of our operations will require the same effort. When it comes to marketing and risk management, we must parallel our efforts to be greater producers with efforts to become savvier managers of margins, not just taking prices but establishing and protecting prices when opportunity knocks.

The days of waiting for a milk check to arrive and hoping it is enough are over. Unfortunately, pain is sometimes the best teacher. A bit of good news…times will again get better. Opportunity will again present itself. What will you do about it? When times get better, let it not just bring a smile to your face, but locomotion to your feet. I challenge you to have a plan in place to be ready for whatever happens. We will talk more in our next article about what to do when that time arrives.

In the meantime, start asking questions. There are no dumb ones. Just the ones that aren’t asked. Maybe you are interested in changing your marketing performance but don’t even know where to start or what questions to ask. If this is you, seek expert advice and let them know where you are at. Allow your pride to be vulnerable as you seek the understanding necessary to help you become profitable.

Don’t just read this article in agreement, but rather move risk management to your To-Day list. You must take action for yourself. We don’t need another government intervention to “fix” the cycles of the market. They do not have the means to legislate you to prosperity. It has never worked. What we need are producers who are more educated about the markets they are involved in and the cycles that dominate them. Producers must become more equipped to handle the tools available to them and more ready to move when price opportunity strikes! I challenge you to take the initiative to make marketing a priority. Ask the tough questions. Get started today! PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

-

Mike North

- Milk Marketing Specialist

- First Capitol Ag