When will milk prices cover your costs? The operative word in this question is “when” – not “will” milk prices ever cover your costs again. Milk prices will cover your cost of production; however, for some milk producers it will be several more months into the future. For some milk producers, it will be a few months too late. Liquidations, foreclosures and bankruptcies are already taking a toll.

Herd liquidations got underway in July and continued through September 2008 as Cooperatives Working Together (CWT) took a 25,000-cow bite out of the nation’s milking herd. The herd count stood at 9.334 million head in July 2008 and was back up to 9.334 million head by December 2008 when CWT launched another buyout to take out 51,000 cows.

This second buyout finally got a herd reduction underway. Two more CWT actions during 2009 kept cow numbers declining throughout the year: From 9.312 million cows in January to 9.082 million cows in December.

A little less milk and some sizeable export orders along with typically strong sales for the year-end holidays translated into a $15.00 Class III price in December. The convergence of these events got the preverbal cart ahead of the horse. Despite a modest CWT buyout, which was in progress during December 2009 and January 2010, milk cow numbers increased during January, at least partly in response to improved milk prices, in the estimation of this analyst.

My forecast anticipates further increases in the size of the milking herd, probably through March. This means lower milk prices. This means more liquidations (without any help from CWT), foreclosures and bankruptcies as milk producers, their suppliers and their bankers begin to say: “Enough is enough.”

By the beginning of the second quarter, I expect milk cow numbers to begin a slow, steady decline. There are plenty of heifers owned and on the farm, so that economically viable milk producers will be able to maintain their herd size. Some producers will be able to increase their herd size; however, a growing number of producers will be shipping their cows off to Hamburger Heaven.

Milk producers still in business are not in a position to cherry-pick herds being liquidated, nor do they need to do so. They have plenty of high-quality heifers on hand.

On the supply side, it adds up like this: Milk cow numbers will bottom out mid-year and then begin to build. By December 2010 the herd will be as large as it is today. Milk producers have learned how to manage through low milk prices and high feed costs (output per cow was up 1.2 percent in 2009), so production per cow will be up about 1.3 percent this year. During 2010, milk production will be just fractionally (down 0.1 percent) below 2009.

Meanwhile, the demand side of the milk price equation looks like this: Relatively good demand domestically; improving demand internationally.

In the U.S., retail cheese sales were up 3 percent during 2009 and retail milk sales were up about 0.6 percent. I’m expecting at least modest increases this year. With milk production flat, just a modest increase in demand is good news.

Food service sales of cheese and milk were also strong last year. High unemployment is making it tough to sell breakfasts – fewer people are going to work. And the numerous “dollar menus” only work for awhile, but the burger chains are responding with a host of new products. Folks are eating out less and/or at lower-cost venues, but that is where the cheese-friendly menus exist.

And then there are the coffee wars: Starbucks versus McDonald’s versus Dunkin’ Donut versus Subway versus… Most of these beverages – lattes, cappuccinos, etc. – are 50 percent to 80 percent milk. Adults are becoming milk drinkers.

Overseas, many economies are doing as well or better than ours. Oil at $70 or more is putting money in the pockets of some of the U.S.’ best customers. Demand is picking up for cheese and butter. It will recover for milk powders and, in fact, milk protein concentrate exports are good. Whey demand is already very good.

If my forecast is correct, almost 10 percent of the milk produced in the U.S. this year will be exported. Longer-term, the export picture looks very good. Rabobank, an international bank that finances dairy farmers and dairy plants, expects worldwide dairy demand to increase by 2 percent to 3 percent annually for the next several years.

Finding enough milk to fill this demand is the big question, according to the bank’s dairy analysts. They are looking to the U.S. to do its fair share.

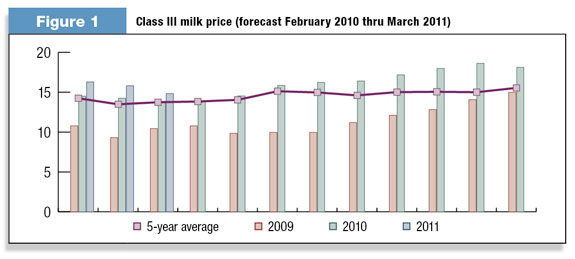

Carefully weighing supply and demand, my Class III forecast (as of February 23) through March 2011 is detailed in Figure 1 .

When will your milk production costs be covered? PD

Jerry Dryer

Chief Market Analyst

Rice Dairy LLC

jdryer@dairymarketanalyst.com